Storied auction house Sotheby’s announced Wednesday that it will facilitate the sale of an art collection called “Grails,” which is comprised of digital artwork that belongs to the now-defunct hedge fund Three Arrows Capital (3AC) and its Starry Night Capital NFT-collecting fund.

The auction house signaled that NFT artwork included in “Grails” would be offered via auctions, private sales, and other methods. Describing “Grails” as an “unparalleled collection,” the set includes NFTs from some of the most notable artists and valuable projects in Web3.

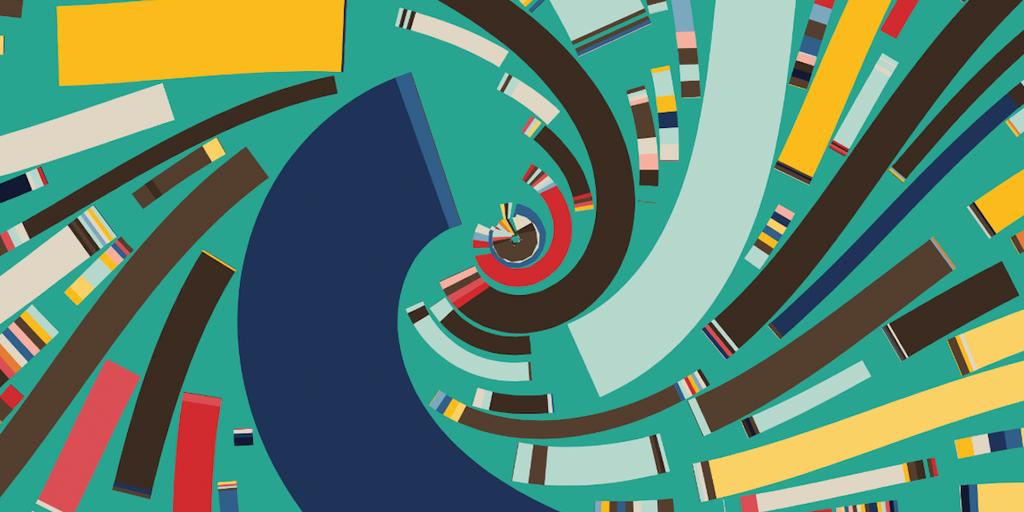

Some of the pieces highlighted by Sotheby’s include Art Blocks Fidenza #216 by generative artist Tyler Hobbs, Ringers #879 (dubbed “The Golden Goose”) by artist Dmitri Cherniak, Chromie Squiggle #1780 by Art Blocks founder Erick “Snowfro” Calderon, and CryptoPunks NFT #6649 and Autoglyph #187 by Larva Labs.

The emblem for the collection appears to be a riff on 3AC’s bow-and-arrow logo, albeit with the arrows tilted upward and without the bow, so that it more closely represents a crown.

Three Arrows Capital was a standout among digital asset firms that collapsed last year, licked amid a string of high-profile bankruptcies after the implosion of Terra’s LUNA and UST. Co-founded by Kyle Davies and Su Zhu, the Singapore-based firm’s bankruptcy is ongoing, and it owes $3.5 billion to creditors.

A spokesperson from Teneo, the company managing 3AC’s liquidation, told Decrypt that Sotheby’s has “a best-in-class approach that will ultimately maximize the value of these assets on behalf of all creditors.”

Though risk management may not have been among the firm’s strengths, Sotheby’s Head of Digital Art and NFTs Michael Bouhanna acknowledged the defunct hedge fund’s eye for fine art in a press release.

“This expansive collection marks an important moment in the rise of generative art on the blockchain in 2021,” he said, “and was guided by the 3AC ethos of acquiring […] some of the highest quality and rarest works available on the market.”

Featuring iconic NFTs, Sotheby’s said it’s staying true to ideals within the Web3 space. The auction house reprised its message of commitment to artists, saying it would continue to “honor creators’ royalties for secondary sales,” per its “Grails” webpage.

Liquidators said earlier this year that some of the failed hedge fund’s NFTs would be put up for sale, a process that kicked off in late March. However, 3AC’s most prized collection—the Starry Night Capital fund—was withheld from that process.

When the initiative was unveiled by 3AC in August 2021, the pseudonymous NFT collector Vincent Van Dough—who curated the fund’s collection—featured Ringers #879 as an example of “what was possible with generative art.”

(1/4) It’s hard to put into words what the Goose Ringer has meant for me in this past 7 months. I remember the first day that images of @dmitricherniak‘s Ringers project was shared before launch and feeling something click for me as to what was possible with generative art. pic.twitter.com/YauuI91B29

— pixelpete (@pixelpete) August 27, 2021

According to data compiled by Dune, the NFTs still held by 3AC are worth around $2.4 million, while NFTs transferred to Teneo are worth $20.8 million. However, it can be difficult to value individual, “rare” pieces from NFT collections, due to limited liquidity for such assets and oft-volatile market conditions.

Artwork from “Grails” will be made available soon, the auction house said. The first auction from the collection will take place in May during its “marquee sale week,” Sotheby’s said, “one of the most anticipated moments of the annual auction calendar with the most high-profile sales of contemporary and modern art.”

Stay on top of crypto news, get daily updates in your inbox.

Source: https://decrypt.co/137285/sothebys-auction-cryptopunk-other-nfts-owned-three-arrows-capital