November 1, 2021

Cycling On-Chain is a monthly column that uses on-chain and price-related data to better understand recent bitcoin market movements and estimate where we are in the cycle. This sixth edition discusses the impact of the newly launched futures ETFs, last month’s all-time high, sell pressure from miners and long-term bitcoin holders, retail activity and concludes with the results of our monthly poll and halving cycle roadmap.

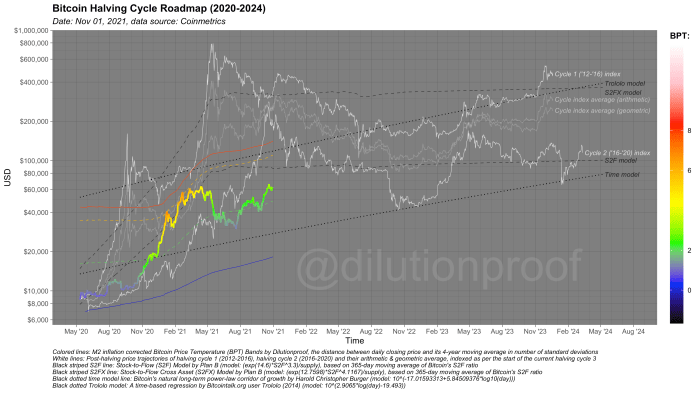

Bitcoin ETF Sparks Bitcoin Futures Demand

Early October 2021, rumors popped up that a futures-based bitcoin ETF might be accepted. This came into fruition when the ProShares Bitcoin Strategy ETF became the first U.S. bitcoin ETF to start trading on October 19. Despite this ETF being a highly anticipated product, its reached trading volumes and assets under management during the first few days surprised many. A second ETF was launched not long after, in what appears to be the start of a new flow of institutional bitcoin-related vehicles that are coming to market. The launch of these futures ETFs attracted a lot of demand for bitcoin futures, most likely by institutions that were interested in getting bitcoin exposure but were not able or allowed to directly buy the asset itself or use other previously existing products. The impact of this new inflow of market participants is particularly visible in the amount of open interest on CME’s bitcoin futures that were heavily bought up by the ProShares Bitcoin Strategy ETF (figure 1).

Figure 1: The amount of open interest in CME’s bitcoin futures products (Source).

Increased Futures Demand Revives The Bitcoin Contango Trade

There appears to be a consensus around Bitcoiners that the bitcoin futures ETFs themselves are far from an ideal product to invest in, as they add multiple layers of counterparty risk, and are very likely to underperform due to direct and indirect exposure to fees. Instead of buying the actual asset itself, money invested in a bitcoin futures ETF is spent on bitcoin futures, which are a derivative product. This means that the investor is also indirectly paying for the fees of the futures product that is being bought, as well as the spread between the futures price and the actual spot bitcoin price.

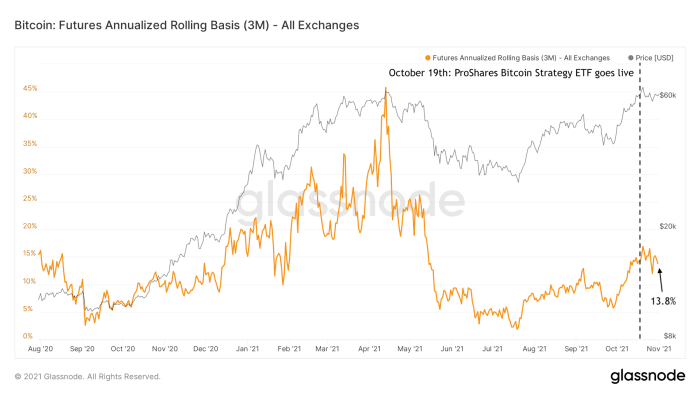

The increased demand for bitcoin futures does have a clear impact on the spot bitcoin price though. Due to the increased demand for bitcoin futures, the prices on those futures become more expensive than the actual spot price (which is called “contango”). This opens up doors for investors — not just bitcoin-minded investors but particularly investors that are looking for “risk-free” yields — to participate in a so-called cash-and-carry trade. By selling a three-month bitcoin future (e.g., at $63,000) while buying spot bitcoin (e.g., at $60,000) at the same time, the investor is simultaneously exposed to upside and downside risk. If the investor then holds the spot bitcoin until the futures product expires and sells it at that time, the investor is guaranteed to earn the spread between those two (in this example $3,000, or 5%).

This type of “contango trade” was one of the factors that helped drive up the bitcoin price during last year’s run-up, and it is currently being revived at a current annualized yield of 13.8% (figure 2).

Figure 2: The annualized percent of yield that investors in the bitcoin futures contango trade are earning (Source).

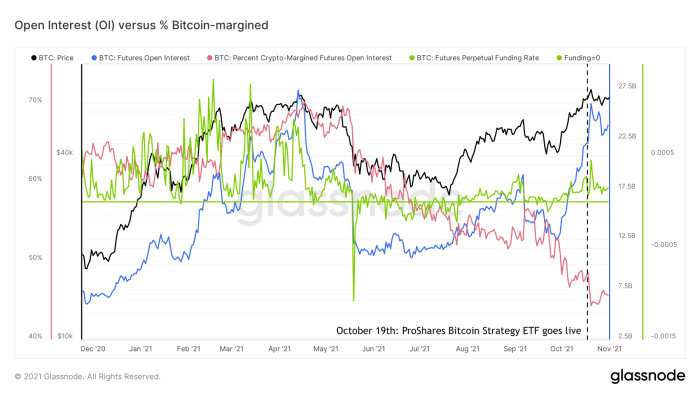

Futures Open Interest Rises Again, But With Less Downside Risk

As a result of the recent surge in the demand for bitcoin futures, the open interest (the total value of all outstanding futures contracts) is back to near all-time highs (figure 3, blue). This may remind you of the overheated market circumstances that we saw in the first quarter of 2021, but overall futures market circumstances are definitely not the same as then. The funding rates of perpetual bitcoin futures markets can be seen as a proxy for the degree in which bitcoin futures markets are long (positive funding rates) or short (negative funding rates). Since bitcoin popped up from its ~$30,000 local bottom in early July, these funding rates (figure 3, green) have been positive, but not nearly as high as earlier this year.

Figure 3: Bitcoin price (black), futures open interest (blue), perpetual futures funding rate (green) and percentage bitcoin-backed futures (red) (Source).

Another factor in the bitcoin futures market that has a relationship with the risk of downside volatility is the percentage of the bitcoin futures that are backed by bitcoin itself (figure 3, red). During the first quarter of this year, between 60–70% of all bitcoin futures were margined by bitcoin, whereas current levels are in the mid-40s.

When the bitcoin price dips, the dollar value of the collateral of bitcoin-margined longs declines as well. As a result, these contracts are at risk of becoming undercollateralized. If that happens, the position is “liquidated.” The trader loses the position and the exchange automatically sells the collateral to pay off the contract. This mechanism adds fuel to the fire, increasing sell pressure on an asset that is already going down in price. The result may be a domino effect of liquidating long positions that may create a steep price crash, for instance like the ones we saw on March 12 and 13, 2020, and on May 19, 2021.

The opposite is true for shorts. Shorts that are not backed by bitcoin itself (which are called “naked shorts”) lose relative value if the bitcoin price spikes up fast, and thus are at risk of becoming undercollateralized. This can also result in a cascade of liquidations, sometimes called a “short squeeze.” A recent example of this was seen in July and covered in COC#3.

The decline in the percentage of bitcoin-margined futures can, therefore, be seen as a proxy for a declined risk of long liquidations while at the same time an increased risk of short liquidations. Combined with the relatively modest funding rates and the fact that the recent increase in open interest is mostly attributable to more traditional platforms like CME that have a lower risk profile than more liberal platforms like Binance who offer much higher leverage, this suggests that futures markets are currently not as heated as earlier this year.

From this perspective, the recent rising open interest in bitcoin futures should not be seen as a direct proxy of exuberant price speculation returning, but perhaps more as a sign that the bitcoin markets are maturing and providing a more liquid and diverse set of derivatives products that large investors need to accommodate their broader investing strategies.

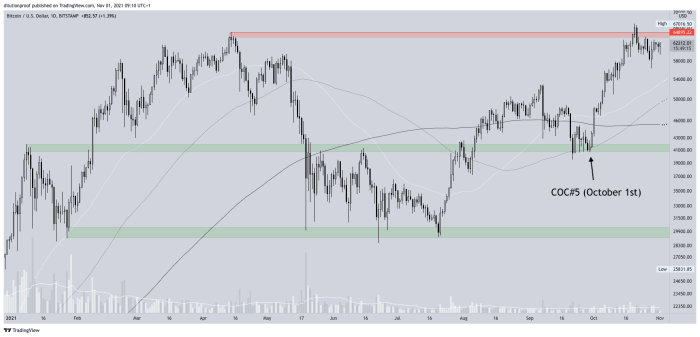

A New All-Time High

The previous edition of Cycling On-Chain (COC#5) pointed out that the bitcoin price was leaning on an important potential support zone at around $40,000. After indeed finding support there, the excitement around a potential new all-time high that was fueled by the bitcoin ETF rumors quickly became a self-fulfilling prophecy. The bitcoin price indeed set a new all-time high on October 20 at a price of ~$67,000 (figure 4).

Figure 4: The BTC/USD price on Bitstamp (Source).

Since the all-time high came one day after the first U.S. bitcoin ETF started trading and after a few weeks of rapid upward momentum, it basically became a “sell the news” type event that pushed price back a bit again. The bitcoin price currently appears to be looking for a new local bottom, which may end up creating a “higher low” (if it hasn’t already), which would validate a bullish price structure from a technical perspective.

Trapped Bears Are Nearly Extinct

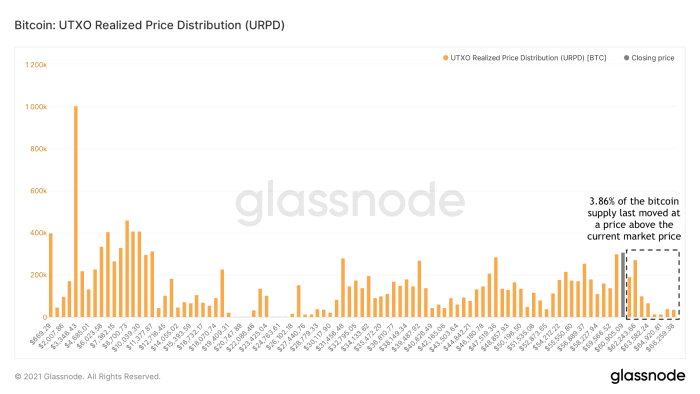

After moving past the previous all-time high, every “trapped bear” that regretted buying bitcoin (e.g., around the April 2021 all-time high) had their chance to sell at their break-even point. Currently, just 3.86% of all bitcoin supply moved at a higher price than the current market price (figure 5).

Figure 5: The Bitcoin UTXO Realized Price Distribution (URPD) (Source).

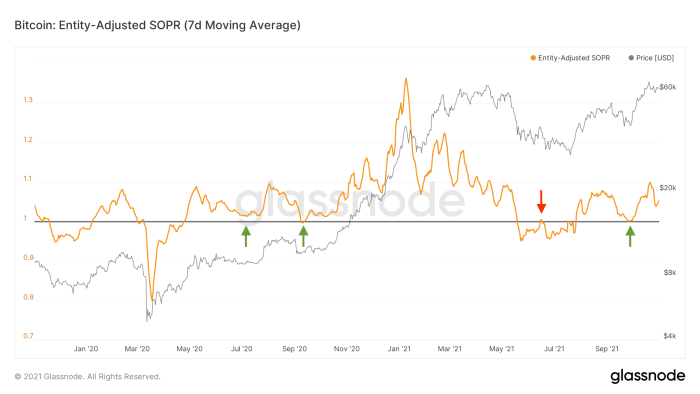

Few Bitcoin Holders Are Currently Willing To Sell At A Loss

Bitcoin price drawdowns provide us with a unique perspective whether we are in bullish or bearish market conditions. During bearish market conditions, fear and anxiety either precede or follow a price drop, or both. Investors that are doubting the short-to-mid-term price course of bitcoin tend to exit their positions during the drop itself or any following relief bounce that nears their break-even point (figure 6, red). During bullish market conditions, where investors are generally positive about bitcoin’s price outlook, they tend to hold onto it during price drawdowns or potentially even “buy the dip” (figure 6, green).

Figure 6: A seven-day moving average of the Entity-Adjusted Spent Output Profit ratio (SOPR) (Source).

During the most recent price drawdown in September, current bitcoin holders were also not moving their coins again at a loss (figure 6, green arrow on the right). Coincidentally or not, this occurred exactly when the bitcoin price was finding support at the ~$40,000 support zone that was highlighted in COC#5.

These current on-chain patterns, therefore, support my thesis that we’re currently not seeing a “double top” like market structure where we should be anticipating a bearish market structure to follow, but more likely a temporary pullback during a new leg up on this long-term bull market. If skies indeed turn out to be clear, who is selling? Let’s first look at miners that have historically provided the market with liquidity during high demand for BTC.

The Changed Role Of Miners

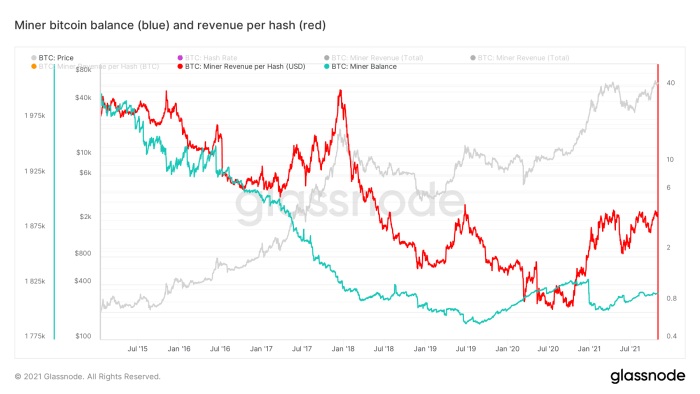

Historically, most bitcoin miners were known to sell a portion of their newly mined bitcoin to cover overhead costs (e.g., electricity and maintenance). In mid-2019, something appears to have changed, as the aggregated balances of bitcoin miners actually started increasing, with the exception of a large amount of profit taking after breaking the previous all-time high of ~$20,000 that was set in late 2017 (figure 7, blue).

Figure 7: Bitcoin price (grey), miner bitcoin balances (blue) and revenue per hash (red) (Source).

Due to global chip shortages over the last year, bitcoin mining hardware has gotten scarce. Existing miners, therefore, had a great competitive edge, causing the miner revenue per hash to structurally increase for the first time in a very long time (figure 7, red). Miners are currently “hot” and can relatively easily acquire funds on capital markets to cover their costs, while they hold onto their mined bitcoin, which is increasingly seen as an ideal collateral.

This, combined with the fact that the amount of newly created bitcoin declines after each halving event, means that the role of miners as structural sellers of bitcoin is changing, and miners are more and more behaving like other market participants. This changing dynamic means that it is increasingly likely that the traditional four-year cycles that we have seen in bitcoin will take on a different trajectory than we witnessed before.

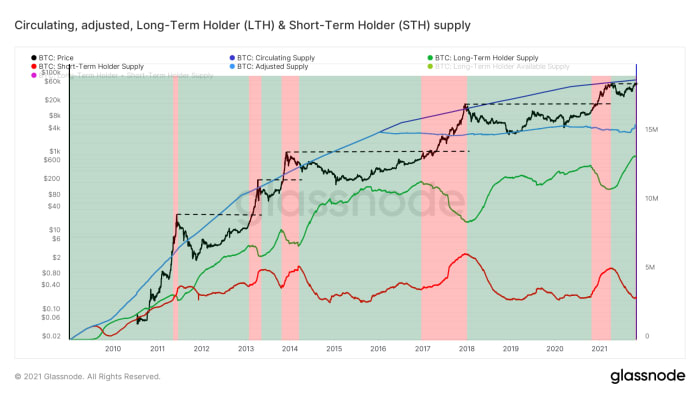

Long-Term Holders (LTHs) Sell During Market Strength

If miners are less active selling their newly mined bitcoin on the markets, it means that any demand for bitcoin must be met by sell pressure from existing holders that are willing to part with their coins. Some existing holders with low conviction might be willing to sell their coins at a relatively modest price, whereas holders with strong conviction may only be willing to sell at higher price levels.

This is usually the case with so-called “long-term golders” (LTH), who are market participants that have bought and held onto their bitcoin for a while, understand its value and are only willing to sell (some) at increased prices. Glassnode estimates the supply held by these types of entities by looking at clusters of addresses that appear to be under control of the same entity, whose aggregated bitcoin position is more than 155 days old. As can be seen in figure 8, these entities tend to only sell during market strength (red areas), around all-time highs (black striped lines) and above, and accumulate again briefly after (green areas).

Figure 8: The bitcoin price (black), circulating supply (dark blue), likely-lost-coins-adjusted supply (light blue) and the long-term holder (LTH, green) and short-term holder (STH, red) supply (Source).

During the recent all-time high break, we also saw the first sign of LTH sell pressure, suggesting that we can expect more of that during price discovery — as always. To structurally push the bitcoin price over its all-time high and keep running, we, therefore, must actually see a strong market demand.

Entities Growth Is Modest

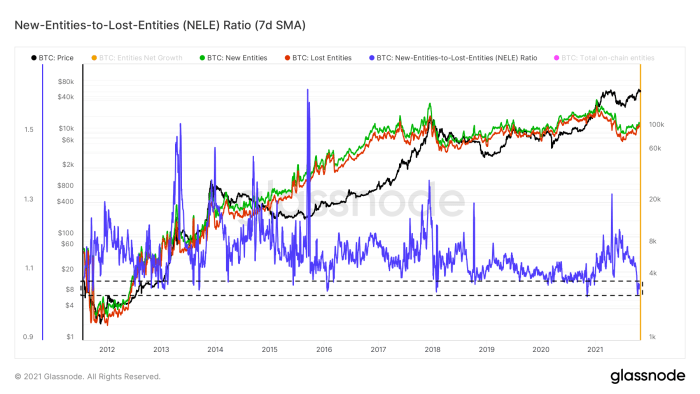

One of the ways to quantify market demand is to look at the number of new entities that are joining the network (figure 8, green), especially in contrast to the entities that are leaving the network (figure 8, red). This is done in a metric called the New-Entities-to-Lost-Entities (NELE) ratio (figure 8, blue). The NELE ratio divides the number of entities that are estimated to be new to the Bitcoin timechain by the number of previously existing entities that appear to have exited their positions.

Figure 9: The bitcoin price (black) and seven-day moving averages of the new on-chain entities (green), lost entities (red) and New-Entities-to-Lost-Entities (NELE) ratio (Source).

During the recent price run to a new all-time high, the number of disappearing entities grew faster than the number of new entities, pushing the NELE ratio down to very low levels that are historically only seen occasionally.

However, the NELE ratio is by no means a perfect representation of “market demand” for bitcoin. After all, one new entity (e.g., Michael Saylor or MicroStrategy) can represent more than a million times more USD buying power than another entity. The fact that the bitcoin price recently moved up a lot while the NELE ratio dipped down hard could, therefore, be a sign that the recent run up might have been fueled by a small number of wealthy entities.

On-chain Activity On Bitcoin Is Still Quiet

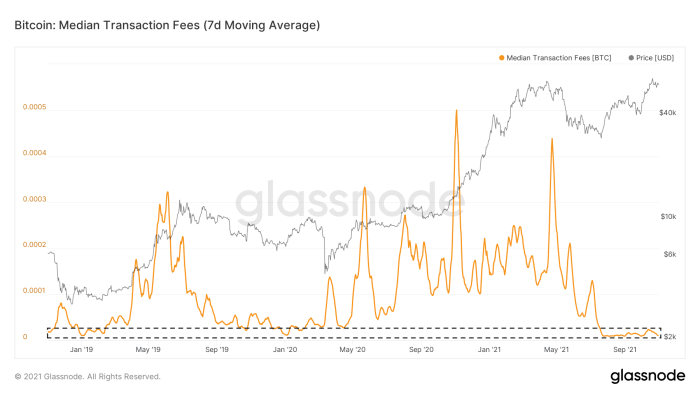

The growth of on-chain entities is not the only thing on Bitcoin’s timechain that is quiet. The number of on-chain transactions that want to be included in the next block has been low since the May 19 market capitulation event. As a result, the median fees that are paid for on-chain transaction fees are still at extremely low levels (figure 10). Although this can be partially attributed to recent increases in Segwit and Lightning Network adoption that were highlighted in COC#4 “On-Chain Silence Before the Storm” on August 1, it is at least a sign that we’re not seeing large numbers of people flock onto the bitcoin timechain either.

Figure 10: The bitcoin price (grey) and a seven-day moving average of the median transaction fees (Source).

Google Search Trends Are Not Peaking

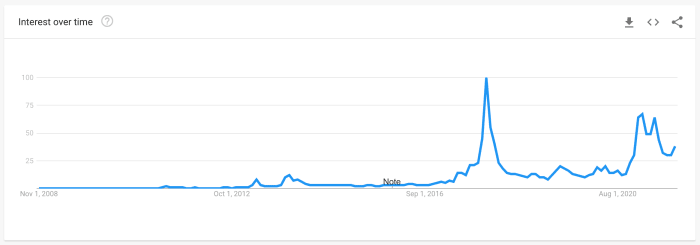

Another metric that is often used as a proxy for retail interest, are Google Trends data that quantify how much searches focus on the word ‘bitcoin’ (figure 11). Current search trends are still lower than the values we saw earlier this year, while both are still lower than the search volumes that we saw at the peak of the 2017 bull market.

Figure 11: Worldwide Google Trends data for ‘bitcoin’ searches (source)

Retail Is Distracted By Altcoins

An all-time high break is usually when bitcoin pops up in mainstream media headlines again, nudging the portion of the retail market that turned their attention elsewhere during bitcoin’s market downturn. The quality of Bitcoin education has grown immensely since the previous periods of market euphoria in 2013 and 2017, but some portion of the market always turns away and looks at altcoins, dreaming of immense gains.

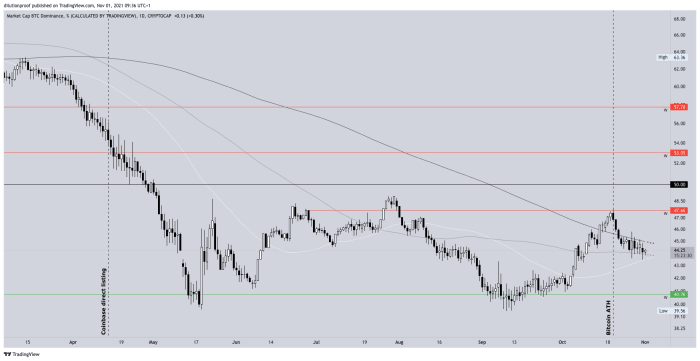

This call of the sirens was also present during the latest all-time high break on October 20. The bitcoin dominance was rising again since September, when the bitcoin price started moving toward its April 2021 all-time high again, but immediately declined as soon as the bitcoin price actually reached a new all-time high and bitcoin came back to the mainstream media headlines (figure 12).

Figure 12: Bitcoin dominance (Source).

It is important to realize that this bitcoin dominance is a flawed metric. Since altcoins are created on a daily basis and their market caps are inflated (extreme example: I create 1 billion free floating KoalaCoin and sell 1 KoalaCoin to someone else for $1, after which KoalaCoin technically has a $1 billion market cap), the metric is pretty much destined to decline by design. The effect is that the metric is particularly biased when comparing current values to historical values, but the recent short-term trend shift is telling nonetheless.

Market Sentiment

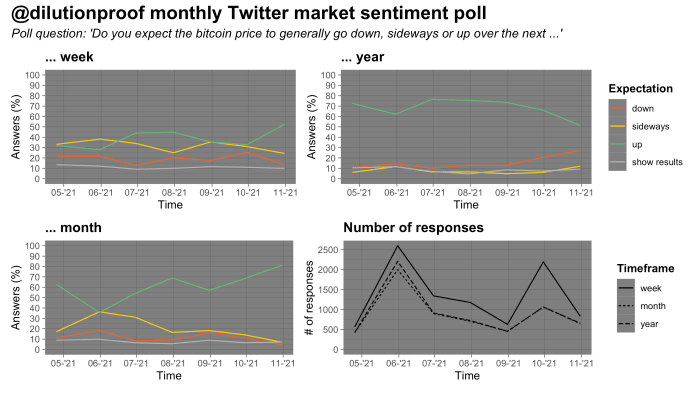

Since late April, when the bitcoin price had just made a new all-time high, I’ve held a monthly bitcoin market sentiment poll on Twitter. The results of such polls need to be interpreted with a grain of salt due to possible selection bias. This month’s poll results are interesting. The respondents gave the most bullish scores ever on a weekly and monthly time frame but also the least bullish scores so far on a yearly time frame (figure 13).

Figure 13: Results of a monthly market sentiment poll on Twitter (Source).

This could be a sign that respondents are leaning toward the narrative that the bitcoin price is destined to be underway in another multi-month leg up in this longer-term bull market, but it is likely to end up in a downward price trend again later in 2022. That type of price movement would seem to fit the type of cyclical movement that would fit bitcoin’s traditional four-year cycle.

Summary

My interpretations of the data in this edition of COC is that we’re seeing

- the maturation of the bitcoin futures market that indirectly leads to increased spot demand via arbitrage;

- a current bitcoin holder basis that has flushed out most of (if not all of) the trapped bears and now has a tendency not to sell at a loss;

- a mining industry that has changed from a net seller of bitcoin to a net accumulator of bitcoin;

- long-term holders that are providing mild sell pressure during market strength but are buying all of the dips;

- while on-chain entities growth and on-chain activity are currently relatively slow, retail investors — that appear not to be too focused on bitcoin just yet — seem to dive on altcoins as somewhat of a leveraged play on bitcoin as soon as it reawakens; and

- a period where short- to mid-term market sentiment is (very) bullish and a seemingly large portion of the market is expecting another multi-month price run, possibly followed by a bear market.

Market circumstances look favorable for bitcoin at the moment. However, it is healthy to realize that when too large a portion of the market has a high conviction that price will move a certain way, Mr. Market has a tendency to suddenly explore another route.

Bitcoin Halving Cycle Roadmap

As always, I’ll close this edition of Cycling On-Chain with the Bitcoin Halving Cycle Roadmap (figure 14). It visualizes the bitcoin price, overlayed by the Bitcoin Price Temperature (BPT) and with price extrapolations based on two time-based models (dotted black lines), the Stock-to-Flow (S2F) and Stock-to-Flow Cross Asset (S2FX) model (striped black lines) and cycle indexes for cycles 1 and 2 (white lines) and the geometric and arithmetic averages of those (grey lines). These models all have their own limitations, but together give us a rough estimate of what may be ahead if history does turn out to rhyme once again.

Previous editions of Cycling On-Chain:

Disclaimer: This column was written for educational, informational and entertainment purposes only and should not be taken as investment advice.

This is a guest post by Dilution-proof. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.