MARA Holdings, Inc. has announced a $2 billion at-the-market stock offering, with plans to use the proceeds primarily to acquire additional bitcoin and for general corporate purposes. MARA Targets Bitcoin Growth Through $2 Billion Stock Offering The company, MARA Holdings, Inc. (Nasdaq: MARA), entered into an agreement with Barclays Capital, BMO Capital Markets, BTIG, Cantor […] Source: https://news.bitcoin.com/mara-holdings-to-sell-2-billion-in-stock-for-bitcoin-purchases/

Author: Crypto Superhero

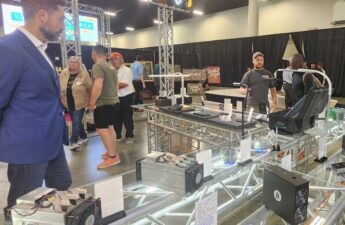

Bitcoin Miners See Growing Opportunity Under Trump, Though Challenges Persist

Smoke from Nicaraguan cigars choked out the room as a heavy-set Bitcoin miner from the Deep South explained how the industry was expanding at an exponential rate. “You have no idea,” he said at this year’s Mining Disrupt pre-party in Fort Lauderdale, Florida, before following up with the common Bitcoiner maxim—repeated by President Trump on the campaign trail—that you should…

FTX Estate to Begin Repaying Main Creditors $11.4B in Cash by May 2025

The bankrupt cryptocurrency platform FTX aims to initiate repayments to primary creditors by May 30, 2025, deploying an $11.4 billion liquidity pool amassed since its 2022 downfall, Bloomberg revealed this week. Bankrupt FTX Creditors to Receive Payouts Having sought Chapter 11 protection in November 2022 amid a liquidity shortfall and fraud disclosures, the firm has […] Source: https://news.bitcoin.com/ftx-estate-to-begin-repaying-main-creditors-11-4b-in-cash-by-may-2025/

Terraform Labs Creditors Have a Month to Submit Claims for Losses

Terraform Labs has opened an online portal for investors to submit compensation claims for financial losses stemming from the May 2022 de-pegging of TerraUSD. Managed by administrators at New York-based Kroll, the portal will open on Monday, March 31 and close on April 30, giving loss-making investors a month to file claims. Applicants will have to submit evidence supporting their…

Binance debuts centralized exchange to decentralized exchange trades

Crypto exchange Binance has debuted centralized exchange (CEX) to decentralized exchange trades (DEX), allowing customers to use funds from their Binance wallets to execute DEX trades — eliminating the need for asset bridging or manual transfers. According to the exchange, customers can use Circle’s USDC (USDC) and other supported stablecoins to acquire tokens on the Ethereum, Solana, Base, and BNB…

Bitcoin Mining Made Predictable: Soluna, Luxor Streamline Bitmine’s Growth

Soluna Holdings and Luxor Technology partnered with Bitmine Immersion Technologies to deploy a turnkey bitcoin mining solution that tripled operational capacity while mitigating risks tied to energy volatility and equipment costs. Bitmine Scales Mining Operations 3x via Soluna-Luxor Partnership Soluna Holdings and Luxor Technology Corporation have enabled Bitmine Immersion Technologies to triple its bitcoin ( […] Source: https://news.bitcoin.com/bitcoin-mining-made-predictable-soluna-luxor-streamline-bitmines-growth/

Bitget Lists KiloEx (KILO) in the Innovation and DeFi Zone

VICTORIA, Seychelles, March 28, 2025 /PRNewswire/ — Bitget, the leading cryptocurrency exchange and Web3 company, has announced the listing of KiloEx (KILO), a DEX focused on risk management and capital efficiency. Trading for KILOI/USDT will commence on 27 March 2025, 13:00 (UTC). KiloEx provides fast trades, real-time market tracking, and a user-friendly interface while offering liquidity providers risk-neutral positions and…

This Week in Crypto Games: ‘Off the Grid’ Token, GameStop Goes Bitcoin, SEC Clears Immutable

The crypto and NFT gaming space is busier than ever lately, what with prominent games starting to release, token airdrops piling up, and a seemingly constant array of other things happening at all times. It’s a lot to take in! Luckily, Decrypt’s GG is all over it. And if you need a quick way to get caught up on the…

Acting SEC Chair Rejects Enforcement, First US Bank-Issued Stablecoin, and More — Week in Review

Acting SEC chair rejects enforcement, first US bank-issued stablecoin, Bitcoin’s four-year cycle at crossroads, and more in this Week in Review. Week in Review Acting SEC Chair Uyeda called for clear rulemaking over enforcement to provide much-needed guidance to the industry. The first U.S. bank-issued stablecoin on a permissionless blockchain—Ethereum—has launched. Bitcoin’s price remains relatively […] Source: https://news.bitcoin.com/acting-sec-chair-rejects-enforcement-first-us-bank-issued-stablecoin-and-more-week-in-review/

Stablecoins are powering deobanks

Opinion by: Maksym Sakharov, co-founder and group CEO of WeFi The current markets are experiencing tailwinds as a result of the tariffs imposed by the US administration and retaliatory measures from trading partners. So far, however, market proponents say that Trump’s tariffs are primarily a negotiation strategy, and their effect on businesses and consumers will remain manageable. Market uncertainty drives…