Between rising inflation, stagnating wages, and ever-increasing living costs, savings are hard to make and can be even harder to maintain. That’s where investing comes in.

An investment journey can start with as little as $1. All you need is a desire to learn and a cool head on your shoulders. Everything else can come with time—and effort. Here’s a step-by-step guide on how to invest even if you don’t have a lot of money.

Please remember that this article does not constitute investment advice. Always DYOR before making any financial decisions.

Step 1: Understand the Basics of Investing

Starting your investment journey doesn’t require having a hefty bank account. It’s about making smart choices with what you have. When it comes to investing with limited funds, knowledge is your most valuable asset.

Before diving into any investment, understanding the basics is crucial. This means getting familiar with terms like stocks, bonds, ETFs (exchange-traded funds), and mutual funds. A solid foundation in these areas can help you make informed decisions and set realistic financial goals.

Another key to investing on a budget is consistency and patience. Starting small doesn’t mean staying small. By regularly contributing to your investments, even in small amounts, you leverage the power of compound interest, which can turn modest savings into significant sums over time.

Avoid common pitfalls such as chasing high returns without understanding the risks of investing in trendy assets without doing your homework. Remember, every investor’s journey begins with a single step, and with the right approach, even the smallest step can lead to substantial growth. Stay informed, stay disciplined, and watch your investment portfolio grow, one dollar at a time.

Step 2: Prepare to Invest

This step can be completed both before and during your investment journey—it’s great practice for everyone who wants to be smart about their finances, which begins with effective budgeting and saving.

The first step to unlocking investment opportunities is to manage your current finances wisely. This means scrutinizing your income and expenses to identify where you can cut back and save. Many find success by adopting the 50/30/20 rule—allocating 50% of income to necessities, 30% to wants, and 20% to savings and investments. This simple yet effective strategy can help in systematically setting aside funds for investment purposes.

Equally important is the establishment of an emergency fund before taking the investment plunge. Life’s unpredictability demands a financial cushion, typically covering 3–6 months’ worth of living expenses, to handle unforeseen circumstances without derailing your investment journey. This fund acts as a financial safety net, ensuring that you don’t have to liquidate investments prematurely, which can be counterproductive to your investment goals.

Step 3: Start Small

There are many different ways to start investing with little money. Investing doesn’t always start in the high-stakes world of the stock market; sometimes, it begins with a simple, secure foundation like a high-yield savings account. These accounts are an excellent starting point for new investors, offering a risk-free method to grow savings at rates higher than traditional bank accounts. Especially for those not yet ready to navigate the complexities of the stock market or individual stocks, a high-yield savings account can be a stepping stone that provides a taste of passive income through accrued interest.

Three different ideas for investing with little money

Micro-investing apps, tailored for those without substantial capital, represent another accessible entry point into the world of investment. These platforms demystify the process, enabling users to invest minimal amounts—sometimes just the spare change from transactions—into a diverse array of investment options, including ETFs and fractional shares of individual stocks. By doing so, they not only offer a practical introduction to investment but also help in gradually building a portfolio in sync with the user’s risk tolerance. Apps like Acorns and Stash stand out by making investment incredibly approachable, merging the ease of saving with the growth potential of investing.

Transitioning from saving to investing can seem daunting, but Dividend Reinvestment Plans (DRIPs) and Direct Stock Purchase Plans (DSPPs) smooth this path. Both allow investors to start small, directly purchasing shares or fractional shares from major companies. DRIPs, in particular, offer a way to automatically reinvest dividends received back into additional shares, harnessing the power of compounding to grow investments over time. This approach not only cultivates an investment habit but also provides direct exposure to the stock market’s potential returns without the need for substantial initial investment.

Active Investing vs. Passive Investing

For a first-time investor focusing on building their retirement savings or growing a small initial sum, it can be really important to understand the differences between active and passive investing. Active investing involves hands-on management, with investors or their financial advisors making specific decisions about buying or selling stocks, bonds, or other securities based on market analysis. This approach aims to outperform the market average and requires a good deal of research, market knowledge, and, often, higher fees for managed funds.

On the flip side, passive investing is about setting a long-term strategy and sticking to it, minimizing the amount of buying and selling. This often involves investing in index funds or ETFs that track a market index, like the S&P 500. The beauty of passive investing, especially for those just starting out with limited funds, lies in its lower costs and the power of compounding interest over time. Online banks and various platforms now offer easy access to these types of investments, allowing for monthly contributions from your account to steadily grow your portfolio.

Step 4: Explore Other Low-Cost Investment Opportunities

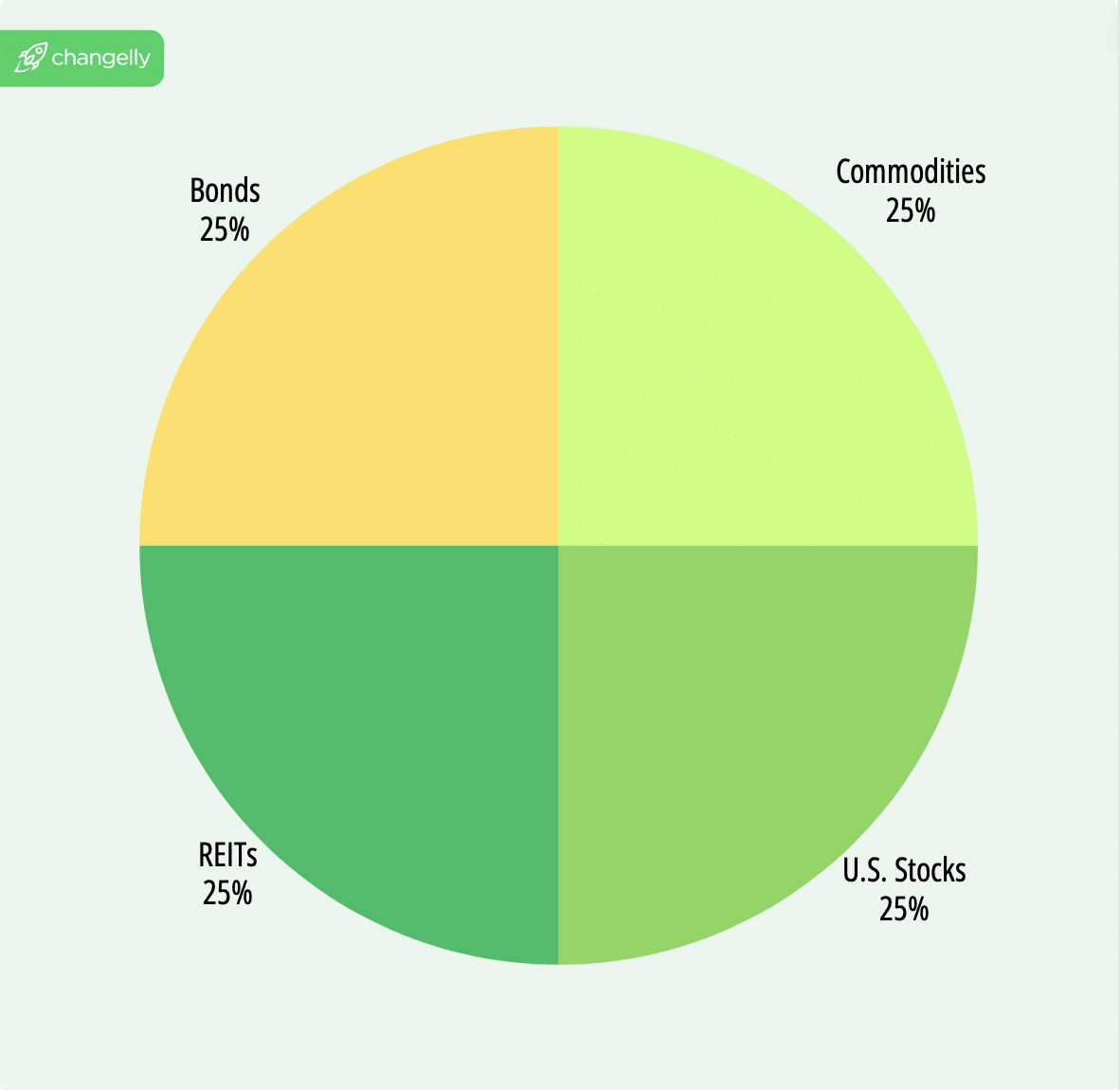

One of the most important rules of investment is that in order to minimize your risks, you need to build a diversified portfolio. The general way to do this is to invest in a balanced combination of high- and low-risk assets, as well as assets belonging to different industries.

Example of a basic balanced investment portfolio

A good starting point is index funds and ETFs (exchange-traded funds). These investment vehicles are celebrated for their ability to offer diversification at a relatively low cost, an essential factor in building a resilient investment strategy. By pooling money from numerous investors, index funds and ETFs invest in a wide range of assets, from individual companies to entire sectors, mirroring the performance of specified indices.

This broad exposure significantly mitigates the risk associated with investing in single stocks, aligning well with the investing goals of those seeking a more conservative entry into the market. Financial advisors often recommend these options to clients looking for an investment strategy that balances growth potential with risk management, all without the need for a substantial minimum investment.

On the other end of the spectrum lies the dynamic world of cryptocurrency. Investing in digital currencies like Bitcoin and Ethereum has become increasingly accessible, with platforms allowing transactions with as little as the amount linked to a debit card purchase. This low entry barrier enables investors to explore the cryptocurrency market without committing large sums, making it an intriguing investment vehicle for those willing to navigate its volatility.

While the potential for a high annual return attracts many to this frontier, it’s accompanied by a level of risk and price fluctuation far greater than more traditional investments like index funds or retirement accounts. Financial planners often stress the importance of understanding these risks and rewards, advising that cryptocurrency should complement, not dominate, a diversified portfolio designed to meet long-term investing goals, including individual retirement planning.

Step 5: Develop Strategies for Growing Your Investment

Growing your investment doesn’t just involve choosing the right types of investments or buying a single share; it’s about making strategic investment decisions that consider your entire financial situation, including managing high-interest debt and student loans.

There are practical strategies designed to help you navigate market fluctuations and build a robust nest egg over time. With careful planning and a focus on long-term goals, these strategies can be instrumental in crafting a diversified portfolio that meets minimum investment requirements and aligns with your investing journey, setting a solid foundation for financial security by retirement age. Here are some of them.

Dollar-cost averaging is a strategy employed by investors looking to minimize the impact of market fluctuations on the purchase of assets, like shares of stock. By consistently investing a fixed amount of money over regular intervals—regardless of the share price—investors can avoid risky attempts to time the market.

This approach means you might buy more shares when prices are low and fewer when prices are high, averaging out the cost of your investments over time. This method is particularly beneficial to beginners with a long-term horizon because it can help in building a nest egg for retirement age without the need to monitor the entire market constantly.

Reinvesting dividends is another powerful strategy to enhance your investing journey. When companies pay dividends to shareholders, instead of taking these payments as cash, you can choose to reinvest them to purchase additional shares. As you effectively earn dividends on your reinvested dividends, this approach can significantly compound your investment growth over time. This is particularly advantageous in employer-sponsored retirement plans or any long-term investment account, where the goal is to grow the investment substantially by the time you reach retirement age.

These methods help mitigate risks associated with market volatility, enhance the growth potential of your investments, and, ultimately, secure a healthy financial status by the time you reach retirement age. Starting on this path as early as possible, even with small amounts, can make a significant difference in the long run, allowing you to navigate your investing journey with confidence.

Common Investment Mistakes to Avoid

No matter what your investment plan or strategy is, there are some common mistakes that can stand between you and success. Here are some of them.

Investing Without Understanding: Jumping into investments without a clear grasp of how they work is akin to setting sail without a map. Whether it’s stocks, real estate investment trusts (REITs), or any other vehicle, a solid understanding is a must. Take the time to do research to ensure that each investment aligns with your goals and risk tolerance.

Attempting to Time the Market: Many investors think they can predict market highs and lows, but this strategy often leads to missed opportunities. Instead of trying to outsmart the market, consider reliable investment strategies like dollar-cost averaging, where investing regular amounts over time can mitigate the impact of volatility.

Lack of Diversification: Putting all your eggs in one basket is risky. Diversification—spreading your investments across various assets like stocks, bonds, and real estate investment trusts—can reduce risk. Remember, a diversified portfolio can include investments across different sectors, geographical locations, and asset classes.

Forgetting the Long-Term Perspective: It’s easy to get caught up in short-term fluctuations and lose sight of your long-term investing goals. Keep in mind that building wealth is a marathon, not a sprint. Adjusting your portfolio in response to short-term market movements can be detrimental to your long-term objectives.

Blindly Trusting Financial Professionals. There are a lot of “advisors” online that promise to build you a profitable portfolio for a small fee, or even for free. Don’t trust these people blindly—there is a really high chance it’s a scam. Additionally, be wary of people posting their investment ideas and plans online, especially if they promise high returns.

How to Invest With Little or No Money: Conclusion

Although it is much easier to start investing when you already have sizable savings in your accounts, it is not impossible to invest when you don’t have a lot of money. Regardless of your current financial status, investment can help you grow your funds and provide you with a safety net.

Remember, successful investing is not just about making thousands of dollars; it’s about making smart, informed decisions that grow your wealth steadily over time, regardless of the size of your brokerage accounts.

FAQ

How to invest in real estate with little money?

Investing in real estate with little money might seem challenging, but it’s entirely possible through creative strategies. One accessible route is through Real Estate Investment Trusts (REITs), which allow you to invest in real estate without buying physical properties. Crowdfunding platforms are another option, as they enable individuals to pool their resources together to invest in larger real estate projects.

How can beginners invest in stocks with little money?

Beginners can start investing in stocks with little money by leveraging platforms that offer fractional shares, allowing you to buy portions of a single share at a time. This approach makes it easier to invest in high-value stocks without the need for a large upfront investment. Additionally, starting with low-cost index funds or ETFs can be a smart way to diversify your portfolio with a minimal initial investment.

How can taxes affect investment decisions?

Depending on your tax bracket, the returns from certain investments may be significantly impacted by taxes. Consider tax-efficient investments and accounts, like Roth IRAs or 401(k)s, especially if you’re in a higher tax bracket. Consulting with a financial advisor can help navigate these waters, ensuring your investment decisions are both growth-oriented and tax-smart.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.