Bitcoin mining revenue has hit a new yearly high, as the price of the cryptocurrency surged this week amid widespread excitement surrounding the possible approval of a U.S. spot Bitcoin ETF by the SEC.

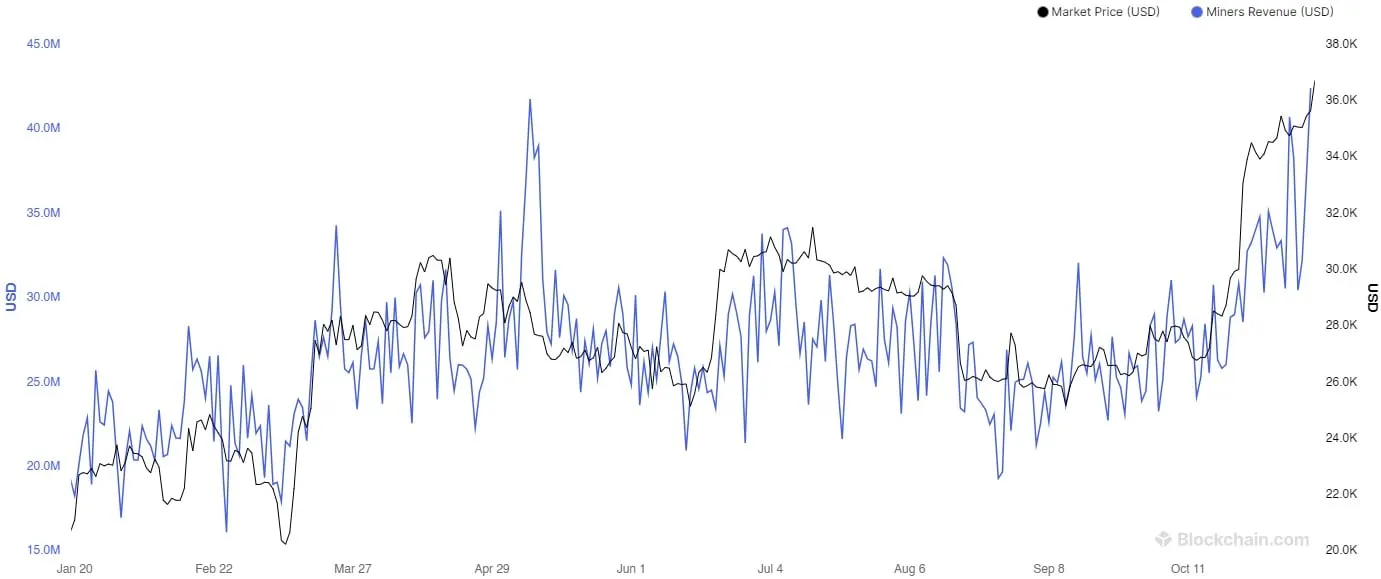

Per data from Blockchain.com, BTC mining revenue hit $42,386,514.038 on November 9, topping its previous yearly high of $41,744,197.067 set on May 8, 2023. For context: That’s even higher than mining revenue was during the Ordinals craze in May.

The spike in mining revenue came as BTC’s price surged to more than $37,000 on November 9, fueled by mounting anticipation of the possible approval of a U.S. spot Bitcoin ETF by the Securities and Exchange Commission (SEC).

BTC’s price currently stands at just over $37,200, up 7.5% on the week.

BTC mining revenue in 2023. Source: Blockchain.com

BTC mining revenue in 2023. Source: Blockchain.com

“Bitcoin miners earn more when two main factors come into play: the price of BTC itself and how busy the Bitcoin network is,” Blockchain.com President Lane Kasselman told Decrypt. “When the network is busier, it means more people are using it, and they pay higher fees for transactions. So, in May, even if Bitcoin’s price wasn’t exceptionally high, the network was congested, leading to a significant boost in miner earnings. However, the recent increase in their earnings is mostly due to the rising price of Bitcoin.”

The May network congestion was due to high demand for Ordinals. Ordinals inscriptions are similar to NFTs and allow digital assets to be inscribed on the Bitcoin blockchain. Miner revenues spiked to $40 million per day, although the BTC price at the time—$27,000—was much lower than it is now.

The SEC and Bitcoin ETFs

Bitcoin’s price surge has come in the wake of optimism over the possible approval of a Bitcoin ETF by the SEC. The expiry of deadlines for rebuttal comments on some pending ETF applications has created a brief window in which 12 applications for a Bitcoin ETF could be approved simultaneously.

It comes on the heels of reports that digital asset manager Grayscale has been in talks with the SEC on the details of its application to convert the Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF. The reported talks follow an order issued last month by the U.S. Court of Appeals for the SEC to review Grayscale’s application, after it described the SEC’s actions as “arbitrary and capricious.”

The SEC has hitherto rejected every application for a spot Bitcoin ETF, or exchange-traded fund. An ETF is a type of investment vehicle that’s publicly traded, tracking the performance of an underlying asset—in this case, BTC.

Approval of a U.S. spot Bitcoin ETF is widely regarded as a significant milestone for institutional acceptance of the cryptocurrency, as it would enable investors to gain exposure to the cryptocurrency market without having to manage the risk of holding the asset themselves.

While many hedge funds and investment firms have filed applications with the SEC for a Bitcoin ETF, new life was breathed into the race earlier this year when BlackRock, the world’s largest asset manager, filed its own application. A recent report from JP Morgan analysts predicted that it was “most likely” a spot Bitcoin ETF could be approved by the SEC as soon as January 2024.

Edited by Stacy Elliott.

Stay on top of crypto news, get daily updates in your inbox.

Source: https://decrypt.co/205318/bitcoin-mining-revenue-hits-yearly-high-amid-etf-fuelled-rally