Tinkoff Investments, the online brokerage of major Russian private bank Tinkoff, is researching cryptocurrency investment services despite the Bank of Russia withholding the bank from launching such tools. Tinkoff Investments head Dmitry Panchenko claimed that the banks brokerage portal is considering projects related to cryptocurrency investment but its too early to discuss specific ideas. The company is now working on…

Author: Crypto Superhero

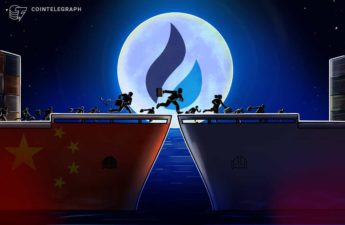

Huobi closes crypto derivatives as part of wind-down for Chinese traders

Major cryptocurrency exchange Huobi has ended futures and other derivatives trading in mainland China today, as planned. Earlier this month, cryptocurrency exchange announced on its website that it will settle all futures, contracts, and other derivatives activities for all Chinese consumers today, as part of the larger plan to cease operations in the country. According to previous announcements, Huobi, China’s…

Kazakhstan Expects $1.5 Billion From Crypto Mining in 5 Years, Estimates Suggest – Mining Bitcoin News

Crypto miners now bring more than $230 million into the economy of Kazakhstan each year and estimates show the figure could increase significantly in the future. The industry’s leading organization has projected that the government can collect more than $300 million in taxes over the next five years. Kazakhstan Makes Millions From Cryptocurrency Miners Kazakhstan’s growing coin minting industry has…

Decentraland Up 44% as Metaverse Tokens Surge in Wake of Facebook’s Meta Rebrand

Cryptocurrencies associated with the metaversea persistent, virtual shared universesaw double-digit gains over the last day, in the wake of Facebook’s announcement that it would rebrand as Meta, with a mission to “bring the metaverse to life.” Decentraland’s MANA token led the pack, with 24-hour gains of over 44.6%, bringing its price to around $1.15. The Sandbox’s SAND rose by 21.5%,…

Biggest Bitcoin fund in the world could become ETF by July as GBTC nears $40 billion AUM

Grayscale could launch its Bitcoin (BTC) exchange-traded fund (ETF) as soon as July 2022, one of its executives has said. Speaking at a virtual event organized by MarketWatch on Oct. 27, Grayscales global head of ETFs, David LaValle, gave a nine-month timeline for approval by U.S. regulators. Grayscale: Now’s the time to file for ETF Grayscale, which runs the largest-volume…

Australian securities regulator issues guidelines for crypto ETPs

The Australia Securities and Investments Commission (ASIC) has issued its response to public consultation on cryptocurrency exchange-traded products (ETPs) alongside fresh industry guidance. On Oct. 29, the regulatorreleased a set of regulatory requirements for funds looking to offer crypto ETPs, including exchange-traded funds (ETFs) and structured products, following months of industry consultation initiated in late June. According to the official…

Cream Finance Suffers $130 Million Hack – Bitcoin News

Ethereum defi protocol Cream Finance suffered an exploit yesterday that allowed attackers to steal $130 million from its holdings. The news was first revealed by Peckshield, a blockchain analytics company that discovered a flash loan had exploited the platform. This is the third hack the protocol has suffered in its history, being exploited for $36 and $29 million before, respectively.…

MicroStrategy’s Bitcoin Coffers Swell to $7 Billion

Business intelligence firm MicroStrategy added nearly 9,000 Bitcoin to its holdings in the third quarter, with a total amount on its balance sheet reaching 114,042 BTC as of September 30, 2021 With Bitcoin currently trading at roughly $61,000, Microstrategy now holds a staggering $7 billion of the leading cryptocurrency. According to MicroStrategys Q3 financial results published on Thursday, the firm…

ビットコイン長期保有者 利益確定の兆候なし【クラーケン・インテリジェンス】

ビットコインは10月20日に過去最高値を更新したあと、落ち着いたペースで推移している。そろそろ調整を懸念する投資家もいるかもしれないが、クラーケン・インテリジェンスのオンチェーン分析によると、長期保有者に利益確定の兆候はみられない。 [NEW!] LINE始めました!フォローをお願いします。 Twitter始めました!フォローお願いします。 クラーケン・インテリジェンスは、10月28日、最新のオンチェーン分析レポートを公開した。オンチェーン分析とは、ブロックチェーン上の取引データを分析してトレードに活かす仮想通貨ならではの手法だ。 今回は、オンチェーン分析の一つである「1年で復活した供給量(1-Year Revived Supply)」を紹介する。 ビットコインの「1年で復活した供給量」は、少なくとも1年間の休眠状態後に動き出したコインの供給量を表す。長期保有者と短期保有者の動向を詳細に見る上で便利だ。 (出典:Kraken Intelligence, CoinMetrics「1年で復活した供給量(7日移動平均)」) ビットコインの「1年で復活した供給量」は、2293.5BTC(約158億円)。8月以降で最低の水準だ。去年の年末や今年のはじめ頃と比べて、少なくとも1年間の休眠期間を経て市場に戻ってきたビットコインの供給量は限られている。 長期保有者が未だに蓄積モードであることが分かる。まだ「復活」させる気がない投資家が多いということだ。ビットコインが一時最高値を更新する中、未だに「供給量不足」の状態が続いていることが伺える。 クラーケンでの口座開設はこちら(無料) [NEW!] LINE始めました!フォローをお願いします。 Twitter始めました!フォローお願いします。 【ご注意事項】 本資料は、一般的な情報提供を目的に作成されたものであり、暗号資産取引の勧誘を目的としたものではありません。 本資料は、本資料作成時点でKrakenグループ及びPayward Asia株式会社(以下合わせて「Kraken 」といいます)が信頼できると判断した情報を基に作成しておりますが、その正確性・完全性を保証するものではありません。 本資料の情報によって生じたいかなる損害についても、Krakenは一切の責任を負いません。 Krakenが、これらの暗号資産の価値を保証したり、推奨するものではありません。暗号資産は、必ずしも裏付けとなる資産を持つものではありません。 Kraken Japan(Payward Asia株式会社)では、BTC、ETH、XRP、LTC及びBCH以外の暗号資産の本邦における取扱いはございません。 The post ビットコイン長期保有者 利益確定の兆候なし【クラーケン・インテリジェンス】 appeared first on Kraken Blog. Source link

Russian crypto market worth $500B despite bad regulation, says exec

The Russian cryptocurrency market has grown to hundreds of billions of dollars despite the absence of sufficient cryptocurrency regulation, according to a major industry executive. Sergei Khitrov, founder of the Russian cryptocurrency event Blockchain Life, gave a keynote speech on the state of cryptocurrency regulation in Russia at the VII Blockchain Life Forum in Moscow on Oct. 27. Based on…