While bitcoin’s value has remained well above the $60K range, the network’s hashrate has surged to over 184 exahash per second (EH/s) as mining devices are far more profitable at these prices. The price has made it so that older generation mining devices manufactured over four years ago, with processing power of more than 8 terahash per second (TH/s), can make a daily profit mining the leading crypto asset.

Bitcoin Hashrate Follows Ethereum’s Hashrate Toward All-Time Highs

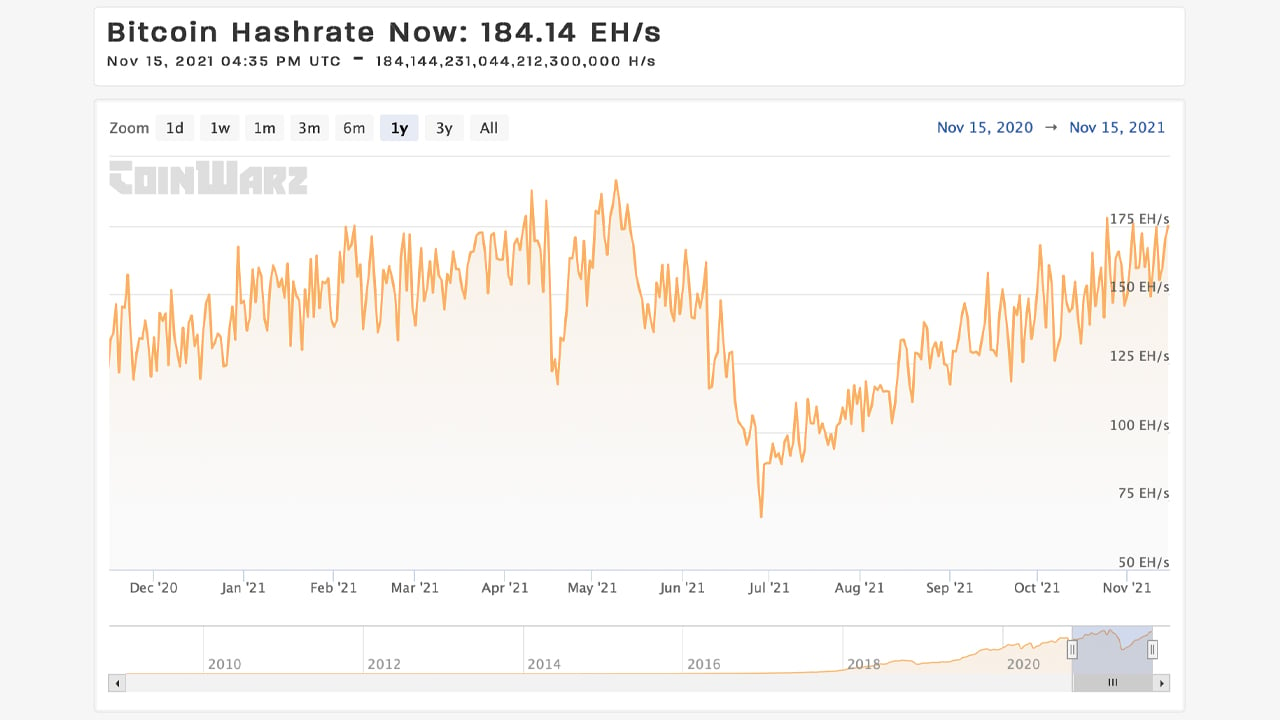

On November 15, 2021, Bitcoin’s hashrate climbed to 184 EH/s gathering 17.19% more hashpower than the network saw a mere two days ago on November 13. Bitcoin’s (BTC) hashrate is getting close to nearing its all-time high (ATH), which was recorded on May 9, 2021, at 191 EH/s. Today’s Bitcoin hashrate metrics show that the hashpower is only 3.8% away from surpassing its ATH, according to coinwarz.com data.

Bitcoin hashrate on November 15, 2021, according to coinwarz.com.

Bitcoin hashrate on November 15, 2021, according to coinwarz.com.

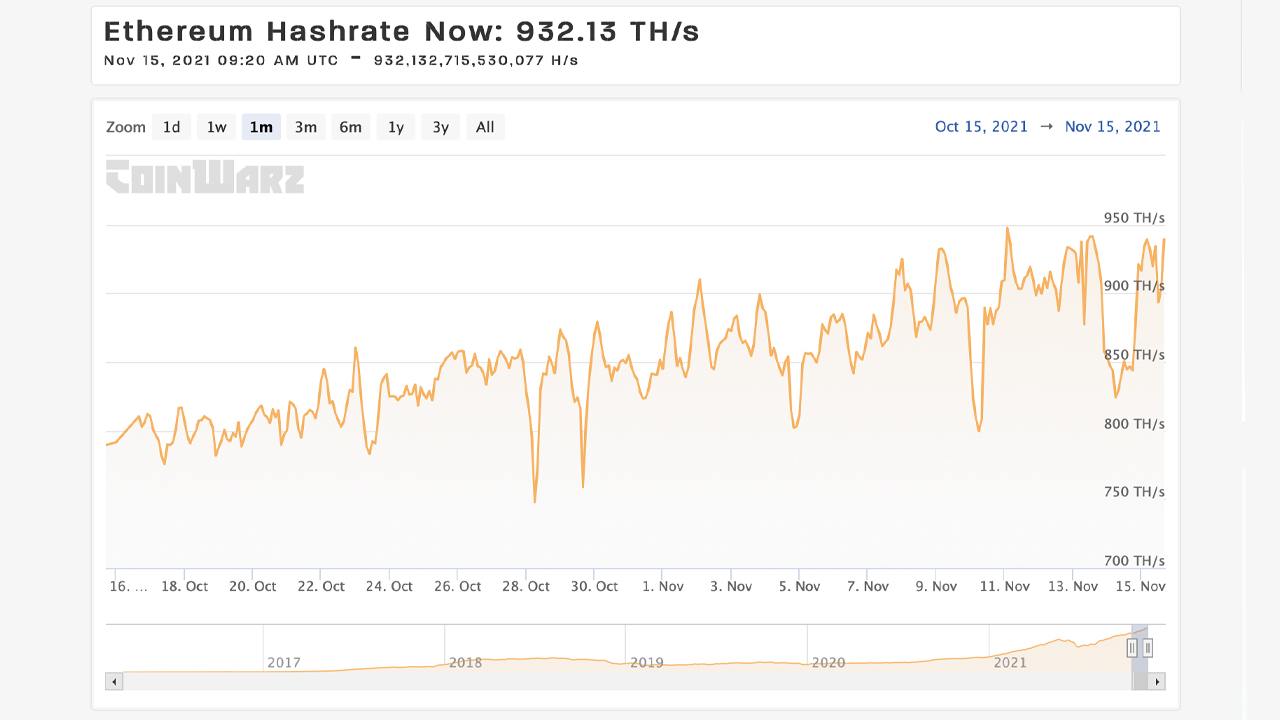

In addition to BTC’s hashrate nearing ATH, the second-largest crypto asset in terms of market valuation, ethereum’s (ETH) higher prices have also propelled its network hashrate. At 932 TH/s, Ethereum’s hashrate is awfully close to a single petahash per second or 0.001 EH/s. Ethereum’s hashrate has already reached an ATH and has continued to soar higher, capturing new records.

Ethereum hashrate on November 15, 2021, according to coinwarz.com.

Ethereum hashrate on November 15, 2021, according to coinwarz.com.

It’s worth it for miners to mine ether in comparison to BTC, as ETH is the third most profitable network to mine. At press time, the most profitable ether mining rig the Innosilicon A11 Pro that produces 1,500 megahash per second (MH/s) or 0.0015 TH/s can rake in $109.29 per day. The profit estimate stems from asicminervalue.com using today’s ether exchange rates and $0.12 per kilowatt-hour (kWh) in electric consumption.

Using Today’s Exchange Rates, Top 3 Bitcoin Miners Make $36 per Day — Bitcoin Miners Manufactured Over 4 Years Ago Still Profit

The profits for the ether mining rigs are larger than BTC’s mining profits stemming from the most profitable application-specific integrated circuit (ASIC) mining devices. Three SHA256 compatible miners on the market today, however, can command $36 per day in profits using $0.12 per kWh in electric consumption and today’s BTC prices.

Top three ASIC bitcoin miners on November 15, 2021, according to asicminervalue.com.

Top three ASIC bitcoin miners on November 15, 2021, according to asicminervalue.com.

The Microbt Whatsminer M30S++, the Ipollo B2, and the Bitmain Antminer S19 Pro are today’s most profitable BTC miners on the market, according to stats from asicminervalue.com. All three models boast hash speeds at over 100 TH/s. The Canaan Avalonminer 1246 which boasts 90 TH/s produces an estimated $27.55 per day using today’s exchange rates. Furthermore, besides the top mining devices pulling in the highest profits, old school miners from 2016 are now profiting.

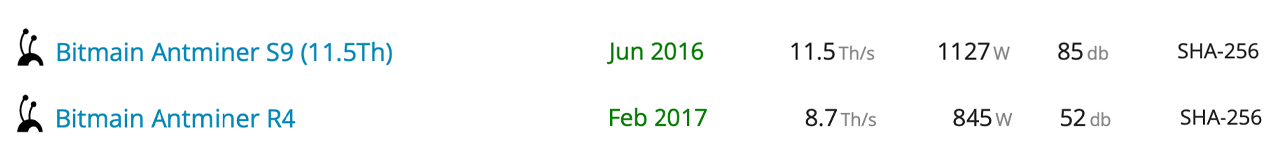

Old school bitcoin miners manufactured in 2016 that produced at least 8.7 TH/s can still profit mining bitcoin.

Old school bitcoin miners manufactured in 2016 that produced at least 8.7 TH/s can still profit mining bitcoin.

For instance, using $0.12 per kWh in electricity per day and today’s BTC prices, a Bitmain Antminer R4 (8.7 TH/s) can get at least $1.18 per day. The R4 mining rig was produced in 2017 and the popular Bitmain Antminer S9 (11.5 TH/s), manufactured over four years ago can get up to $1.53 per day with electrical rates at $0.12 per kWh.

What do you think about the recent mining action and Bitcoin’s hashrate climbing to 184 exahash per second? Let us know what you think about this subject in the comments section below.

Tags in this story

All time high, Antminer, Antminer R4, Antminer S9, ATH, Bitcoin mining, BTC Hashrate, BTC Mining, difficulty, ETH hashrate, Ether Mining, hashrate ATH, Innosilicon Miner, Ipollo, Microbt, mining, mining bitcoin, Mining BTC, Mining Pools, Old School Miners, Processing Speed, Top 3 Bitcoin Miners, Whatsminer

Image Credits: Shutterstock, Pixabay, Wiki Commons, coinwarz.com, asicminervalue.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.