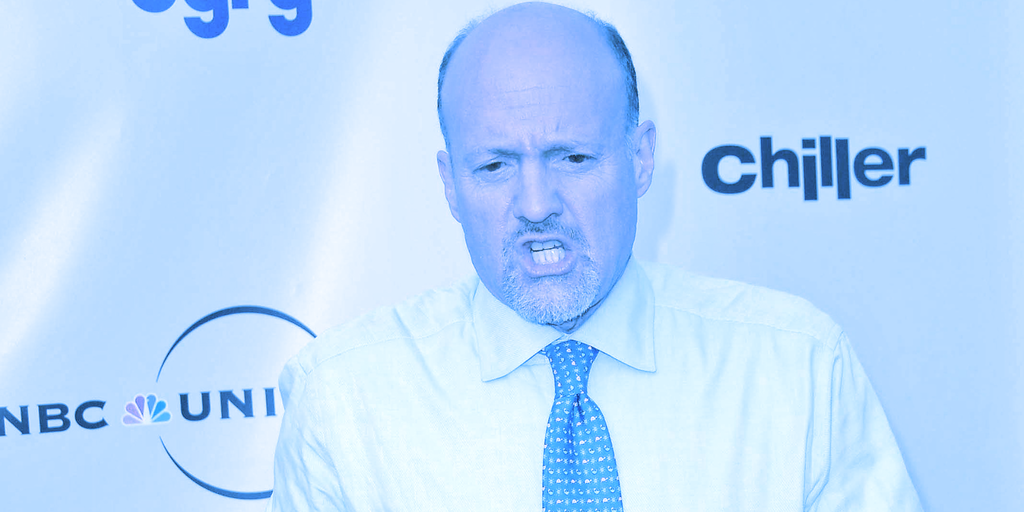

CNBC’s Jim Cramer calls today’s market meltdown “Crypto Monday.”

“I don’t want to make a joke of it,” Cramer said on the CNBC’s “Squawk on the Street” podcast. “A lot of younger people and people who borrowed money, they are going to be gone today if they are not careful.”

Cramer called the correction shocking. His comments represent a shift from last year when he had a more positive take on crypto.

While Cramer says he did not want to make a joke of the meltdown, Crypto Twitter had no problem making a joke of Cramer’s takes. Cramer’s mixed record on financial analysis recently prompted the emergence of the “Inverse Cramer ETF,” a fictional Exchange-Traded Fund that recommends the opposite of anything Cramer says.

Solana co-founder Anatoly Yakovenko predicted yesterday that Cramer’s view would turn bearish. “A major fund must also close and Cramer will utter a bearish crypto prose,” he tweeted.

Almost on cue, the “Mad Money” host and popular meme target soon said that he is getting a pessimistic view of crypto from many in Silicon Valley, saying that some called digital assets “a con.”

Cramer told podcast hosts Carl Quintanilla and David Faber that he had told SEC chair Gary Gensler that he was getting 8% with his Ethereum; Gensler told him it’s too good to be true.

When i had SEC Chairman Gary Gensler on last year we talked about how it was possible that i was getting 8% on my crypto balance and he said it wasn’t; as the Celsuis Community just found out

— Jim Cramer (@jimcramer) June 13, 2022

During the “Squawk” podcast, Cramer pointed out that the marketing push for crypto has driven people into speculating on digital assets, bringing up the Crypto.com ad with Matt Damon that said, “Fortune favors the brave.”

“Here’s what happens in these situations,” Cramer said. “The people with a lot invested in crypto will come in and make a stand—it’s Braveheart,” Cramer says, referencing the 1995 Mel Gibson film depicting William Wallace’s fight against English rule in Scotland.

Cramer, who has acknowledged owning Bitcoin and Ethereum, took his message to Twitter, “Crypto–need the big crypto lovers to buy and stabilize,” Cramer tweeted.

Not everyone agreed with the former hedge fund manager. “Any word @jimcramer?” investment research company, Hedgeye tweeted with a meme of two men looking over a cliff. The meme reading, “bet he still won’t admit he made a mistake.”

“No, they need the Fed to stop withdrawing liquidity,” responded Christopher Vecchio, Senior Strategist for DailyFX. “Nothing changes until the macro winds shift direction.”

No, they need the Fed to stop withdrawing liquidity. Nothing changes until the macro winds shift direction.

— Christopher Vecchio, CFA (@CVecchioFX) June 13, 2022

“As someone who lives in SF, and knows many ‘traditional’ tech execs and VCs, I don’t know any who say crypto is a con,” tweeted Xend Finance’s Kevin Leu. “Maybe he is referring to altcoins, because this isn’t accurate.”

As someone who lives in SF, and knows many “traditional” tech execs and VCs, I don’t know any who say crypto is a con. Maybe he is referring to altcoins, because this isn’t accurate.

— Kevin Leu (@kevinleu) June 13, 2022

Dogecoin co-creator Billy Markus was more direct in his criticism of Cramer’s takes. “Jim ya gotta shut up sometimes,” Markus replied to a Cramer tweet.

jim ya gotta shut up sometimes

— Shibetoshi Nakamoto (@BillyM2k) June 13, 2022

Despite pushback from Crypto Twitter, it does appear that the market may be heading towards a “crypto winter,” as the combined market capitalization of all cryptocurrencies fell to $969 billion today, according to CoinMarketCap.

Want to be a crypto expert? Get the best of Decrypt straight to your inbox.

Get the biggest crypto news stories + weekly roundups and more!

Source: https://decrypt.co/102828/jim-cramer-turns-bearish-on-crypto-is-that-bullish