Billionaire Jeffrey Gundlach, aka the “Bond King,” has predicted that the Federal Reserve will be cutting interest rates substantially soon. “Red alert recession signals,” he added, noting that all U.S. Treasury yields two years and out are “well below the fed funds rate.” Doubleline CEO on Fed Rate Cuts and Recession Jeffrey Gundlach, chief executive and chief investment officer of…

Month: March 2023

White House report takes aim at Bybit — and forgot about Deribit

The White House released its annual economic report on March 20, and it dedicated an entire section to digital assets. The authors should be commended for doing so. I largely agree with the report’s assessment that certain aspects of the digital asset ecosystem are causing problems for consumers, financial systems and the environment. However, as a builder in the digital…

Cathie Wood Buys the Dip on Coinbase Stock Two Days After Dumping

Cathie Wood’s tech-focused investment firm, ARK Invest, bought nearly $18 million worth of Coinbase (COIN) shares shortly after the exchange was threatened with enforcement action from regulators on Wednesday. The crypto exchange, which has been targeted by the U.S. Securities and Exchange Commission (SEC) for allegedly violating federal securities laws, traded from over $84 to less than $62 on Wednesday. …

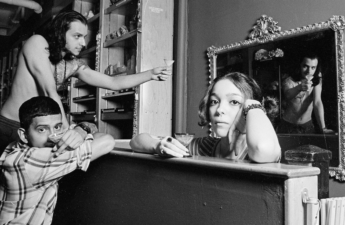

From ‘Twin Flames’ to Tarot: Justin Aversano Exhibits ‘Smoke and Mirrors’ Photo NFTs

Justin Aversano set the standard for NFT-based photography projects with “Twin Flames,” a collection of 100 photos of twin siblings tokenized on the Ethereum blockchain. The project has captivated collectors, racked up millions of dollars’ worth of sales, and made it to auction house Christie’s and the collection of the Los Angeles County Museum of Art (LACMA). On Saturday, Aversano…

US Treasury’s Financial Stability Oversight Council held unscheduled, closed meeting

The United States’ most powerful financial regulators gathered March 24 by video conference for an unscheduled, closed meeting of the Treasury Department’s Financial Stability Oversight Council (FSOC), the department announced in a statement. Treasury Secretary Janet Yellen convened the meeting. Details were sparse in the Treasury statement, but it said Federal Reserve Bank of New York staff gave a presentation…

Animoca Brands cuts metaverse fund target to $800M: Report

Hong Kong-based Animoca Brands, a developer of blockchain gaming technology, has reportedly cut its target for its metaverse fund by a further 20% to $800 million, Reuters reported citing sources familiar with the matter. The blockchain gaming technology company reportedly scaled back on its billion-dollar goal due to volatility in the crypto sector. The company had previously announced in November…

Mastercard opens network to USDC, OKX departs Canada, Bitcoin climbs

Take, for example, the recent issues that Circle-issued USD Coin (USDC) faced when it depegged from the U.S. dollar following Silicon Valley Bank’s collapse. Two weeks later, Mastercard boldly integrated the stablecoin into its infrastructure in the Asia-Pacific region, allowing users to spend USDC through its network. It’s happening, folks! And let’s not forget about Bitcoin (BTC) — that digital…

Justin Aversano’s Inspiration for Tarot-Themed NFT Photo Series ‘Smoke and Mirrors’

Justin Aversano’s Inspiration for Tarot-Themed NFT Photo Series ‘Smoke and Mirrors’ Justin Aversano, best known for his high-selling “Twin Flames” NFT photo series, joined Decrypt’s Andrew Hayward ahead of the upcoming L.A. exhibition for his new Ethereum NFT project “Smoke and Mirrors.” He shared the wild inspiration behind the tarot-themed collection, and why—despite his growing profile—he opted not to exhibit…

gm: How Gnosis Has Endured and Evolved

Gnosis first launched in 2015 as a decentralized prediction market built on Ethereum. Now it’s a DAO, a multi-sig wallet, a staking chain, and a vibrant community with its own GNO governance token. Co-founder and COO Friederike Ernst talked to Dan Roberts and Stacy Elliott about the careful evolution of Gnosis, decentralization impostors, account abstraction, DeFi UX failures, why Ethereum…

Bitcoin bulls remain bullish, but macro and crypto-specific hurdles have BTC pinned below $30K

On March 23, Bitcoin (BTC) price recovered the $28,000 support after a brief correction below $27,000. The movement closely tracked the traditional financial sector, particularly the tech-heavy Nasdaq Index, which gained 2.1% as Bitcoin surpassed the $28,000 threshold. On March 22, the Federal Reserve raised its benchmark interest rate by 0.25%, but hinted that it is nearing its maximum level…