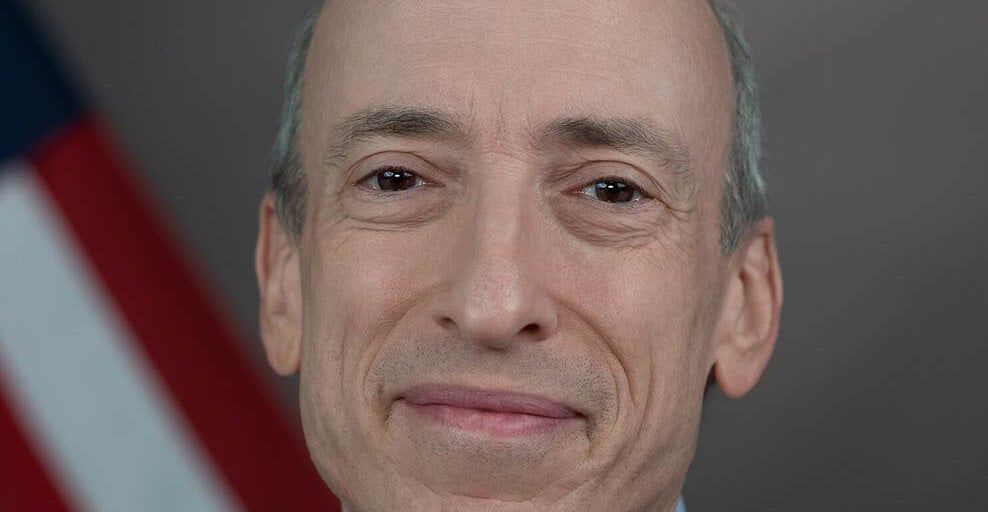

Gary Gensler, the often embattled chair of the U.S. Securities and Exchange Commission, once again sounded the alarm about artificial intelligence and how its rapid advancement could affect financial markets.

“One shouldn’t greenwash, and one shouldn’t AI wash—I don’t know how else to say it,” Gensler said during the “Balancing Innovation & Regulation” AI event hosted by The Messenger in Washington, D.C. on Wednesday. “If you’re raising money from the public, if you’re offering and selling securities, you come under the securities laws and give full, fair, and truthful disclosure, and investors can decide.”

Greenwashing refers to making exaggerated or false claims about environmental, social, and governance practices, also known as ESG, to make a project more attractive. The SEC has previously warned that greenwashing can distract investors about the actual risks, rewards, and pricing of an asset.

Gensler said the hype around AI is turning the technology into a similar distraction.

“We are worried about faking the markets and fraud on this macro issue,” he continued. “I think it really needs a lot of discussion amongst not just financial regulators here but around the globe.”

Even though generative AI can mimic a human’s speech patterns and writing style with surprising complexity, he emphasized that a human is behind the machine who must answer for financial crimes committed by the chatbot.

“Let me just say fraud is fraud, and if there’s a human that’s using a model that’s defrauding the public; that human—depending on the facts—is likely going to hear from us,” Gensler said. “Artificial intelligence as we know it now still has humans in the loop.”

He acknowledged, somewhat jokingly, that human involvement may not always be the case.

“I don’t know when we get to Sarah Connor days,” he said, referencing the iconic character played by Linda Hamilton in the Terminator film franchise. “But there are humans that are putting that AI model in place and setting what’s called the hyperparameters, so there are still humans that have responsibility for that AI.”

Gensler zeroed in on the risks of using AI in finance, pointing out the potential for developers to include personal biases and conflicts of interest in the training data. Gensler also highlighted the dangers of relying on uniform or centralized datasets, which he cautioned could lead to market instability due to a lack of diversity in decision-making.

“If you have large parts of the market relying on one dataset, on mortgage data,” Gensler said. “The hurting effect could drive us off of an inadvertent cliff.”

Even though the number of AI developers and significant investments in the space continues to grow, Gensler said we will eventually see less fragmented data as the number of AI models is whittled down to three dominant players.

“That generally happens early in a technology,” Gensler said. “So we’re likely to end up—because of the network economics—with three of these dominant foundations or models that largely everybody else is relying upon… it’s a supply chain of AI.”

“If you haven’t thought about it, if you’re a fintech startup, a community bank, a smaller asset manager, you can’t build the big models, you’ve got to rely on somebody else’s model,” he added.

In September, Gensler added his name to the growing list of government officials concerned about the adverse impact of generative AI, focusing specifically on AI-generated deepfakes. Testifying before the Senate Banking Committee, Gensler warned that AI deepfakes pose a risk to financial markets, highlighting an instance of an AI deepfake of the SEC Chair that attempted to manipulate the U.S. Stock Market.

“I think we have good laws, but these new technologies will challenge these laws,” Gensler said. “If you’re using AI and you’re doing deepfakes in the market, that’s a real risk to the markets.”

Edited by Ryan Ozawa.sd

Stay on top of crypto news, get daily updates in your inbox.

Source: https://decrypt.co/208944/dont-ai-wash-investment-pitches-sec-chair-gary-gensler