Interest rate swaps (IRSs) are one of the most commonly traded derivatives in traditional finance—and if they can make the leap to the nascent decentralized finance (DeFi) ecosystem, the potential upside is immense.

To put things into perspective, the entire DeFi market in 2021 was worth roughly $90 billion, while interest rate swaps alone generate around $1.9 trillion.

“With that in mind, when DeFi matures, interest rate swaps is a product that’s really going to take off,” said David Garai, founder of Tempus, an open-source protocol that lets users manage their exposure to variable yield and convert variable yield rates into fixed rates based on their personal risk tolerance level.

But what exactly is an interest rate swap?

In traditional finance, interest rate swaps are complex, non-collateralized financial instruments that are heavily negotiated between two parties.

Although most people may not realize it, interest rate swaps very likely play a big role in their daily lives.

The TL;DR on IRSs

In the world of traditional finance, interest rate swaps are complex, non-collateralized financial instruments that are heavily negotiated between two parties. An interest rate swap transforms a loan with a variable rate into a fixed cost, typically as a way to manage credit risk and hedge against losses.

A swap occurs when two parties, usually a company and a bank or two banks, agree to exchange interest payments over a specified period of time and at a predetermined amount.

Borrowers are protected if interest rates shoot up, while lenders have the opportunity to make money if interest rates stay flat or fall.

If you’ve taken out a fixed-rate mortgage, chances are your bank is swapping the fixed interest payment with another financial institution in return for a floating rate so the bank still has a chance to benefit if interest rates go up.

Some lenders require that private companies enter into an interest rate swap to convert their variable-rate loans to a fixed rate to shield them from market volatility. Pensions and insurance companies use interest rate swaps to protect themselves against rate fluctuations.

Swap right

That same concept makes a lot of sense if applied to DeFi. Imagine staking tokens or being able to engage in yield farming while having the option to optimize your exposure to the ups and downs of the crypto market.

But DeFi needs its own version of interest rate swaps, because the traditional product won’t fly in a decentralized environment.

For example, interest rate swaps in traditional finance are always either non- or under-collateralized, because both parties know who the other is and what to expect.

“The same structure won’t work in DeFi, because you don’t know who the counterparty is and you’ll never know,” Garai told Decrypt.

Negotiating swap terms and conditions is also often a heavily negotiated and prolonged process overseen by the International Swaps and Derivatives Association and it can take days to hammer out what the deal should look like and what the rates and obligations will be on both sides.

“In DeFi, people want to access products through the click of a button without having to jump through hoops like that,” Garai said. “That’s why we need a more innovative approach.”

Time for Tempus

And that’s where Tempus comes in.

Tempus allows lenders to deposit their yield-bearing tokens into a pool and enter a smart contract with a specified maturity date, and either earn at a fixed rate or speculate on the future yield for profit.

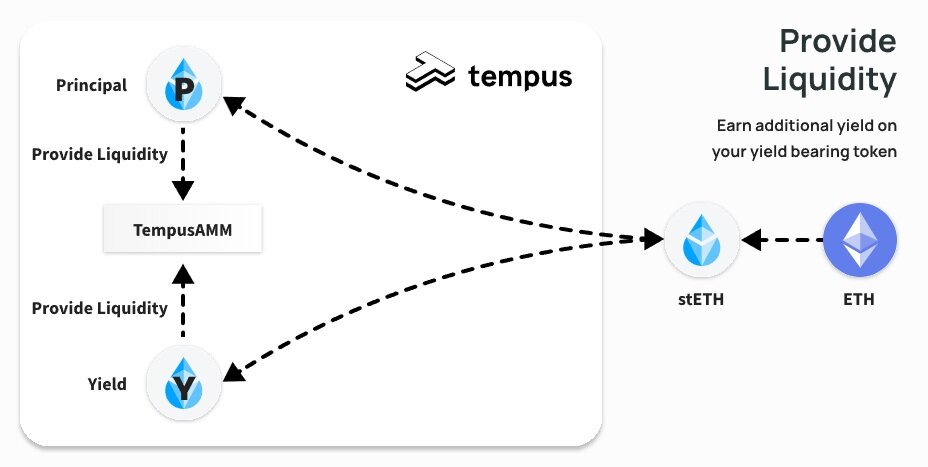

Once users commit to the contract, Tempus splits the yield-bearing token into two newly created tokens. On one side are Principal tokens equal to the amount of money a user invested at the start, and on the other are Yield tokens that accrue value during the life of the pool.

After the ETH is divided into separate tokenized principal and yield positions, users can trade them against each other using Tempus’ custom AMM, or automated market maker protocol, which provides liquidity so they can earn additional swap fees on top of whatever they gain through the yield framing protocol.

“The AMM allows people to give up their exposure to an unknown future yield and swap it for more principals so they know how much they’re going to get,” Garai said. “You can also check the ratio to see how the Principal and the Yield are trading against each other, which gives you a sense of market dynamics.”

Users can then make speculated bets based on where they think the interest rate will go. If they think it’ll go up, they can take on more risk with the potential of a higher return, and if they think it’ll go down, they can load up on Principal tokens to protect themselves.

“In DeFi, people want to access products through the click of a button without having to jump through hoops.”

David Garai

And they can get in—or pull out—whenever they want. Users can deposit or withdraw their money into or from a pool at any time. That’s very different from most traditional financial products, like a bond or a long-term fixed-rate mortgage.

“In a nutshell, it’s a risk reallocation mechanism for different participants depending on their risk profile,” Garai said. “That’s what we do.”

Welcome to DeFi

And that, Tempus argues, is what new participants entering the DeFi market for the first time—including institutions and retail investors—need in order to feel comfortable.

“Projects like ours are working to bridge the gap between traditional finance and DeFi.”

David Garai

The rewards for staking crypto are potentially high, but it’s a risky business. Early DeFi adopters don’t care, though. They want the highest yield possible and they’re usually happy taking any sort of risk to get it, Garai said.

But risk-averse investors want to guarantee themselves a steady stream of income, while also having access to DeFi-inspired versions of TradFi products they’re already familiar with.

With the introduction of fixed-rate lending for DeFi, the space is starting to mature—and become more hospitable to the traditional banking world.

“Projects like ours are working to bridge the gap between traditional finance and DeFi,” Garai said. “As this happens, we’re really seeing demand for fixed rates grow.”

Sponsored post by Tempus

This sponsored article was created by Decrypt Studio. Learn More about partnering with Decrypt Studio.

Source: https://decrypt.co/88107/tempus-is-bringing-the-1-9-trillion-interest-rate-swap-market-to-defi