Nine years and nine months ago, on May 9, 2013, coinmarketcap.com recorded 14 cryptocurrency assets, and bitcoin’s overall valuation was $1.24 billion, with 11.13 million bitcoins in circulation at the time. Today, the same website indicates that there are 22,709 crypto assets. Additionally, the market capitalization of the crypto economy has grown significantly, increasing by 80,466% since 2013.

The Evolution of the Crypto Economy: From 14 Coins to 22,709 Coins

Although over $1.5 trillion has been lost from the crypto economy since its peak in November 2021, its market capitalization has still increased by more than 80,466% since 2013. A snapshot of coinmarketcap.com (CMC) hosted on archive.org shows that, in 2013, there were 14 coins listed on the website. These included bitcoin, litecoin, peercoin, namecoin, feathercoin, terracoin, devcoin, freicoin, novacoin, chncoin, bbqcoin, mincoin, bitbar, and ixcoin. Together, the value of these crypto assets on May 9, 2013, was just over $1.32 billion.

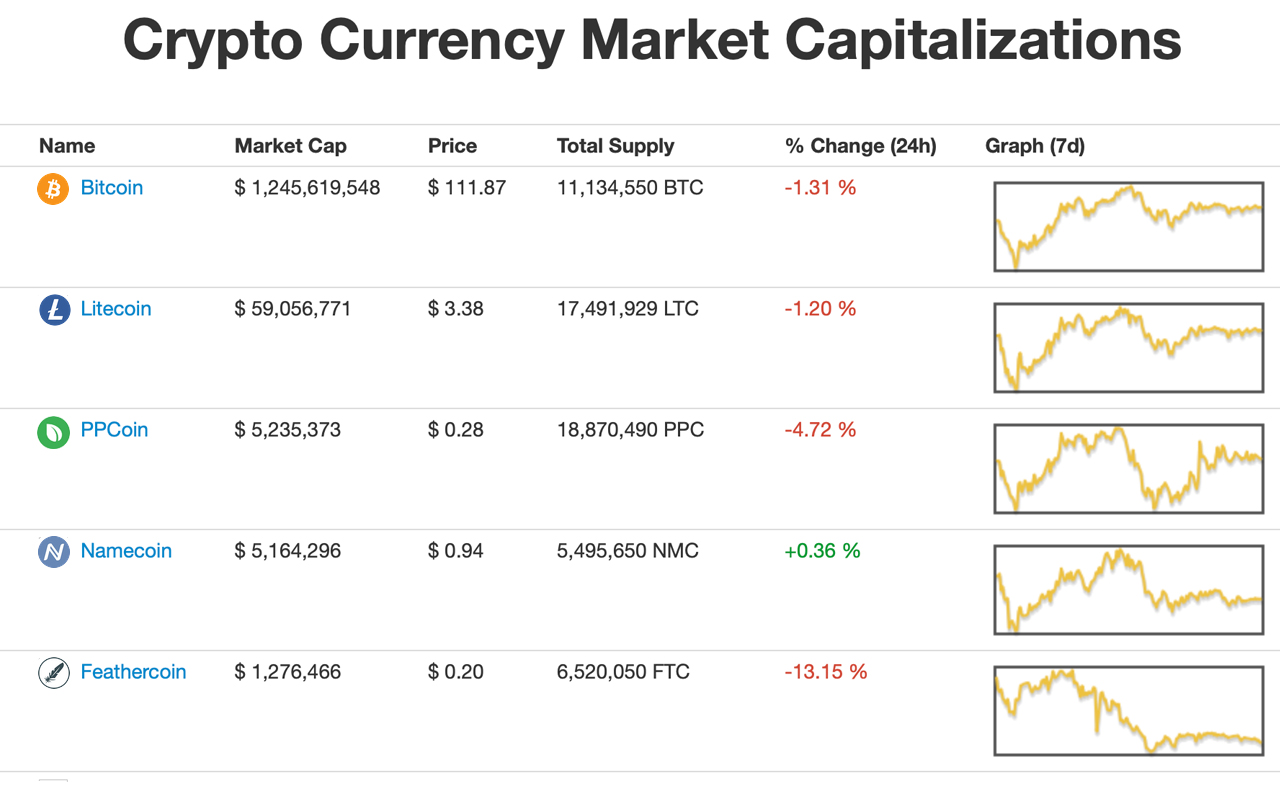

Top five crypto assets on May 9, 2013.

Top five crypto assets on May 9, 2013.

Of course, many of these coins have been forgotten and a great number of today’s top crypto assets did not exist back then like ethereum, bnb coin, solana, cardano, tether, usd coin, and avalanche. Stablecoins did not exist at that time and today, they represent $137 billion in value out of the current $1.06 trillion crypto economy. On May 9, 2013, BTC was trading for a whole lot less than it is today as it was exchanging hands for $111.87 per coin. There were only 11.13 million BTC in circulation in comparison to today’s 19.30 million BTC.

In 2013, BTC’s overall valuation was $1.24 billion, and litecoin’s (LTC) market capitalization was the second-largest. At the time, LTC’s market valuation was around $59.05 million, according to the CMC snapshot. Today, LTC’s market cap is much larger, at $6.79 billion. Peercoin’s (PPC) market capitalization was $5.23 million, and despite being an old-forgotten coin, PPC’s market valuation is around $13.15 million today. Other coins, like terracoin (TRC), were not as fortunate. TRC’s market cap in May 2013 was $1.14 million, and today it has fallen to $340,296. Additionally, some coins are so forgotten that they are no longer listed on coin market cap aggregation sites like CMC.

In 2013, there were only a small handful of crypto exchanges, and some of them were sketchy, to say the least. Digital currency wallets were also few and far between, and overall, the crypto economy’s infrastructure nine years ago was a shell of what it is today. 2022 was a difficult year in the crypto sector, and a great number of businesses collapsed from the downturn. Despite the collapses and the hundreds of billions that evaporated from the market, it is a significantly larger forest compared to the small patch of trees it once was in 2013. Besides the internet itself, not many sectors have seen 80,466% growth in less than a decade.

Tags in this story

adoption, Analysis, Avalanche, bbqcoin, Bitcoin, Blockchain, bnb coin, Cardano, chncoin, Coinmarketcap.com, Crypto, crypto economy, crypto exchanges, Cryptocurrency, devcoin, Digital Currency, Economy, Ethereum, feathercoin, Finance, freicoin, growth, Innovation, Internet, investment, ixcoin, litecoin, loss, market, Market Cap, Market Capitalization, mincoin, namecoin, novacoin, peercoin, perspective, Profit, Regulation, Solana, Speculation, Stablecoins, technology, terracoin, Tether, trading, trend, usd coin, valuation, volatility, Wallets

What do you think the future holds for the crypto economy, and how do you see it evolving in the coming years? Share your thoughts in the comments below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.