2022 is coming to an end and during the last 12 months, the crypto economy has lost roughly $1.486 trillion in value against the U.S. dollar. On Dec. 20, 2021, bitcoin was trading for $46,406 and it has lost more than 63% in value year-to-date, while the second leading crypto asset ethereum shed 69% against the greenback over the last year.

2022’s Top Ten Cryptos Shed Billions While a Few Played Musical Chairs

Approximately 365 days ago on Dec. 20, 2021, the crypto economy was worth a lot more in value than it is today. 12-month statistics indicate that $1.486 trillion has been erased from the crypto economy since that day, as it slid from $2.334 trillion to the Dec. 20, 2022 value of $848 billion.

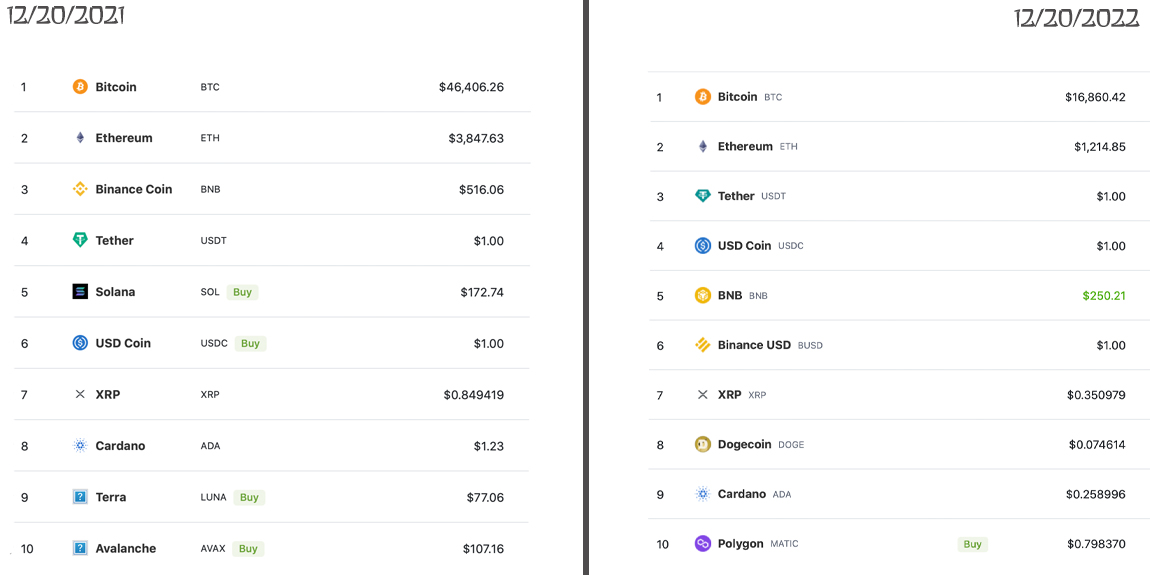

Top ten crypto coins last year compared to the top ten this year. $1.486 trillion has been erased from the crypto economy during the last 12 months.

Top ten crypto coins last year compared to the top ten this year. $1.486 trillion has been erased from the crypto economy during the last 12 months.

At the time, bitcoin’s (BTC) nominal value measured in U.S. dollars was around $46K per coin and ethereum (ETH) was priced at $3,847 per unit last year. 24-hour global trade volume was also much larger, as $118 billion in trades were recorded on Dec. 20, 2021.

Today, the global trade volume has been sliced in half, as there’s been roughly $48 billion in swaps recorded on Dec. 20, 2022. Last year at this time, the top ten crypto market cap looked a whole lot different.

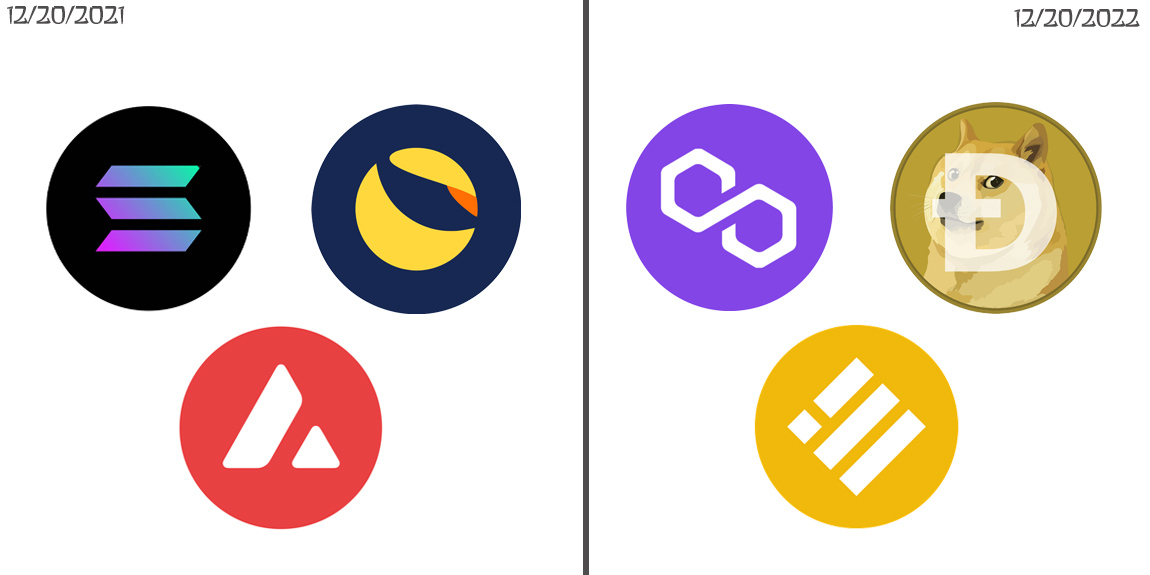

(Pictured left) Solana (SOL), terra (LUNA), and avalanche (AVAX) have all been removed from the top ten standings. (Pictured right) Polygon (Matic), dogecoin (DOGE), and BUSD have entered the top ten standings.

(Pictured left) Solana (SOL), terra (LUNA), and avalanche (AVAX) have all been removed from the top ten standings. (Pictured right) Polygon (Matic), dogecoin (DOGE), and BUSD have entered the top ten standings.

A number of tokens have been displaced from the top ten, while new coins have been added. The top ten largest crypto market caps last year included bitcoin (BTC), ethereum (ETH), bnb (BNB), tether (USDT), solana (SOL), usd coin (USDC), xrp (XRP), cardano (ADA), terra (LUNA), and avalanche (AVAX), respectively.

In June 2022, and for the first time in crypto history, three stablecoins entered the top ten standings. USDT, USDC, and BUSD are the three stablecoins in the top ten. Today, USDT has a market cap dominance of around 7.81%, while USDC’s market cap dominance is 5.24%. BUSD’s market cap dominance on Dec. 20, 2022, is 2.13% of the current $848 billion in value across the entire crypto cap.

In June 2022, and for the first time in crypto history, three stablecoins entered the top ten standings. USDT, USDC, and BUSD are the three stablecoins in the top ten. Today, USDT has a market cap dominance of around 7.81%, while USDC’s market cap dominance is 5.24%. BUSD’s market cap dominance on Dec. 20, 2022, is 2.13% of the current $848 billion in value across the entire crypto cap.

12 months later, SOL has been kicked out of the top ten, LUNA imploded and spiraled below a U.S. penny per coin, and AVAX was pushed out of the top ten standings as well. On Dec. 20, 2021, only two stablecoins existed in the top ten, and today — and for the first time in history — three stablecoins are included in the top ten spots.

Top ten stablecoin assets back then were USDT and USDC, and in June 2022, BUSD managed to enter the top ten positions. New entries into the top ten at this time include dogecoin (DOGE) and polygon (MATIC).

Terra’s LUNA, which is now called luna classic (LUNC), suffered the most after it was once a top ten token last year. On Dec. 20, 2021, LUNC exchanged hands for $77 per unit and today it’s worth $0.00013 per unit. Terra’s LUNC suffered after the blockchain’s algorithmic stablecoin terrausd (UST), now called terraclassicusd (USTC), depegged from the U.S. dollar on May 9, 2022. On May 11, 2022, LUNC was trading for just above $1 per unit and two days later it was trading for less than a U.S. penny per unit.

Terra’s LUNA, which is now called luna classic (LUNC), suffered the most after it was once a top ten token last year. On Dec. 20, 2021, LUNC exchanged hands for $77 per unit and today it’s worth $0.00013 per unit. Terra’s LUNC suffered after the blockchain’s algorithmic stablecoin terrausd (UST), now called terraclassicusd (USTC), depegged from the U.S. dollar on May 9, 2022. On May 11, 2022, LUNC was trading for just above $1 per unit and two days later it was trading for less than a U.S. penny per unit.

Last year at this time, tether (USDT) had a much larger market valuation at $77.39 billion, while today it stands at $66.22 billion. USDC’s market cap has increased during the last 12 months from $42.21 billion to the Dec. 20, 2022 market valuation of $44.43 billion.

365 days ago, BUSD’s market cap was $14.54 billion and it stands at $18.06 billion today. Besides LUNA, two coins that were once top ten contenders — solana (SOL) and avalanche (AVAX) — have suffered considerable losses during the last 12 months.

Bitcoin’s dominance level remained the same during the last 12 months while ethereum’s dominance level slipped from 20.2% to 17.3% this past year. Bitcoin’s hashrate tapped an all-time high in 2022, reaching 347.16 exahash per second (EH/s) on Nov. 12, 2022, at block height 762,845. Bitcoin’s mining difficulty also reached an all-time high in 2022, tapping 36.95 trillion on Nov. 20, 2022. Prior to Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS), the network’s hashrate tapped an all-time high on June 4, 2022, at block height 14,902,285, when it tapped 1.32 petahash per second. The transition from PoW to PoS occurred at Terminal Total Difficulty (TTD) of 58750000000000 on Sept. 15, 2022.

Bitcoin’s dominance level remained the same during the last 12 months while ethereum’s dominance level slipped from 20.2% to 17.3% this past year. Bitcoin’s hashrate tapped an all-time high in 2022, reaching 347.16 exahash per second (EH/s) on Nov. 12, 2022, at block height 762,845. Bitcoin’s mining difficulty also reached an all-time high in 2022, tapping 36.95 trillion on Nov. 20, 2022. Prior to Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS), the network’s hashrate tapped an all-time high on June 4, 2022, at block height 14,902,285, when it tapped 1.32 petahash per second. The transition from PoW to PoS occurred at Terminal Total Difficulty (TTD) of 58750000000000 on Sept. 15, 2022.

Year-to-date, SOL has shed 93.2% against the greenback and AVAX has lost 89% this past year. SOL has notched down from the fifth largest market cap to the current 18th position. AVAX was holding the number ten spot last year and currently, AVAX is coasting along in the 20th spot.

While dogecoin (DOGE) is a top ten contender today, it had a much larger market cap when it was not included in the top ten standings. Dogecoin’s market valuation has slipped from $21.78 billion to today’s $10.22 billion.

Polygon too, which is now a top ten coin, used to have a $14.7 billion market cap on Dec. 20, 2021, but today the market valuation is down to $7.16 billion. The only anomaly of the small handful of cryptos that got added to the top ten and managed to increase its market valuation was the stablecoin BUSD.

12 months ago, when the crypto economy’s market cap was $2.334 trillion, BTC had a dominance rating of around 38.4% and today it stands at 38.3%. While BTC’s dominance didn’t really flinch, ETH’s dominance, on the other hand, moved from 20.2% to 17.3% over the last year.

Tags in this story

$1.486 trillion, 12 months, 2022 performances, Avalanche (AVAX), Bitcoin (BTC), bnb (BNB), BUSD, cardano (ADA), crypto assets, crypto economy, crypto market, Cryptocurrencies, Dominance, Ethereum (ETH), Market Caps, Market Data, Markets, new coins, Polygon (MATIC), Solana (SOL), Stablecoins, terra (LUNA), Tether (USDT), Top Ten, usd coin (USDC), Xrp (XRP)

What do you think about the top ten crypto coin changes during the last 12 months? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.