beginner

Because of their volatile nature, crypto assets are no strangers to crashes. Sometimes, coins and tokens manage to bounce back and recover their price: Bitcoin is the best example here. Many cryptocurrencies, however, never recover — and while these are often smaller tokens with tiny market caps, this fate can also befall bigger projects. After all, we all remember the Terra crash.

So, why do these crashes happen? In this article, I will take a look at the potential reasons for crypto crashes as well as at five examples of cryptocurrencies losing a big percentage of their value.

What Can Cause a Crypto Crash?

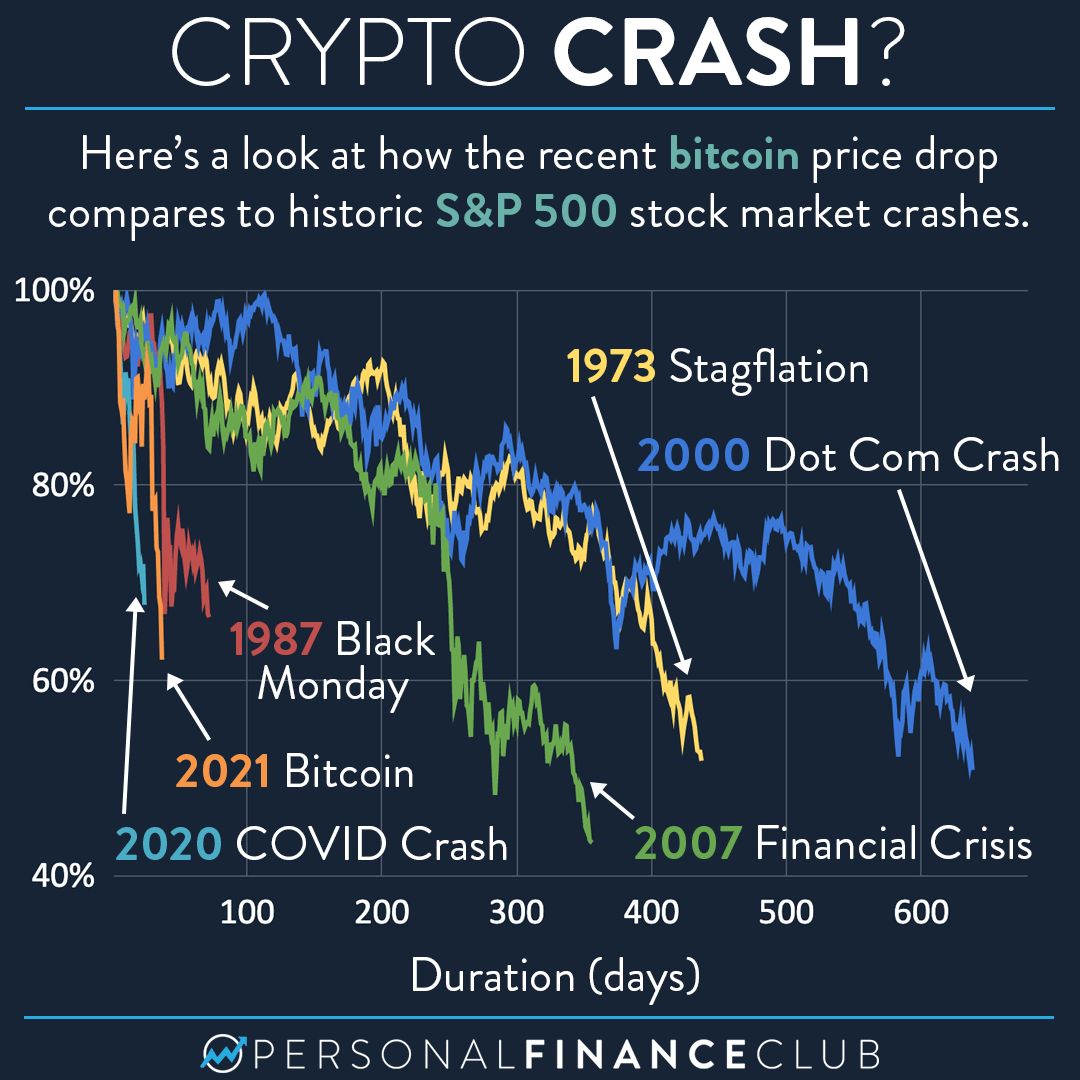

Bitcoin crash vs. stocks market crashes

A cryptocurrency crash, similar to a stock market crash, is a sudden and significant drop in the value of digital assets in the crypto market. Several factors can trigger such an event:

Regulatory Scrutiny. Cryptocurrencies operate in a decentralized system based on blockchain technology, largely outside of traditional monetary policies. A sudden increase in regulatory scrutiny by governments can spook crypto investors and result in a sell-off.

Cyber Attacks. The crypto market operates mainly on digital platforms or crypto exchanges. Any major security breach in the largest cryptocurrency exchanges can cause panic and escalate into a market crash.

Market Manipulation. Given the relatively young and unregulated nature of the crypto market, it is susceptible to manipulation. For instance, a pump-and-dump scheme can lead to an artificial boom followed by a crash.

Investor Sentiment. Like any investment, cryptocurrencies are subject to investor sentiment. Any bad news or fears about the future of digital currencies can create a domino effect, culminating in a market crash.

Why Is the Cryptocurrency Market Down Today?

The entire cryptocurrency market can be down for several reasons. Today’s decline could be a result of negative news affecting investor sentiment, such as a potential regulatory clampdown, a major hack of a crypto exchange, or simply market correction after a period of significant gains.

It’s also important to remember that cryptocurrencies are considered risky assets. Institutional investors may decide to reduce their exposure to riskier assets in times of economic uncertainty, which could impact virtual currencies.

Top 5 Biggest Crypto Crashes in History

Here are 5 of the biggest crypto crashes the industry has seen.

December 2017–December 2018. Bitcoin, the first and largest of all cryptocurrencies, reached an all-time high of nearly $20,000 in December 2017. However, what followed was a massive crash that saw the value of Bitcoin tumble by over 80% within a year.Black Thursday, March 2020. Amid the global panic caused by the COVID-19 pandemic, the crypto market was not spared. On March 12, 2020, Bitcoin’s price dropped by almost 50% in a single day.May 2021. Triggered by Elon Musk’s announcement that Tesla would no longer accept Bitcoin due to environmental concerns and China’s crackdown on crypto companies and services, Bitcoin and other popular cryptocurrencies experienced a significant drop. This crash wiped out more than $1 trillion from the entire crypto market.May 2022. In just a few days, both terraUSD (UST), a stablecoin, and LUNA, the cryptocurrency that was meant to stabilize its price, lost almost all of their value. Following this crash, UST digital tokens ceased to exist, and neither the original LUNA, which was renamed Luna Classic (LUNC), nor the new one were able to retake the coin’s previous highs ever again.November 2022. The token of the cryptocurrency exchange FTX (FTT) went from being worth over $20 to less than a dollar following the leak of the exchange’s balance sheet. The fallout from this crypto crash left a lasting impact on the whole crypto industry.

What Are the Most Volatile Cryptocurrencies?

While all cryptocurrencies are known for their volatility, some stand out more than others:

Bitcoin (BTC). As the first and most significant cryptocurrency, Bitcoin often experiences substantial price swings. Any major fluctuation in Bitcoin’s price can affect the entire crypto market.Ethereum (ETH). Ethereum, being the second-largest cryptocurrency, is also known for its volatility. However, it is worth noting that Ethereum’s blockchain technology, which supports smart contracts and the creation of decentralized applications, holds significant promise.Smaller Market Cap Coins and Tokens. Cryptocurrencies with smaller market caps, including numerous altcoins, crypto tokens, and non-fungible tokens (NFTs), can be extremely volatile. Their prices can dramatically fluctuate based on hype, speculation, and investor sentiment.

While volatility can present investment opportunities, it also comes with increased risk. Crypto investors should exercise due diligence before investing in these digital assets.

FAQ

How many cryptocurrencies are there?

As of mid-2023, there are more than 10,000 different cryptocurrencies. These digital assets operate on a range of blockchain networks and serve various functions. Some, like Bitcoin, function as digital money, while others, like Ethereum, provide the infrastructure for decentralized applications.

As crypto enthusiasts and companies develop new blockchain-based projects, the number of cryptocurrencies continues to grow. Even though some cryptocurrencies, having gained considerable traction, are widely used now, many others have only limited adoption.

Will Bitcoin crash?

Predicting the future of Bitcoin or any digital asset is challenging. Inherently volatile, crypto markets are influenced by a wide range of factors, from technological advancements to regulatory changes introduced by federal securities laws and central banks. For instance, a severe Bitcoin scandal or stringent regulations could potentially trigger a crypto collapse.

However, it’s also possible for the crypto sector to continue growing, particularly as more people and businesses adopt digital currencies. It’s crucial for investors to do their research and perhaps consult with financial advisors before making any significant investments in Bitcoin or any other cryptocurrency.

Can a cryptocurrency recover after a crash?

Yes, a cryptocurrency can recover after a crash. History has shown that while crypto prices can plummet during periods known as “crypto winter,” they also have the capacity to rebound. For example, after Bitcoin’s significant drop in 2018, it managed to recover and even reach new highs in the following years.

That said, recovery is not guaranteed for all cryptocurrencies, especially for those from a smaller crypto company or those with less widespread adoption. Therefore, it’s important to diversify your portfolio by investing in more than a single digital asset and to avoid investing more than you can afford to lose. Additionally, factors such as the ability to execute Bitcoin withdrawals from an exchange should also be taken into account when investing.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.