intermediate

Ethereum, alongside Bitcoin and Dogecoin, is one of those cryptocurrencies that are well-known even outside of the crypto community. And it is for a good reason — Ethereum is one of the most feature-rich and interesting blockchains out there.

Besides being an incredibly innovative technology, Ethereum is also a great asset for investment. Unlike small altcoins, it has less of a chance to crash and burn, but it still has the potential to moon and bring its investors astronomical profits.

In this article, we will attempt to forecast how Ethereum’s price may behave in the future. Please remember that due to the unpredictable and volatile nature of the cryptocurrency market, all crypto price predictions should be taken with a grain of salt. This article does not constitute investment advice.

What Is Ethereum?

The best way to become a better investor, capitalize on your initial investment, and increase your profit is to learn more about the asset you’re working with. While cryptocurrency prices — unlike those of traditional assets, such as stocks — are more speculative in nature and rely a lot less on their intrinsic value, they still depend in some ways on what the coin/token can and is supposed to be able to do. For example, cryptocurrencies like Polkadot may see a surge in price if their ability to provide blockchain interoperability suddenly becomes especially in demand.

As a famous and popular cryptocurrency, Ethereum and its functionality aren’t exactly shrouded in mystery — most people have heard about its connection to smart contracts, NFTs, and DeFi. However, that’s not all there is to that coin since Ether has even more to offer.

Ethereum was launched back in 2015 and is famous for being a decentralized and open-source proof-of-work blockchain with smart contracts functionality. Unlike Bitcoin, Ethereum has an uncapped supply.

One of the biggest challenges that Ethereum has to overcome in the near future is its ever-rising transaction fees — or, as they’re called for this particular network, gas fees. The more people use Ethereum, the higher those gas fees become, making the coin’s growing popularity a double-edged sword. More and more cryptocurrencies with similar functionalities but cheaper transaction costs and higher throughput, like Solana (SOL), continue to emerge. However, the implementation and launch of Ethereum 2.0 will likely turn this situation around and solve at least some of these issues.

At the end of the day, what sets ETH apart from other coins is the variety of this cryptocurrency’s functions. Ethereum has a ton of cool features and plans for the future — this is why this cryptocurrency is as popular among crypto investors as it is. ETH isn’t just a speculative asset; it has actual value.

Ethereum Functionality

One of Ethereum’s biggest strengths is its variety of use cases, and the list keeps on growing every year. As long as the coin’s team continues to develop the blockchain and introduce new innovative features, as well as actually implementing everything they’ve promised, Ethereum will likely continue to grow and prosper.

Smart Contracts

Smart contracts are self-executing orders that can be written directly into lines of code and are an essential part of the Ethereum network. They outline the agreement terms between the buyer and seller and enable trustless, anonymous transactions on the blockchain. Basically, smart contracts represent a set of rules that determines the way of executing a transaction.

This technology takes credit for making crypto transactions traceable, transparent, and irreversible.

Learn more about smart contracts here.

NFT

Non-fungible tokens, or NFTs, are fully unique crypto tokens that have their own identification codes and metadata that allow them to be distinguishable from other similar tokens. As a result, NFTs of the same type cannot be traded 1-for-1 — they all have their own unique values.

NFTs have gained a lot of popularity in recent years, but they have also started seeing some animosity in the last few months. Most of the concerns are quite valid: users are worried about the environmental impact of traditional crypto transactions. As the Ethereum blockchain is currently the biggest NFT hub, the switch to the more sustainable proof-of-stake protocol may potentially, if not silence, then at least lessen these concerns.

NFTs have a bright future ahead of them: they are one of those cryptocurrency-related services that can be easily implemented in non-crypto fields, such as art, music, and so on. The success of NFTs is sure to attract new investors to ETH.

DApps

Decentralized applications, or dApps for short, are computer applications that run on various decentralized systems. The Ethereum blockchain is the most popular platform for dApp deployment. There are already hundreds of dApps on Ethereum, and they cover a wide range of services, from games to investment.

While dApps are rapidly gaining popularity, there are a lot of challenges that prevent them from becoming mainstream: for one, they are rather inaccessible to the general public. Although, in reality, they are easy to use, most people seem hesitant to try them out. As more businesses adopt dApps, making them the norm, the value and market cap of ETH are sure to go up — after all, all dApp actions cost a fee.

Blockchain in Retail: Fashion, Agriculture and Food Industry, Healthcare, Banking.

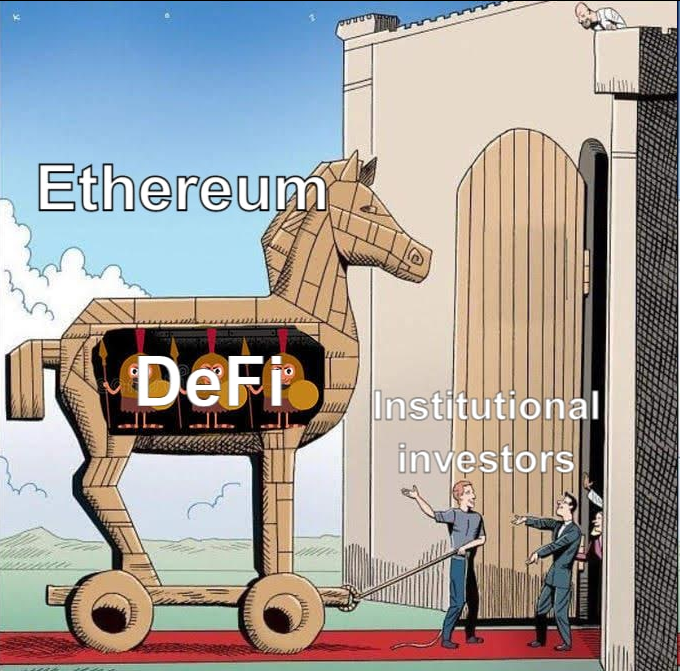

DeFi

Decentralized finance, or DeFi, is a new blockchain-based financial technology that allows users to perform trustless transactions without the involvement of third parties, such as banks.

DeFi might very well be one of the most applicable and innovative use cases of blockchain technology: it allows people to take back control of their money by enabling decentralized, quick, and cheap money transfers.

Learn more about DeFi here.

Ethereum 2.0

The launch of Ethereum 2.0 is probably one of the most anticipated events in the crypto industry at the moment. The change (almost) everyone is excited about is the switch from the proof-of-work consensus mechanism to the proof-of-stake one.

This solution will remove one of the biggest issues the general public has with crypto — how unsustainable it is. Additionally, ETH 2.0 will also help solve the scalability problem that the Ethereum network is currently facing.

There’s just one problem: the aforementioned switch from PoW to PoS has been already talked about for at least three years, and it’s still not here. Unfortunately, there’s no way of knowing whether the Ethereum team will continue to put it off further or not. This uncertainty can potentially pose a threat to the ETH price in the near future.

Ethereum Price Today

Ethereum Price Predictions for 2022 by Experts

Most experts are bearish on Ethereum in the short term. In the last month of 2021 and at the beginning of 2022, the cryptocurrency market faced a massive sell-off and lost a fifth of its total value compared to the peak achieved in November 2021.

There are several reasons why this may have happened: it is most likely due to investors preferring to make their portfolios less risky as the new COVID-19 variant, Omicron, proceeds to become an increasingly bigger threat. This is not exclusive to crypto — the stock market also saw a decline in the last quarter of 2021 due to a decrease in investors’ risk appetite. We are also starting to see more and more worrying news about stricter crypto regulation, particularly in the US.

Another reason why Ethereum’s prospects may not seem as bright as they used to a year ago is the general public’s discontent with NFTs (and crypto technology, overall). While non-fungible tokens have a lot of supporters, there are also a lot of people online ridiculing them and raising concerns about the impact they may have on the environment.

Although most of those people do not directly connect NFTs to Ethereum, some investors still may become hesitant to invest in a project that is receiving so much bad publicity. That said, we don’t think this is a major issue at the moment — just something to consider when predicting Ethereum’s future prices.

Wallet Investor

Wallet Investor is bullish on this cryptocurrency in the long run. They expect it to hit $7K by the end of 2022 and get really close to $20K by the end of 2026. That’s a 380% return in just five years!

Wallet Investor’s experts predict that Ethereum’s (ETH) price will continue to have short growth/decline spurts before taking off to the moon in late 2022. Currently, however, they are bearish on the coin and expect its price to go down further.

Gov Capital

Gov Capital’s Ethereum price prediction also includes brief periods of growth followed by sell-offs, with the cycle repeating itself over and over again. However, unlike WI, the experts on this platform predict a short-term downward trend for the coin. They think that while the highs of the ETH coin will stay the same, its lows will continue to plunge further and further down.

That said, Gov Capital is still bullish on Ethereum in the long run.

TradingBeasts

Experts from TradinigBeasts have also carried out their own Ethereum technical analysis and prepared their ETH price prediction for the next few years. According to it, the coin’s value will slowly continue to rise but won’t exceed $5K in either 2022, 2023, or 2024. That is a rather conservative prediction — it does not take into account any potential price spikes or drops. They are even predicting that Ethereum’s average future price will be lower than it is now.

DigitalCoinPrice

DigitalCoinPrice are extremely positive in their Ethereum price prediction: they expect the coin to hit $7K by 2024. They also predict that ETH’s growth will only stall for a brief period of time in 2025 and will continue rising otherwise.

Other Crypto Experts

An investment expert from CNBC hasn’t mentioned Ethereum itself but said the cryptocurrency market, in general, is unlikely to burst in 2022. Since they have a negative opinion on crypto as a whole, this prediction can be considered as a good sign — we don’t know for how long this current bear market will last, but it is unlikely to get too bad before the next rally.

In general, most experts have a positive outlook on Ethereum’s price. This coin’s functionality established reputation, and upcoming updates instill a lot of faith in it — there’s hardly any other crypto project out there that has all these qualities. Even if the crypto market gets affected by strict regulation, Ethereum will still have the potential to remain relevant and a worthwhile investment.

Most crypto influencers are expecting Ethereum to hit astronomical highs in the next few years but are bearish on it in the short run. Trading View demonstrates the same sentiment, and their technical analysis gives Ethereum a “sell” signal.

Ethereum (ETH) Price Prediction for 2022-2030

Please remember that the crypto market is extremely unpredictable, and the contents of this article are not investment advice. Always do your own thorough research before making any investment decisions, and make sure that you’re aware of all the risks.

Here’s our long-term Ethereum price prediction for 2022-2030.

Ethereum Price Prediction 2022

In general, our Ethereum price prediction for 2022 is rather conservative: while we forecast that its price can reach as high as $7K sometime later this year, we think that the coin’s average price will be a lot lower — around $4K.

2022 has a lot of “mooning” potential for Ethereum: if the ETH 2.0 launch goes well, the coin may go on a one-way trip into space. However, we cannot disregard the current bear market and its possible effect on Ethereum’s price. If it continues and there will be no substantial hype this year, ETH is more likely to remain at the same price level as it is now, below the $4,000 mark.

ETH Price Prediction for January 2022

According to technical analysis, Ethereum will slowly continue to decline in early 2022. Although its price fell quite significantly at the beginning of the month, it seems to have become somewhat stable by the end of the second week of January. Overall, we think that the coin will likely continue to experience some minor ups and downs this month. Our price prediction says that the ETH price has the potential to reach as high as $5.5K in January and fall as low as $3K.

ETH Price Prediction for February 2022

The bear market is likely to continue in February. While we don’t expect the price of Ethereum to drop below the $3K level, it can still happen — a lot will depend on how the crypto market will feel in these early months of 2022.

Ethereum Price Prediction 2023

2023 will be an interesting year for Ethereum. If the coin transitions to a proof-of-stake algorithm and implements the other changes promised in its 2.0 version, Ethereum will most likely dramatically rise in popularity. It can even potentially become the most talked-about cryptocurrency of that year.

The increased sustainability will give Ethereum a lot of popularity points among the general public. If the coin manages to advertise its strengths well, it may be adopted by more businesses and picked up by more institutional investors.

All these changes are hypothetical, of course, but if they happen, we could see Ethereum breaking into the $10,000 price level. We don’t think the coin will stay there and actually forecast it to average out at around $7K, but we can definitely see a big price spike happening sometime in 2023.

Ethereum Price Prediction 2024

Industry experts and the general market commentators all seem to expect Ethereum to have a bunch of new partnerships and integrations in 2024, so it could be a really good year for the coin. That said, we don’t think the market cap and the price of Ethereum will rise that dramatically in 2024. Of course, there is a possibility that Ethereum will reach $15K or more already in 2024, but, at the moment, we don’t think that it’s likely, and it doesn’t align with our Ethereum forecast.

In our opinion, it is likely that Ethereum will stay around the $10K mark in 2024, with price spikes reaching as high as $12K and going as low as $7K.

Ethereum Price Prediction 2025

Our Ethereum price prediction for 2025 is, once again, very optimistic: after all, we expect this cryptocurrency to steadily continue to rise in value as the years pass by. That is, of course, barring any unexpected changes in crypto regulation.

If the network’s scalability issues get resolved in 2022, it will likely positively reflect on Ethereum’s price in 2025 and beyond.

Despite all this, we think that Ethereum will spend 2025 storming the resistance level of $13K. The max price it is likely to achieve that year is either $13,000 or something really close. The minimum price it will probably hit in 2025 is $9K.

Ethereum Price Prediction 2026

We expect that, in four years, this coin will come very close to reaching the price of $15,000. According to our tentative Ethereum long-term price prediction, the coin is unlikely to go below the support level of $11K in 2026.

Ethereum Price Prediction 2030

Nine years is a very, very long time on the crypto market. After all, just nine years ago, Bitcoin was still a relatively unknown technological gimmick that was mostly spoken about on specialized forums and conferences.

However, if all goes well for the crypto market, we can see Ethereum still having a solid performance in 2030 and most likely retaining its position as the second-biggest cryptocurrency. We could see the coin tripling its current value and reaching $15,000.

Ethereum Price Prediction 2040

As always, we are going to refrain from predicting prices that far in the future. There is just no way of making an accurate price prediction for something so uncertain.

Instead of making a price prediction, we can speculate on what the crypto market will look like in 20 years. It’s tempting to say that it will strengthen its position judging by the current trends, but there are too many factors at play here — who knows what crypto regulation is going to look like in 2030 and 2040. Therefore, we do not really have an Ethereum price prediction for 2040: it may reach $40K, may drop back to $100, or may not even exist at all anymore.

Can’t load widget

FAQ

Will Ethereum go up or down in 2022?

Ethereum’s price will likely continue to decline at the beginning of 2022, but it may go back up later on during the year.

Can Ethereum’s price reach $10,000 in 2022?

If we see another crypto market boom in 2022, the ETH price can potentially reach $10,000. Otherwise, it’s unlikely.

Will Ethereum ever overtake Bitcoin?

Although everything is possible, Ethereum’s price is unlikely to overtake Bitcoin ever. That said, ETH has the potential to overtake BTC in terms of market cap since it has an uncapped supply.

Should I invest money in Ethereum?

If it aligns with your investment objectives, then yes. Ethereum will be a great fit for many portfolios — just make sure you are okay with taking on the risk associated with all crypto assets.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Source: https://changelly.com/blog/ethereum-eth-price-predictions/