In a stunning display of bullish momentum, Bitcoin (BTC) has shattered the $60,000 barrier, reaching a daily high of $60,700 before retracing slightly to its current price of $60,503.

Over the past 24 hours, Bitcoin has surged by an impressive 6.2%, with a weekly gain of 18.3% and a staggering 158% increase over the last 12 months. But what’s driving this remarkable rally, and how are market sentiments reacting to the news? Let’s dive in.

The recent spike in Bitcoin‘s price can be attributed to a significant increase in institutional interest, following the approval of 11 Bitcoin exchange-traded funds (ETFs) in the United States earlier this year. This development has opened the floodgates for institutional investors, who are now flocking to the crypto market in search of lucrative opportunities.

Adding fuel to the fire is the highly anticipated Bitcoin halving event, scheduled for April this year. Historically, halvings have triggered massive bull runs, as the mining rewards are cut in half, effectively reducing the inflation rate of new Bitcoin supply by 50%.

Very Bullish Bitcoin Indicators on Charts

A confluence of technical indicators points to an extremely bullish outlook for Bitcoin. The relative strength index (RSI) currently stands at 86/100, suggesting that BTC is being extremely overbought. That means buyers account for nearly 86% of the market and far outweigh sellers.

The average directional index (ADX) for Bitcoin, which measures the strength of a specific price movement, is currently at 39, indicating a robust upwards trend. Typically, the ADX is considered to be balanced when it hovers around 20.

Furthermore, the separation between the Bitcoin 10- and 55-day exponential moving averages (EMA10 and EMA55) is widening daily, signaling that the price is accelerating upwards as time progresses.

Greedy, Greedy Bitcoin Traders

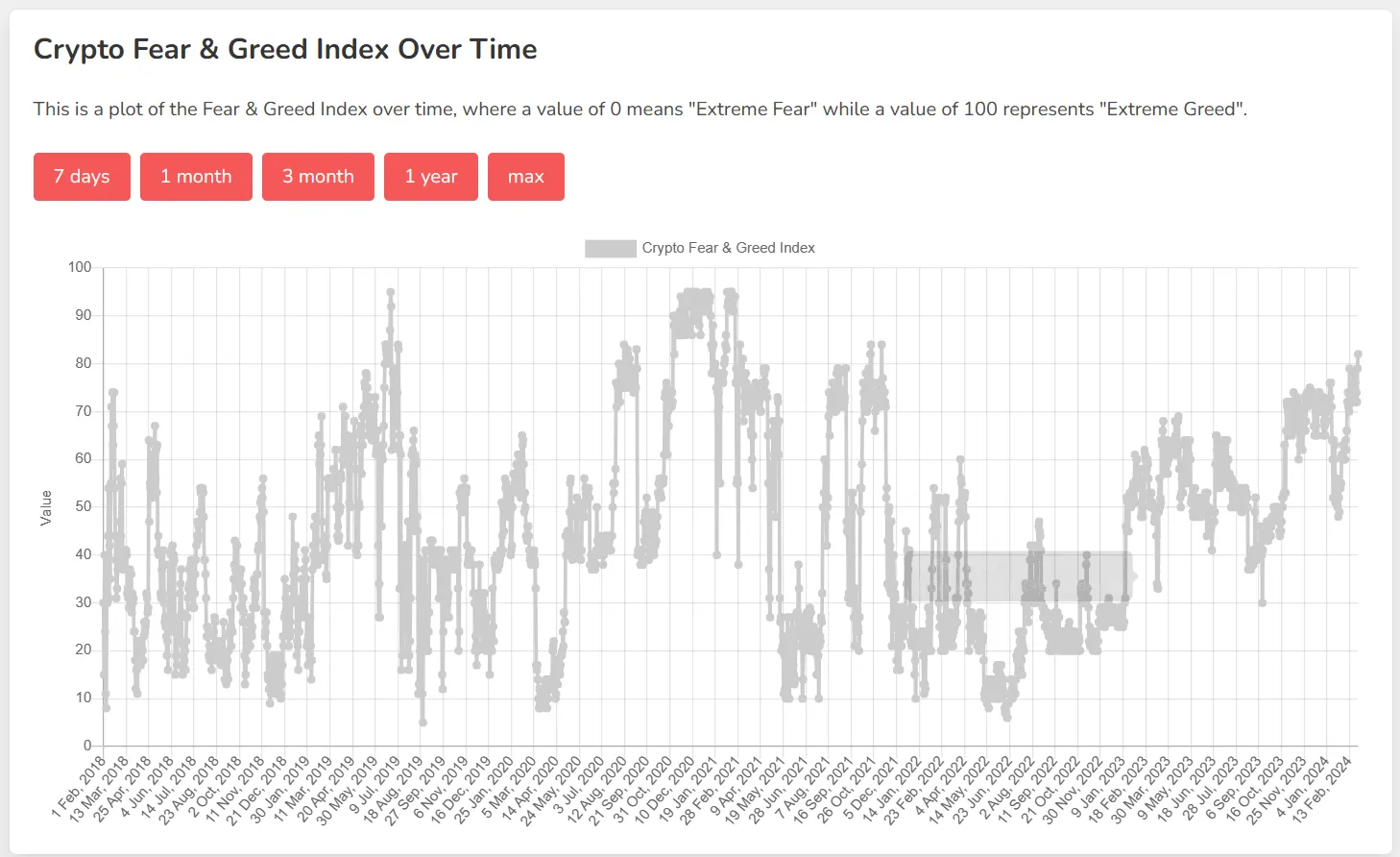

The Crypto Fear and Greed Index, an indicator that measures the overall sentiment of the crypto market on a scale of 1 to 100, is currently sitting at 82. Markets are in a phase of “extreme greed” for the first time since 2021, underscoring what the charts already show: a highly bullish sentiment among traders.

Interestingly, this marks the first time since the inception of the Crypto Fear and Greed Index that the market sentiment has shown a consistent upward pattern. Instead of reacting volatilely to news and events, traders have gradually gained confidence in an upward momentum since June 2022.

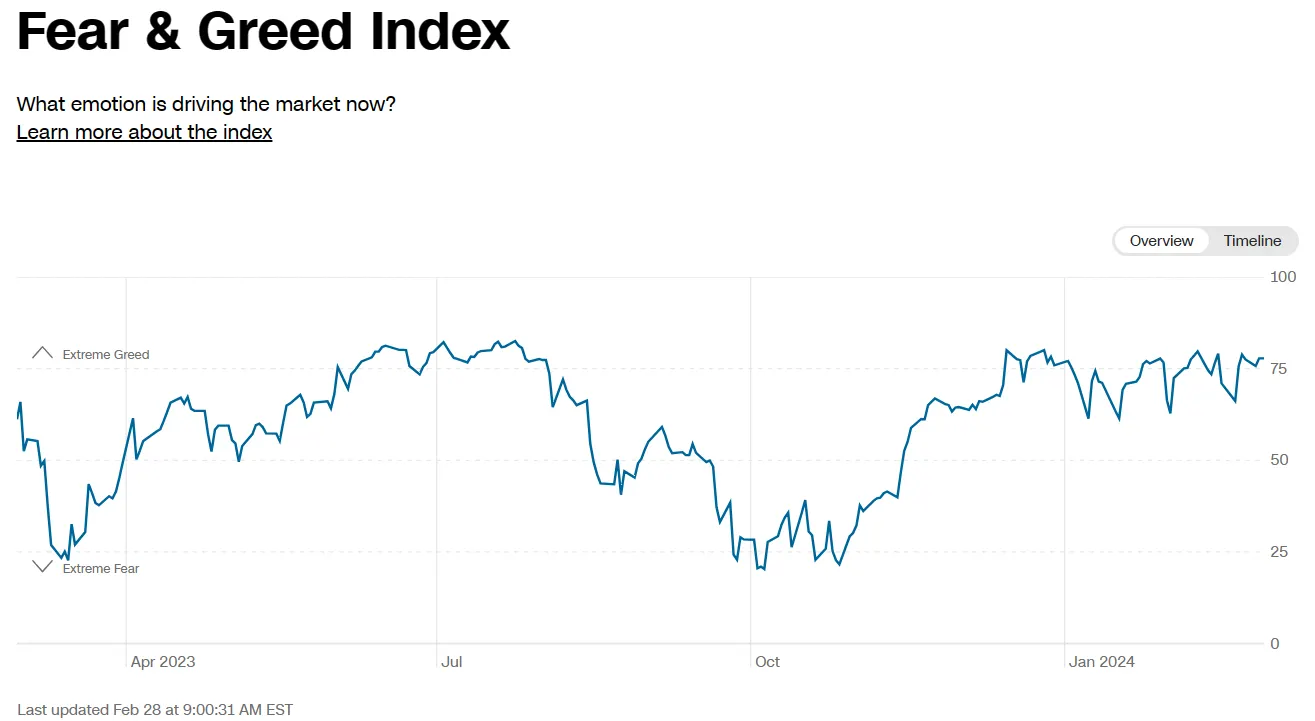

In contrast, the Fear and Greed Index for the S&P 500 has been lingering in “extreme greed” territory since December 2023. It’s been primarily driven by the hype surrounding AI stocks, which propelled the index’s recovery last year.

The overall crypto market is mirroring Bitcoin’s bullish sentiment, with the total market capitalization growing by $1 billion in the last 24 hours, from $2.2 trillion to $2.3 trillion, with PEPE leading the round at +41% in 24 hours and BitTensor (TAO) registering the worst performance at just -3%.

Edited by Stacy Elliott.

Stay on top of crypto news, get daily updates in your inbox.

Source: https://decrypt.co/219427/bitcoin-blasts-past-60k-markets-extreme-greed