Decrypting DeFi is Decrypt’s DeFi email newsletter. (art: Grant Kempster)

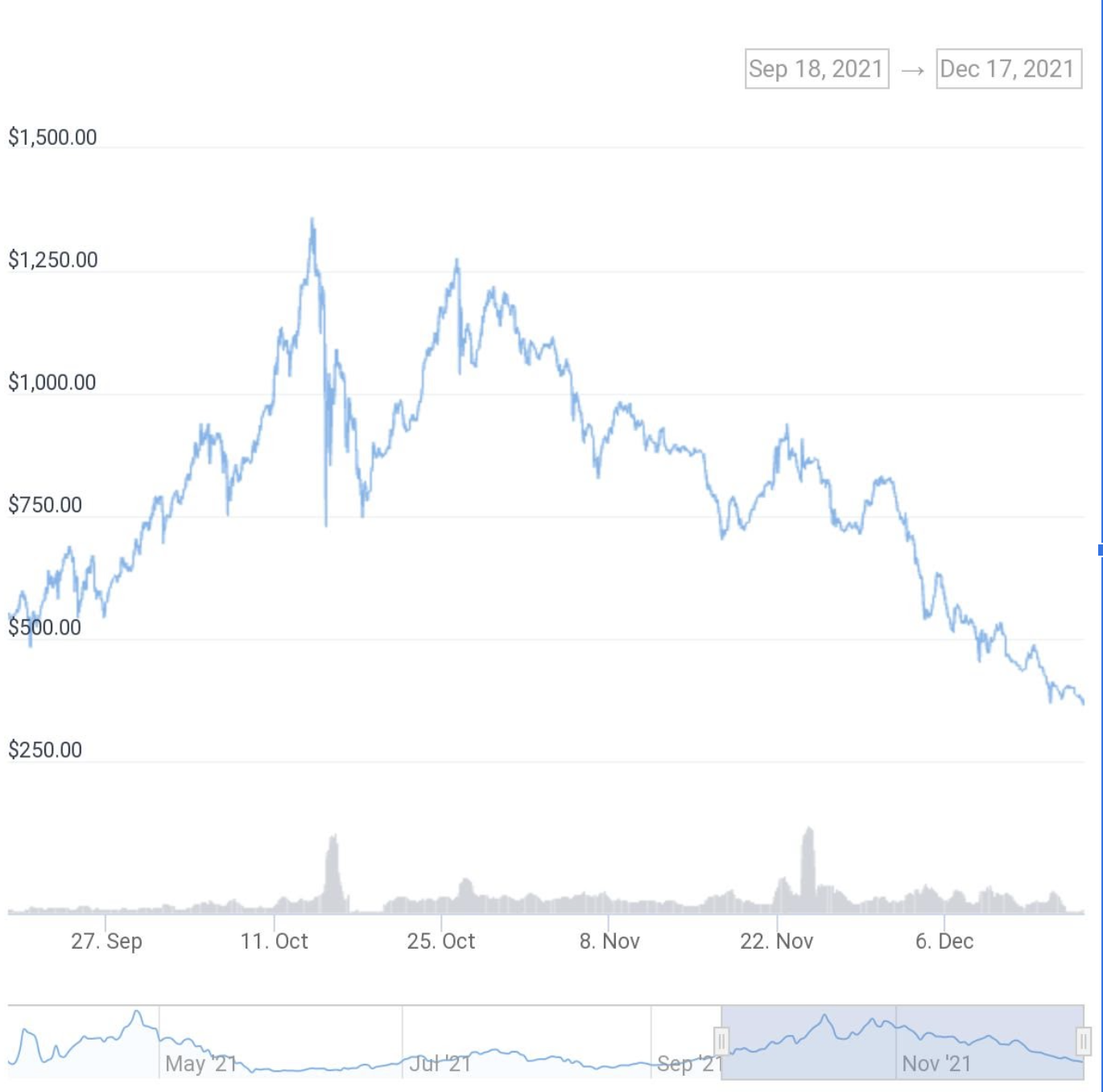

In a heated Senate hearing on stablecoins this past week, one name came up far more than anyone in crypto would have expected: OlympusDAO and its OHM stablecoin. OHM is a so-called stablecoin that, unlike other stablecoins, is not pegged to a fiat currency. Its price has declined sharply recently, but that hasn’t stopped a slew of DeFi projects from partnering with OlympusDAO because they want to tap its white-label liquidity solution, OlympusPro.

So, what is it they’re all clamoring for? It’s simple: protocol-owned liquidity.

Source: CoinGecko

Source: CoinGecko

In a nutshell, DeFi projects have been suffering from mercenary yield farmers. These are often large bag holders who swoop in on essentially any project with a token-incentive scheme going.

Leading DeFi blue-chip project adding token rewards for the next few weeks? They’re there. Small, unknown decentralized exchange on Boba doing something similar? Count the mercenaries in.

The size of the project doesn’t matter. Just the size of the APY.

And while this can create a hefty spike in a project’s total value locked (TVL), it rarely lasts. As soon as the rewards scheme ends, these farmers withdraw their liquidity, sell their tokens, and move on in search of the next opportunity.

The Senate Review referring to $OHM and @OlympusDAO as an “algorithmic stablecoin” today just tells you how well they understand crypto.

— Showtime2kX (@Showtime2kX) December 14, 2021

Nansen, a blockchain analytics platform, also revealed that “a whopping 42% of yield farmers that enter a farm on the day it launches exit within 24 hours. Around 16% leave within 48 hours, and by the third day, 70% of these users would have withdrawn from the contract.”

On and on this goes, leaving a project’s true believers holding a worthless bag.

Fixing this arrangement is thus the promise of so-called DeFi 2.0 projects, like OlympusDAO. One particular feature is Olympus’ bonding function.

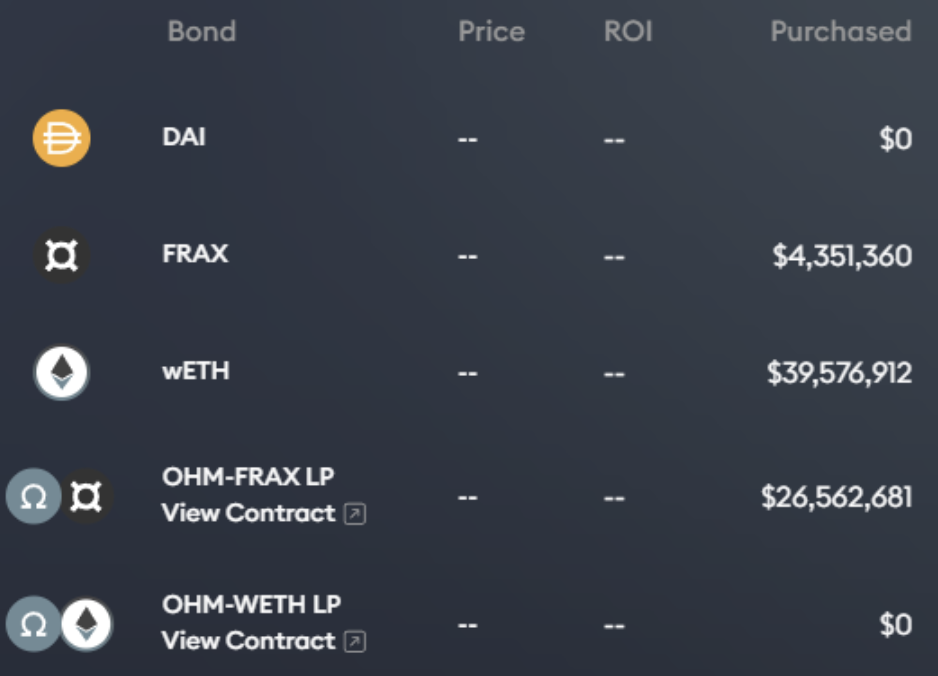

Olympus bonds are similar to traditional bonds. They offer users a way to buy discounted OHM tokens by swapping either a handful of cryptocurrencies or liquidity provision (LP) tokens from another exchange like SushiSwap.

These are all the current bonds available on Olympus. Source: OlympusDAO.

These are all the current bonds available on Olympus. Source: OlympusDAO.

The OHM is distributed regularly to the bond-holder until it reaches maturity at 15 epochs, where one epoch equals roughly 8 hours.

If, for example, OHM costs $500 on the open market, users can purchase that same token for $450 (plus wait time) through the bonding mechanism. That wait time also keeps folks locked into a protocol much longer than the figures Nansen cites regarding typical yield farmers.

Because this OHM is cheaper as a bond, users are thus incentivized to sell their liquidity in exchange for the project’s native token. This also grows the protocol’s liquidity and lets users get their hands on the token without some of the risks of traditional liquidity provision like impermanent loss, which is what happens when tokens in a pool change prices (either up or down), sometimes reducing people’s exposure to the more lucrative token.

And, just as a reminder, this doesn’t even begin to scratch the surface of OHM’s exorbitant staking returns.

With OHM in hand, you can also stake (i.e., lock up those tokens with the protocol) and get 1:1 staked OHM (sOHM) in return. Once staked, users can earn more than 4,297.3% APY on those holdings, which is paid out in OHM every epoch. Earlier this year, that figure was a whopping 16,000%.

But it’s the bonding mechanism, not the staking, that’s got DeFi projects excited.

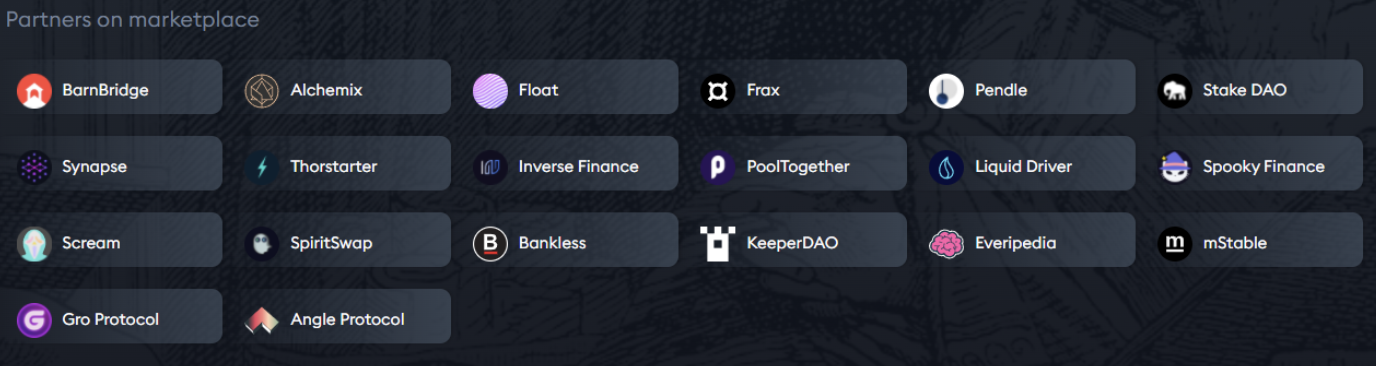

The mechanism is unique enough that Olympus has now rolled out a bonding-as-a-service product called OlympusPro. For a 3.3% fee on all bond payouts in a project’s native token, the Olympus team will implement this bonding mechanism for you.

Source: Olympus Pro

Source: Olympus Pro

So far, they’ve attracted a ton of interest across several different blockchains.

It’s certainly an interesting experiment, and as the service gains more traction, it may very well become a key tool for the rest of DeFi. But expect OHM to continue to have some controversy around it when politicians talk stablecoin regulation.

Source: https://decrypt.co/88654/why-defi-projects-flocking-olympusdao-bonding