The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In today’s Daily Dive, we’re highlighting the Market Realized Gradient metric coined by Glassnode’s lead on-chain analyst, Checkmate. The metric looks to capture the current state of market momentum comparing price to capital inflows.

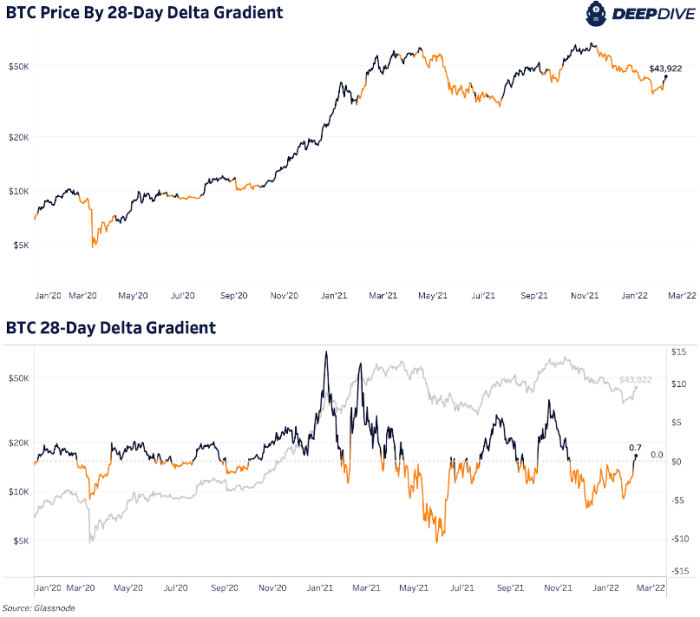

Here we are highlighting the 28-day Delta Gradient which looks at the difference between price over the last 28 days relative to the difference in realized price over the last 28 days with statistical normalization applied. This measures the momentum change in speculative value (price) versus true organic capital inflows (realized price). On interpreting the Delta Gradient from Glassnode:

When the Delta Gradient is positive it indicates an expected uptrend is in play which can be expected to last a similar length of time to the period of the oscillator considered (i.e., 28-day Delta Gradient, suggests a one- to two-month uptrend is in play).When the Delta Gradient is negative it signals the converse, that a downtrend is in play with similar expected duration.

As the bitcoin price and market cap move faster than realized price and realized cap, we can look for times when there’s a possible trend reversal in price that realized price has yet to catch up to.

As a refresher, the realized price of bitcoin is the average price of every coin on the network the last time it has moved, with a current reading of $24,069.

Detailed bitcoin price data.

Detailed bitcoin price data.

What we saw over the last two days is that the 28-day Delta Gradient flipped positive indicating upside to the market over the next month and that a potential market low is in, short-term. This shows that on-chain inflows have yet to catch up to the latest macro price reversal.

Source: https://bitcoinmagazine.com/markets/bitcoin-market-momentum-flips-bullish