On Friday, the Valkyrie Bitcoin Strategy Exchange-Traded Fund (ETF) launched on Nasdaq under the ticker BTF and dropped in value not too long after the ETF first came out of the gate. The second bitcoin ETF to launch in the United States followed bitcoin’s spot price movements on Friday, as BTF started the day above $25 and dropped to just over the $24 mark.

Initial Market Performance of Valkyrie’s Bitcoin ETF Lackluster Compared to the First Bitcoin ETF Debut

Valkyrie’s bitcoin futures ETF officially launched on Friday and reached a high of $25.60 per unit at around 9:00 a.m. (EDT). The senior ETF analyst for Bloomberg Intelligence, Eric Balchunas, tweeted about Valkyrie’s ETF after the first few minutes of trading.

“BTF up and running with a healthy $10m traded in [the] first [five minutes], BITO is at $30m. You have to be happy with that spread if you are BTF, [it] will be tough to keep up [though],” Balchunas said.

The stock subsequently fell in value as it followed the spot price of bitcoin’s drop before the weekend. BTF tapped a low of $23.96 per unit and as the day progressed it inched above the $24 handle.

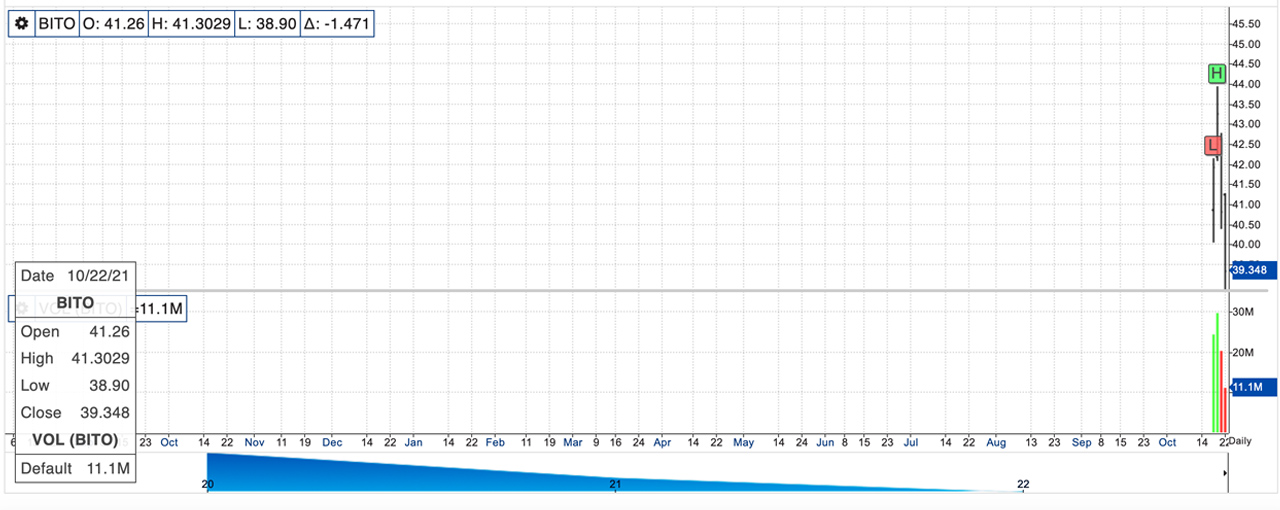

The Proshares ETF BITO also followed bitcoin’s spot market price and dipped under the $40 handle to $39.39 down 3.5%. BTC spot markets fell from $63,735 per unit in the morning (EDT) to a low of $59,954 on Bitstamp at 12:15 p.m. in the afternoon.

Vaneck Bitcoin Exchange Traded Fund Expected to Drop on Monday

BTC managed to jump back above the mid-$60K per unit position during the trading sessions on Friday afternoon. A great number of bitcoin enthusiasts were excited to see Valkyrie’s bitcoin futures ETF launch after the Proshares ETF saw a phenomenal market performance this past week.

“Valkyrie… the floor is yours,” the Twitter account dubbed ‘British HODL’ said on Friday. “2 Bitcoin ETF’s at trading open today. Let the corporate hunger games for bitcoin allocations begin,” he added.

After the weekend ends, next week the crypto community expects the Vaneck bitcoin futures exchange-traded fund (ETF) to launch on Monday. After years of rejections from the U.S. Securities and Exchange Commission (SEC), there will be three bitcoin-related ETFs on Wall Street.

With Vaneck’s fund, two ETFs will be listed on the New York Stock Exchange (NYSE) and Valkyrie’s bitcoin futures ETF is listed on Nasdaq. Just before the closing bell on Friday, Valkyrie’s BTC managed to climb above the $24.30 region. BTF’s rise at the end of the trading day on Friday followed bitcoin’s spot price jump, after BTC went from $60,600 to $61,150 per unit.

What do you think about Valkyrie’s ETF launch on Friday? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Nasdaq, NYSE,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.