beginner

If you have ever been interested in any form of trading or financial markets, you have probably heard the terms “bid” and “ask.” But what do they mean, and how can learning more about them help you increase your profits?

The Bid Price

The name “bid” price refers to the fact that you’re basically bidding an X amount of money to buy an asset. If your bid is the highest, you will be the one who gets that asset. Most prices you will see on exchanges and price aggregators are equal to the highest buying price available for that asset.

The bid price is the highest price that a market participant is willing to pay for any given asset.

Understanding the Bid Price

If you sell an asset at the current market price — the price displayed when viewing the asset on an exchange — then that means you are selling it at its bid price. That’s the maximum price an asset can be sold for at the moment.

The Ask Price

The name “ask” price refers to the fact that you’re basically asking to buy an asset at X price. If your asking price/sell price/offer price is the lowest price available on the market, you will get the deal.

The ask price is the lowest price for which a market participant is willing to sell any given asset.

Understanding the Ask Price

If you buy an asset at the price you see on the exchange — place a market order — it means you’re buying it at its selling (ask) price. It is the minimum price assets can be bought for.

What Is the Difference Between a Bid Price and an Ask Price?

By definition, the ask price will always be higher than the bid one. The numerical difference between the bid and ask is called the bid-ask price spread.

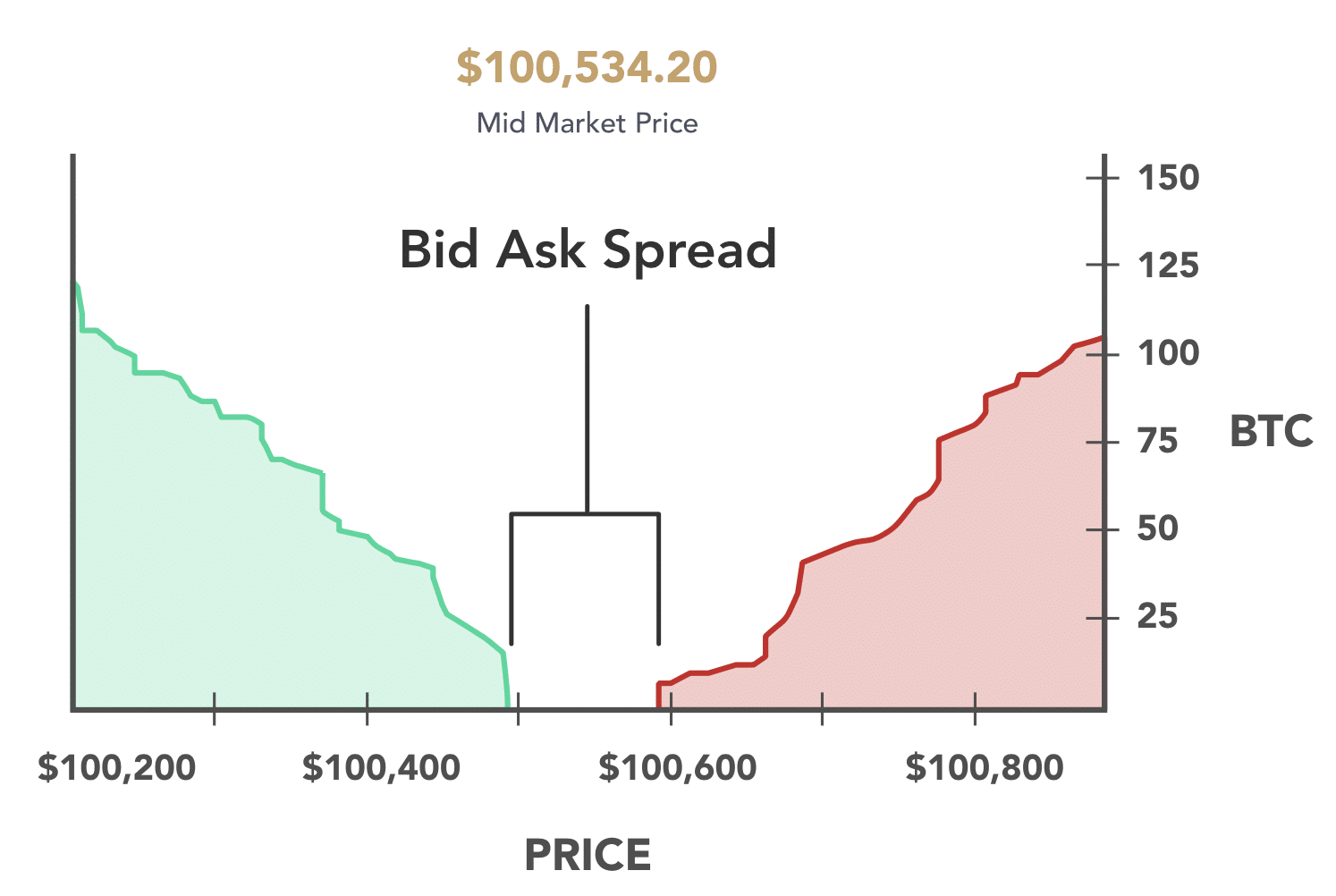

The Bid-Ask Spread Definition

Source: River Financial

Source: River Financial

The bid-ask spread is simply the difference between the highest price being offered for an asset (bid) and the lowest price it is being sold for.

The bid-ask spread itself does not necessarily reflect the price movements of an asset — instead, it shows the overall level of trading activity and volume on the market. The more trades are being made, the smaller the difference between the bid and ask price is.

Who Benefits from the Bid-Ask Spread?

All market makers can profit from the bid-ask spread. These are market participants that make a two-way price quote, providing both a bid and an offer. Each market maker provides liquidity and depth to the market.

Here’s an example of how a market maker can profit from the bid-ask spreads: let’s say trader Alex quotes a buy order at $10 while simultaneously opening a sell order for $11. No matter which one of these closes first, the market maker’s profit will still be equal to $11 − $10 = $1.

Being a market maker isn’t easy, and it’s definitely not recommended to everyone — it often involves owning a significant amount of an asset you are planning to trade.

What Does It Mean when the Bid and the Ask Are Close Together?

The smaller the spread, the greater the liquidity of the asset. It also means that the demand for that asset is currently high. A small bid-ask spread is called “narrow.” Narrow bid-ask spreads make it easier for new participants to enter the market.

The bigger the spread is, the more profit can be made. However, the higher reward also comes with a higher risk and higher costs — when the bid and ask prices are further apart, trading can become a rather hard and time-consuming activity.

Example of Bid and Ask

Let’s imagine that there’s a girl named Emma who really wants to buy some Bitcoin on an exchange. She can see that BTC is trading in the range between $35K and $37K, but Emma does not want to pay more than $35,500 for 1 BTC, so she places a limit order at that price. $35.5K is her current bid price.

On the other hand, there’s Simon — he has recently found his old crypto wallet and wants to sell 1 BTC that was in it. He sees the same range of prices Emma does and decides that he wants to sell his Bitcoin for no less than $37.5K. That’s his ask price.

If we imagine that these two amounts are the lowest/highest prices anyone is willing to sell/buy Bitcoin respectively at on that particular exchange, then the bid-ask spread will be $37,500 − $35,500 = $2,000.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.