Last year and during the first half of 2022, speculators assumed the third-largest bitcoin address was a ‘mysterious whale,’ even though the wallet had shown strong characteristics of being a cryptocurrency exchange. The address known as “1P5ZED” has since been replaced by another address, after the wallet started to transfer its entire bitcoin balance in mid-July 2022. The bitcoin address “1LQoW” is now the third-largest wallet today, and it’s very likely that the owner of the 1LQoW wallet is the same entity that managed the 1P5ZED wallet.

The Third Largest Bitcoin Wallet Changed to a New Address, a Wallet That’s Likely Controlled by the Same Owner

After bitcoin’s price soared to new heights in November 2021, there was a significant amount of speculation concerning the third-largest bitcoin wallet known as “1P5ZED.” Rumors about the wallet plagued social media and some people erroneously attributed the wallet to Microstrategy’s stash of BTC.

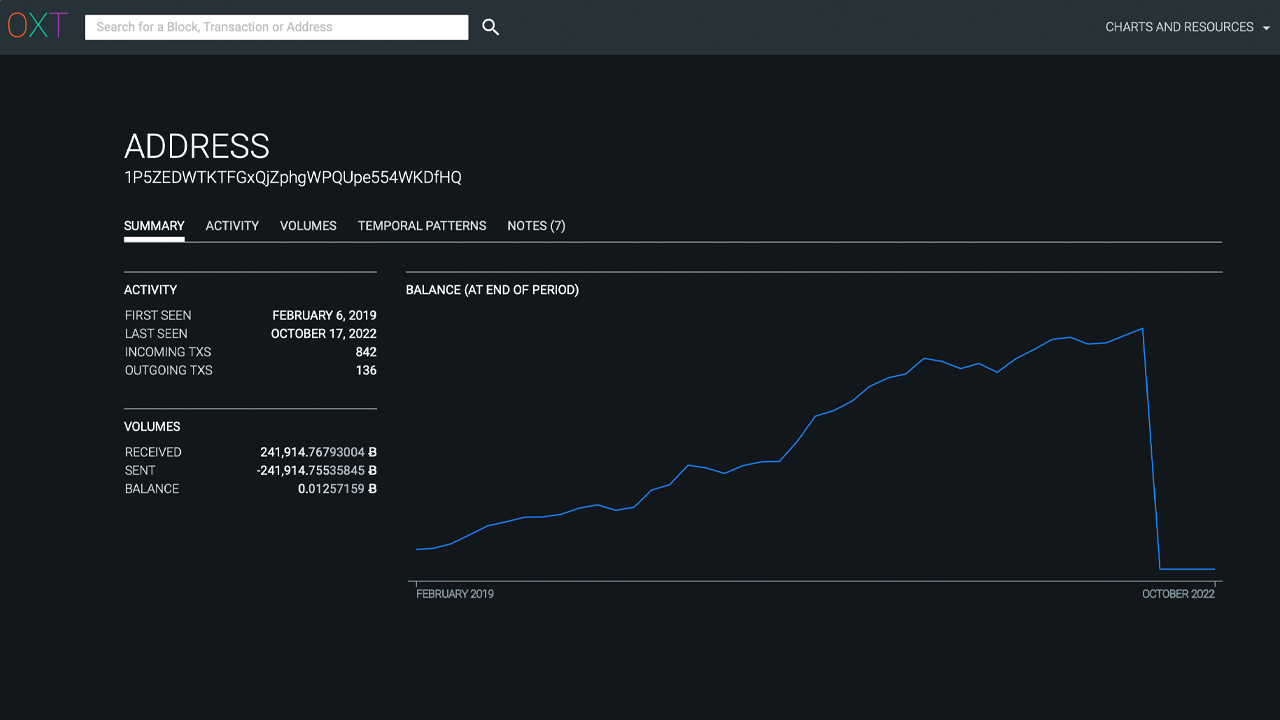

Bitcoin Address: 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ

Bitcoin Address: 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ

Then after the rumors were debunked, blockchain observers noticed that 1P5ZED moved all of its bitcoins in mid-July. Blockchain records show that by the end of June 2022, the 1P5ZED address was down to 0.01257 BTC. In 2021, when Bitcoin.com News reported on 1P5ZED, a source with “access to blockchain analytics tools (Chainalysis and Ciphertrace) as part of their job function” told our newsdesk:

There is an almost 100% chance that both addresses in your article, both 1P5ZED and 1FzWLk, belong to Gemini.

The 1P5ZED wallet also had shown signs of exchange spending patterns like cluster spending. Furthermore, the block explorer oxt.me highlights two annotations, which assume that the “1P5ZED” bitcoin address may have been tied to the exchange Bittrex.

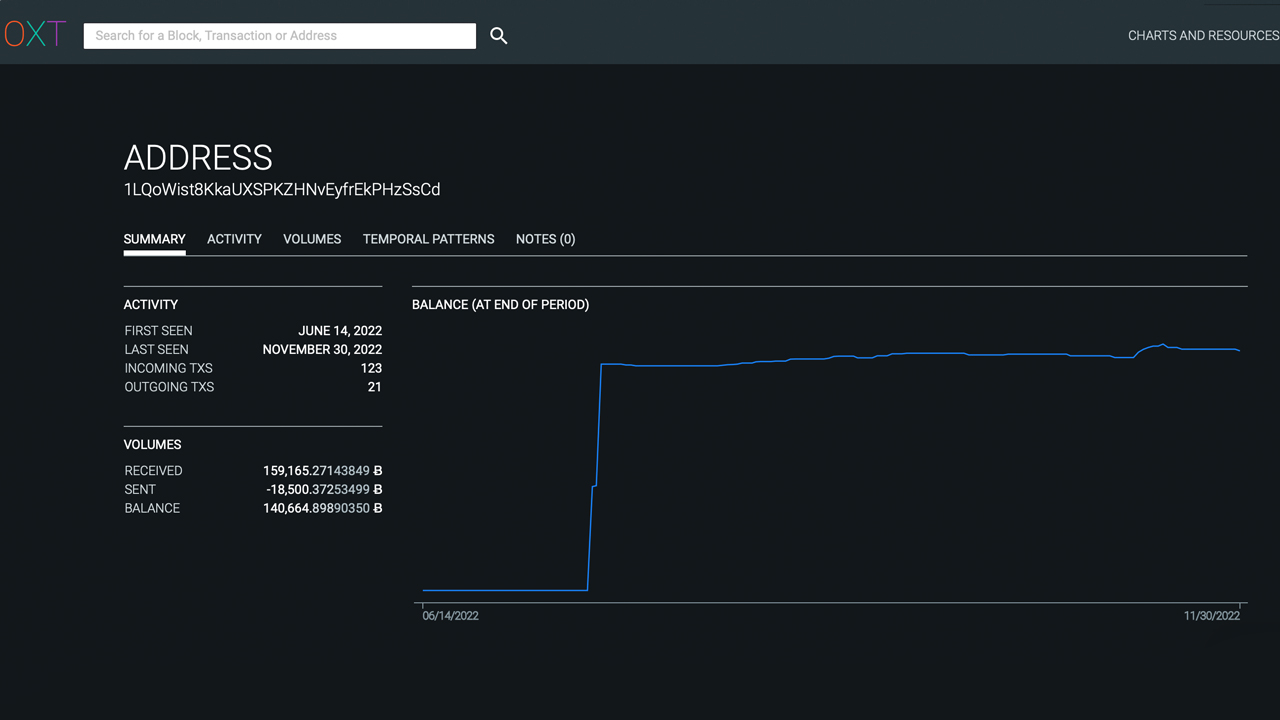

Bitcoin Address: 1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd – This BTC address is now the third-largest holder.

Bitcoin Address: 1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd – This BTC address is now the third-largest holder.

However, following the mid-July and end-of-June removal of more than 132,000 BTC, data still indicates that the wallet is still likely associated with the crypto exchange Gemini. Even if analysts cannot identify the exact owner of 1P5ZED, onchain data, clustering, and heuristics show that 1P5ZED simply changed hands (addresses), but the owner remains the same.

Despite Speculation, Bitcoin’s Third Largest Wallet Is Not a ‘Mystery Whale’ or ‘New Market Player’ — Onchain Data Points to an American-Based Crypto Exchange

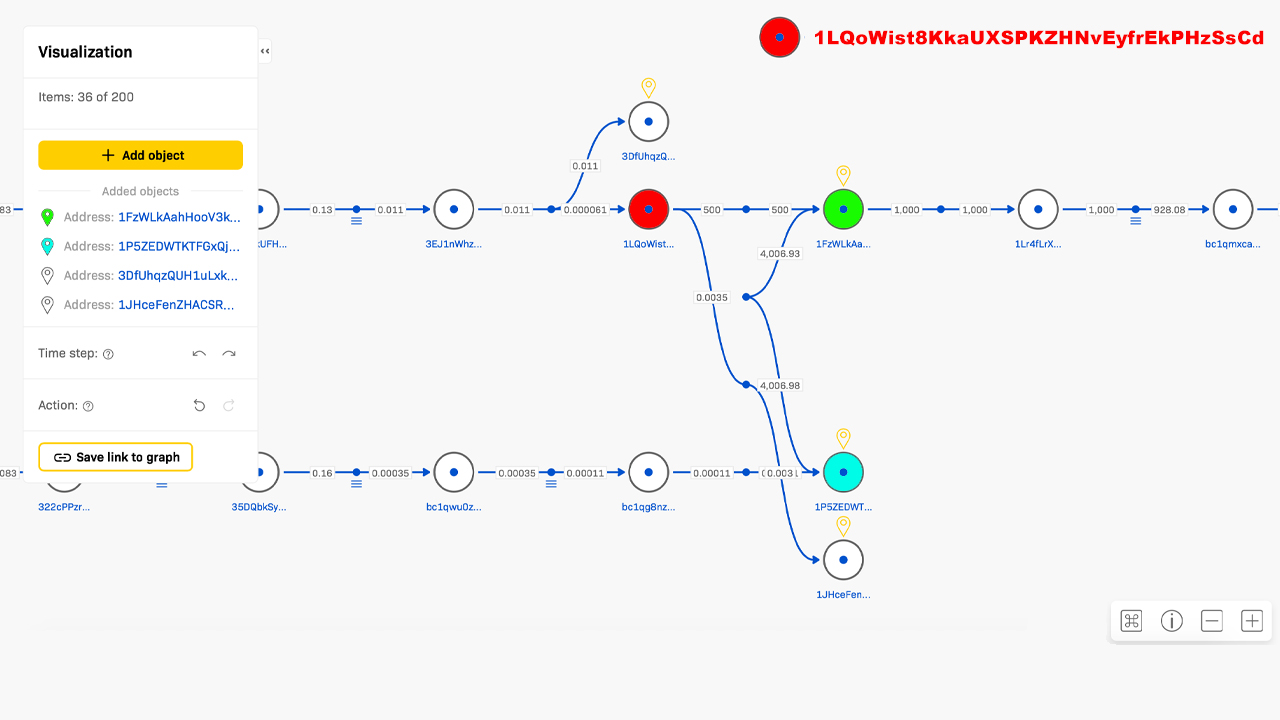

The third largest bitcoin wallet today, “1LQoW” has a balance of more than 140,000 BTC, and the wallet is connected to 1P5ZED and “1FzWLk.” As we noted in our prior reports, 1FzWLk transacted with 1P5ZED on numerous occasions and it transacted with 1LQoW as well. It seems that the now empty 1FzWLk wallet dispersed the funds to other addresses including 1LQoW. Data further shows that 1FzWLk’s transactions were often connected with known Gemini exchange wallets and the current third richest bitcoin wallet today 1LQoW.

Bitcoin Address 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ, Bitcoin Address 1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd, and Bitcoin Address 1FzWLkAahHooV3kzTgyx6qsswXJ6sCXkSR all have ties with each other.

Bitcoin Address 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ, Bitcoin Address 1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd, and Bitcoin Address 1FzWLkAahHooV3kzTgyx6qsswXJ6sCXkSR all have ties with each other.

Per usual, social media posts and crypto publications identified 1LQoW as a new ‘mystery whale’ or new mega player in the market. OXT researcher Ergo BTC, tweeted about the address in July and August 2022. “1LQoW was first seen a few weeks ago, receiving its first [transaction] in a batch withdrawal from Coinbase,” Ergo tweeted on July 19. “It’s 2 outgoing [transactions] are back to 1FzWL, which implies that this address is at least linked and possibly co-owned by 1P5Zs/1FzWL/key rotation? In other words not ‘selling.’” Speculating on whether or not it was Coinbase Custody, Ergo wrote:

Coinbase Custody: Pros: By adjacency and first inflows into 1LQoW. Cons: The first seen on 1FzWL doesn’t quite align with the Coinbase Custody announcement.

Ergo also spoke about the bitcoin wallet 1LQoW on Aug. 2, 2022, when a lot of speculative reporting started to rise after the 1P5ZED myths prior. “Crypto tabloids and clickbaiters have gone from ‘1P5Z is dumping all his coins’ to ‘1LQoW is a new whale that bought $1.64B out of nowhere. ’lmao,” Ergo tweeted. Onchain data also confirms that 1LQoW is not a new ‘mega whale’ or ‘market player’ that just suddenly took the third-largest bitcoin wallet reigns from 1P5ZED.

1LQoW is most likely an American-based crypto custodian or exchange, and we can’t say for 100% certain that it is a Gemini-associated BTC wallet. Cons include the fact that the wallet does not match Gemini’s bitcoin reserve data hosted on cryptoquant.com and other reserve data sites like Glassnode. The stats from cryptoquant.com’s Gemini-associated bitcoin reserve data shows Gemini’s stash is around 136,923 BTC. The third-largest BTC address 1LQoW holds approximately 140,664 BTC (as of 2:00 p.m. ET on Dec. 4, 2022). Coinglass.com data shows Gemini’s BTC reserves stash is estimated to be around 132,102 BTC today, which is also a discrepancy.

Tags in this story

1FzWLk, 1LQoW, 1P5ZED, 3rd largest address, 3rd largest wallet, American Crypto Custodian, Analysis, annotation, Bitcoin, Bitcoin (BTC), Bitcoin Wallet, bitcoin whale, Bittrex, Block explorer, BTC Reserves, BTC wallets, BTC Whale, Coinbase, coinbase custody, collecting BTC, crypto exchange, custodian, data, Ergo BTC, Ergobtc, Exchange, Exchange Reserves, first seen, flag, Gemini, Largest BTC wallets, Onchain, Onchain analysis, Onchain data, OXT Research, OXT researcher, oxt.me, rumors, Speculation, speculators, third largest wallet

What do you think about the relationship between wallets 1P5ZED, 1FzWLk, and the current third-largest bitcoin wallet 1LQoW? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.