The long-defunct cryptocurrency exchange Mt. Gox is reemerging from the dustbin of crypto history, with scattered reports that its custodians have begun confirming the Bitcoin addresses of creditors to make repayments. This repoted movement in the compensation process for those impacted by the exchange’s collapse twenty years ago, however, is having an impact on the crypto market today.

“The rehabilitation trustee shared your details with the cryptocurrency exchange or the custodian,” reads an email reportedly sent to former Mt. Gox users. “In the future, it is anticipated that the Exchange will accept your subscription of agency receipt indicated on the System to receive repayment in BTC/BCH as your agent.”

Source: u/erlichisapig on r/mtgoxinsolvency on Reddit

If true, this represents hard-won progress in the civil rehabilitation plan sanctioned by the Tokyo District Court in 2018.

Mt. Gox—previously the largest cryptocurrency exchange in the world—abruptly ceased operations and declared bankruptcy following a substantial hack that led to the loss of 750,000 Bitcoin plus 10,000 BTC of the exchange’s proprietary funds. Logged as the equivalent of a $63.6 million loss a decade ago, that Bitcoin would be worth almost $30 billion today.

Social media platforms, notably Reddit and its r/MtGoxInsovency subreddit, have been abuzz with reports from self-identified users. Some shared screenshots of what they said were deposits in their bank accounts, while others received instructions to complete missing steps in the repayment process.

“I just got paid,” posted one. “I’m a three-digit creditor living in Japan,” highlighting the global impact of the saga.

Image: u/koheisan on r/mtgoxinsolvency on Reddit

Image: u/koheisan on r/mtgoxinsolvency on Reddit

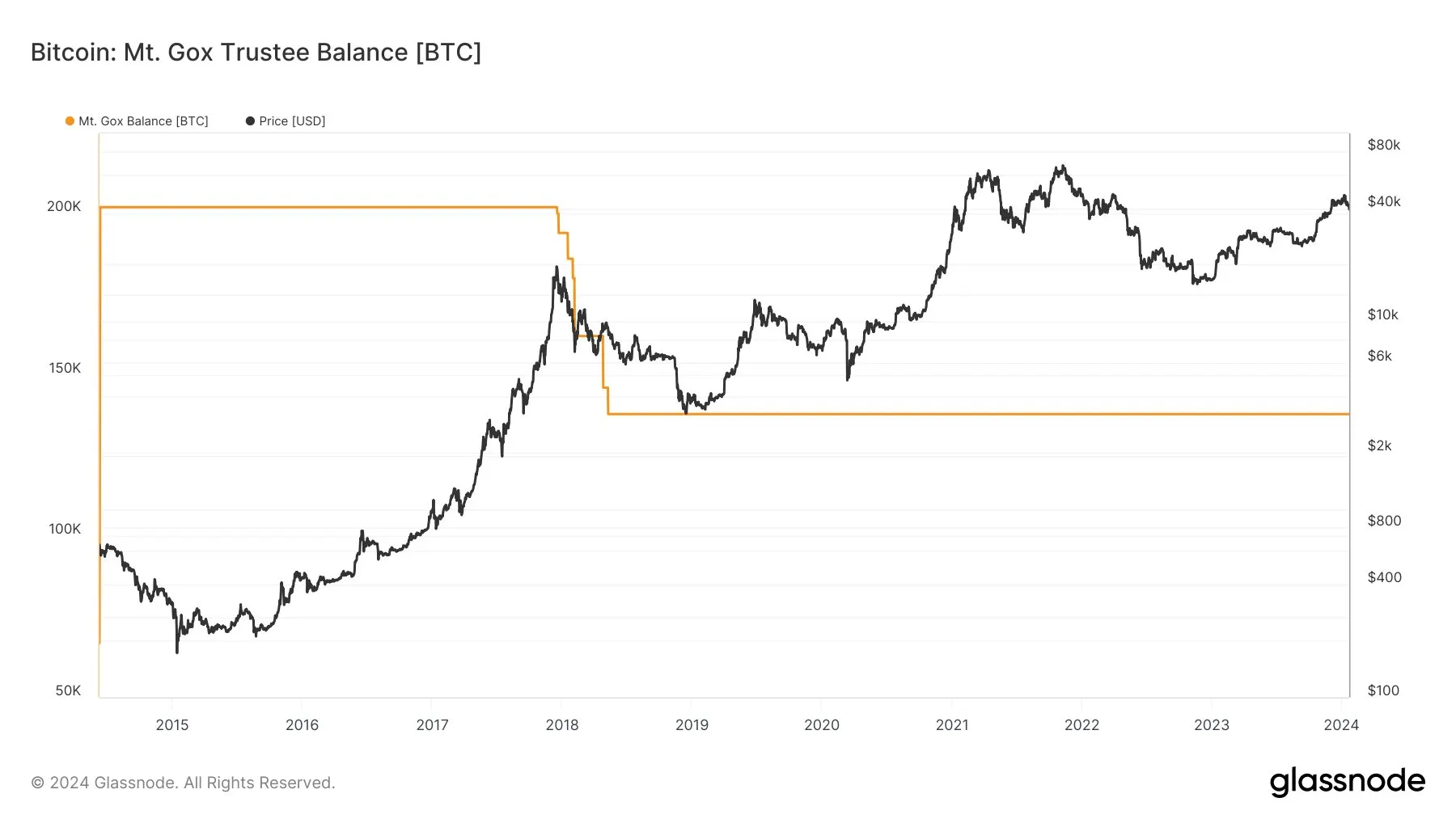

Platforms tracking the funds ascribed to Mt.Gox had not revealed any major BTC dumps—until now.

Source: Coinglass

Source: Coinglass

The ripple effects of the potential revival of the Mt. Gox case are having a tangible effect on the cryptocurrency industry. Indeed, every time rumors had previously spread that there was some movement from Mt. Gox to fulfill its obligations, the price of Bitcoin fell prey to FUD—and today was no exception.

The price of Bitcoin fell below $40,000 for the first time since early December, coinciding with the spread of rumors about the repayment process.

Image: Tradingview

Image: Tradingview

As the cryptocurrency world closely monitors these events, the extended timeline for creditor repayments—pushed to October 2024 since the latest extension—continues to weigh on market sentiments, effectively canceling the spike that followed the Bitcoin ETF approval.

Self-identified former Mt. Gox clients have not yet responded to a request for comment from Decrypt.

Edited by Ryan Ozawa.

Stay on top of crypto news, get daily updates in your inbox.

Source: https://decrypt.co/213987/mt-gox-repayment-reports-bitcoin-crash