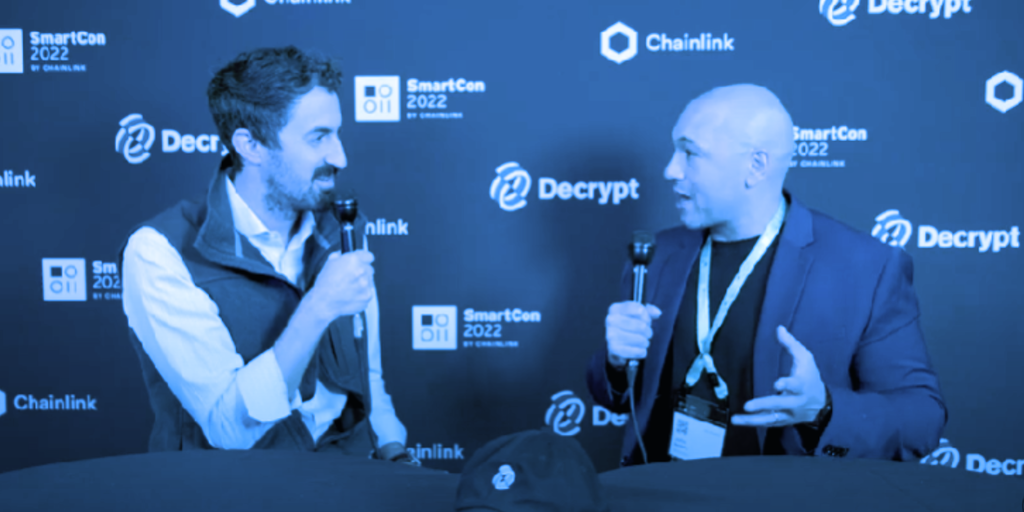

A common refrain in the blockchain industry is that regulators do not provide clear guidelines or useful regulatory frameworks for digital assets. John Belitsky, a co-founder of real estate DAO Balcony DAO, disagrees.

“There are regulations in place to do this,” Belitsky told Decrypt at Chainlink SmartCon. “Private placement offerings exist, Regulation D and CF offerings exist. You follow those protocols already laid out for you, and you can release these tokens in a compliant way.”

A DAO, or decentralized autonomous organization, is an organizational structure where control is spread out rather than hierarchical. DAOs use smart contracts on a blockchain, with participants using governance tokens to vote on proposed actions.

Founded in October 2021, Balcony DAO is a Web3 real estate-focused outfit that aims to bring real estate investing on-chain.

“We are not a DAO in the traditional sense,” Belitsky notes. “A traditional decentralized autonomous organization cannot exist with regulated securities.”

Belitsky pointed to the anonymous nature of DAOs, where members are not required to reveal their identity to have a say in the organization. That’s a nonstarter under existing law.

“I hate to burst everybody’s bubble, but real estate is a centralized asset class,” Belitsky says. “It lives in one place. It will never be decentralized.”

According to the Securities and Exchange Commission, any offer or sale of a security must be registered with the SEC. Regulation D provides several exemptions from the registration requirements, allowing some companies to offer and sell their securities without having to register the offering with the agency.

Regulation CF covers crowdfunding and requires all transactions to take place online through an SEC-registered intermediary. CF also requires disclosing information in filings with the SEC, investors, and the intermediary facilitating the offering. A company is permitted to raise a maximum aggregate amount of $5 million through crowdfunding offerings annually.

Notwithstanding the centralized component, Belitsky says the DAO model can still be applied to properties.

“There are two places for DAOs to exist in real estate,” he explains. “The first one is on the asset level, and the second is the community.”

For example, Belitsky says, if a group purchases a building, that building is now a special purpose vehicle (SPV)—effectively becoming a DAO. Special purpose vehicles are used to purchase and rent out properties in real estate and property investment.

Belitsky explains these SPV DAOs could then vote on decisions like how often yield is distributed or if the DAO will reposition the asset as a hotel.

Belitsky resisted the direct comparison of what Balcony DAO is doing to a co-op, saying that a co-op is a corporation, and investors may hold shares, but they don’t hold onto the real estate itself.

“Maybe the SEC does hate crypto, but they don’t hate private placement offerings,” he said. “They gave us that.”

Belitsky says the idea of not having to deal with Know Your Customer and Anti-Money Laundering policies may be a crypto-anarchist dream, but it will never happen in real estate.

Belitsky attributes the continued assertion that there are no clear regulations to laziness and not wanting to spend the money or take the time to follow the rules.

“They don’t want to jump through the hoops, and they don’t want to wait,” he said.