Authorities in the Middle Eastern state of Oman have asked specialized companies, interested in helping the country set up a regulatory framework for virtual assets, to submit their proposals. Interested companies need to submit their proposals no later than March 23, 2022.

Process Divided Into Two Phases

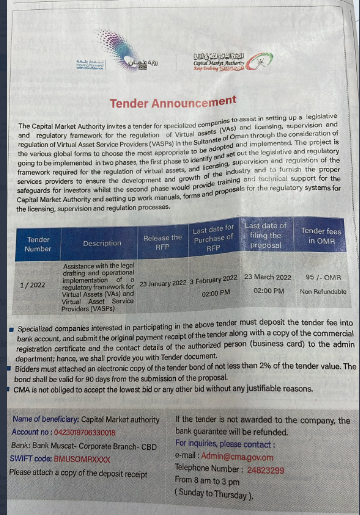

The Oman financial regulator, the Capital Markets Authority (CMA), recently invited companies interested in helping it set up a regulatory framework for virtual assets to participate in a tender process.

According to a report by Unlock Media, this process of creating the regulatory framework will be divided into two phases. The first part will identify and set out the legislative and regulatory framework required for the regulation of virtual assets. It will also establish the proper safeguards for investors.

The next phase, according to the report, will involve training and technical support for the CMA as well as creating the work manuals forms. Meanwhile, in a screenshot of the tender advertisement shared by a Twitter user, the CMA asks “specialized” companies that wish to participate in the tender process to pay a tender and to submit the required documents which include a copy of the commercial registration certificate.

Crypto Taskforce

The CMA’s floating of the tender comes several months after the country’s central bank warned Oman residents of the risks of cryptocurrency trading. The tender invitation also comes nearly four months after the central bank’s launch of a task force mandated with studying the pros and cons of authorizing the use of cryptocurrencies.

According to the tender advertisement, interested companies need to file their proposals on or before March 23, 2022.

What are your thoughts on this story? Tell us what you think in the comments section below.

![]()

Terence Zimwara

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.