Silicon Valley Bank’s (SVB) collapse has had a “limited impact” on the European Union but authorities must still “stay alert” to events as they unfold, European Commissioner Mairead McGuinness has said. Despite McGuinness’ reassuring remarks, stocks of Europe’s largest banks still plunged by as much as 10% on March 15. Silicon Valley Bank’s ‘Limited’ EU Impact According to the European…

Month: March 2023

Asia Express – Cointelegraph Magazine

Our weekly roundup of news from East Asia curates the industry’s most important developments. Chinese billionaire arrested in U.S. for $1B financial fraud According to an announcement published by the U.S. Department of Justice (DOJ) on Mar. 15, Chinese billonaire Ho Wan Kwok (aka Miles Guo and more commonly as Guo Wengui), has been arrested on a total of twelve…

Collapse of Silvergate and Silicon Valley Bank represent a challenge for crypto

The collapse of Silicon Valley Bank (SVB) and Silvergate Capital, some of the most crypto-friendly banks in the industry, has forced many crypto firms to hold their breath. The loss of a significant banking partner for many companies means it will be even harder for them to comply with regulations and offer their services in a way that is consistent…

US lawmaker suggests Signature’s collapse was tied to instability of crypto

Michael Bennet, a United States Senator representing the state of Colorado, has suggested that banks that associated with crypto firms did not make “prudentially sound” decisions. Speaking at a March 16 hearing of the Senate Finance Committee, Bennet brought up the recent closure of the crypto-friendly Signature Bank with lawmakers and Treasury Secretary Janet Yellen in a discussion of U.S.…

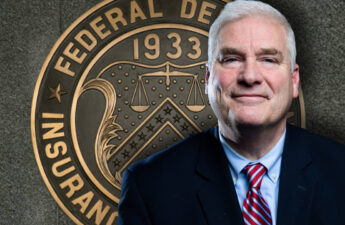

Republican Congressman Tom Emmer Queries FDIC on Alleged Efforts to Purge Crypto Activity from US – Bitcoin News

On Wednesday, Tom Emmer, the U.S. Republican congressman from Minnesota, revealed he sent a letter to Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation (FDIC), regarding reports that the FDIC is “weaponizing recent instability” in the U.S. banking industry to “purge legal crypto activity” from the United States. Specifically, Emmer asked Gruenberg if the FDIC instructed banks not…

MakerDAO passes proposal for $750M increase in US Treasury investments

Lending protocol and stablecoin issuer MakerDAO passed a proposal on March 16 to increase its portfolio holdings of United States Treasury bonds by 150%, from $500 million to $1.25 billion. The proposal aims to increase the protocol’s exposure to real-world assets and “high-quality bonds,” following its Dai (DAI) stablecoin losing its $1 peg during market volatility on March 11. The…

Swiss Bankers Association proposes deposit tokens to develop digital economy

The Swiss Bankers Association released a white paper on how Swiss banks can support the development of the country’s digital economy. A Swiss franc “joint” deposit token is the solution the group settled on. Stablecoins have limited penetration in the Swiss financial system, even as end-to-end digitization is becoming more common in business models, and no Swiss stablecoins are accessible…

Bitcoin bears could face $440M loss in Friday’s options expiry

The rejection that followed Bitcoin’s (BTC) rally to $26,500 may appear to be a victory for bears, but $24,750 on March 14 was the highest daily close in nine months. Furthermore, Bitcoin has gained 26.5% since March 10, when the California Department of Financial Protection and Innovation shut down Silicon Valley Bank (SVB). The recent price increase could be attributed…

Orca DEX to block US users from trading with its interface

The Solana-based decentralized exchange (DEX) Orca will block all United States users from trading using its web interface beginning March 31, according to a March 16 notice posted to its official website. The exchange did over $634 million worth of trading volume in February and has over $46 million total value locked in Solana smart contracts, according to DefiLlama. On…

YouTube Influencers Slapped With $1 Billion Lawsuit for Promoting FTX

A group of investors who did business with defunct cryptocurrency exchange FTX brought a class action lawsuit against multiple internet influencers Wednesday, alleging the content creators pushed unregistered securities on their viewers and followers while promoting the collapsed exchange. The lawsuit seeks over $1 billion in damages and was brought against content creators that reached millions online, including BitBoy Crypto…