Image Source: Bitrawr.

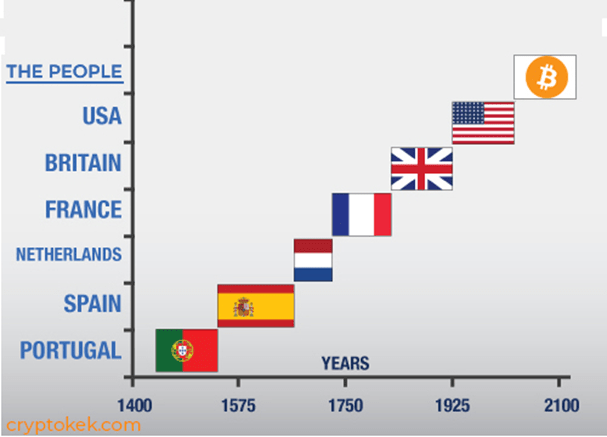

If the last 700 years are any indication, reserve currencies have a shelf life of roughly 100 years. The U.S. dollar (USD) officially became the world reserve currency 77 years ago (Bretton Woods, 1944). Arguably, USD was the reserve as far back as the late 1920s.

Source: “Will a Digital Gold Rush Save America’s Economy?” Cryptokek Blog.

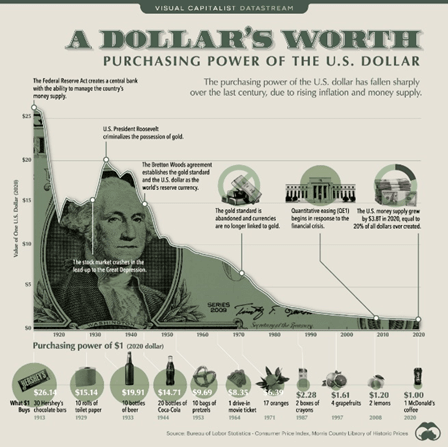

From a historical timeline perspective, the USD is in the twilight of its reserve status. Couple that with the fact that the United States is also expanding the money supply exponentially (devaluing the purchasing power of the existing supply of USD in the process), and to put it politely, this growth rate is unsustainable.

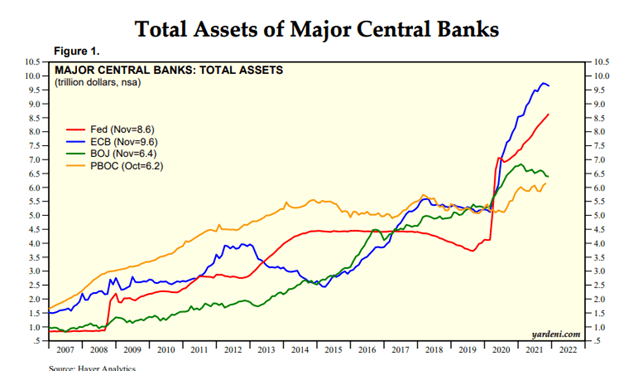

For the record, the U.S. Federal Reserve is not operating in isolation. Most major central banks across the globe are following this trend. Examples include the European Central Bank (ECB), the Bank of Japan (POJ) and the People’s Bank of China (PBOC) to name a few. Frankly, the majority of major central banks are racing one another to see who can debase their currencies the quickest.

Source: Haver Analytics.

Stanley Druckenmiller, who is considered a legendary investor in part due to his study of history and macroeconomics, thinks the USD will lose reserve currency status within 15 years.

“I can’t find any period in history where monetary and fiscal policy were this out of step with economic circumstances, not one.” — Stanley Druckenmiller

So, if the USD has a shelf life partially due to historical precedence and partially due to fiscal irresponsibility (overprinting of the money supply), what comes next? What replaces the USD? Another fiat currency? It’s possible, but my guess is the days of trusting a centralized party to maintain a stable supply of a currency have come and gone. Why trust, when you can just verify? An argument could be made that gold is today’s reserve asset as it is held by the majority of central banks.

For me, gold is the past, while Bitcoin is the future. Bitcoin is decentralized, easily verifiable, immutable, divisible with a known supply and is easily amalgamated into an ever-increasing digitizing global economy. Bitcoin is already legal tender in El Salvador, a status that will be difficult for gold to parallel based on its transportation and divisibility limitations. There is a groundswell of Bitcoin adoption happening from different sectors of the economy.

Retail, institutions, governments, pension funds, REITS and banks are all accumulating bitcoin. The diversity of accumulation produces “game theory” adoption, accumulation which is occurring far quicker than most would have predicted. For example, El Salvador became the first government to make bitcoin legal tender in September 2021. Today, there are more residents with Bitcoin wallets than traditional bank accounts. As of October 2021, exports of goods grew 34% in 2021 in El Salvador, while gross domestic product (GDP) is projected to be greater than 10% in 2021, making El Salvador one of the fastest growing economies in central America.

Source: @DylanLeClair_

El Salvador continues to acquire bitcoin at a fast pace, now owning approximately 1,220 bitcoin at the time of writing this article. Bitcoin adoption is an accumulation race. The thing is, most do not realize that the gun has already gone off and the race has started. Ask Michael Saylor of MicroStrategy if they plan to sell, let alone stop accumulating more bitcoin.

From a government level, Laos mines bitcoin. They expect to earn $190 million dollars from bitcoin mining in 2022. Tonga is actively drafting legislation to make bitcoin legal tender in the fall of 2022. Panama, Zimbabwe and Ukraine are all looking into possible adoption. Singapore seeks to become a Bitcoin hub.

“We think the best approach is not to clamp down or ban these things,” said Ravi Menon, managing director of the Monetary Authority of Singapore.

The president of El Salvador is currently in Turkey, the first G20 country to experience near hyperinflation. I would guess Nayib Bukele would bring up the benefits that adopting bitcoin as legal tender could do for the Turkish people.

For every case like China, which chose to close its doors to Bitcoin, there are two other countries ready to embrace it. You cannot ban Bitcoin, a country can only choose to ignore it, but Bitcoin is not going away. Ignore at your peril. Bulgaria owns 213,518 bitcoin, Ukraine owns 46,351, Finland 1,981 and El Salvador, at the time of writing, 1,220.

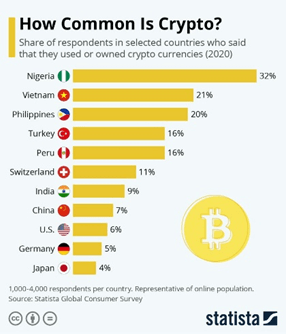

Source: Buy Bitcoin Worldwide.

Even in countries where governments do not present favorable policies toward Bitcoin adoption, high levels of citizen adoption can force the government’s hand. Nigeria and Turkey are two prime examples. Grassroots citizen adoption (retail) is taking hold in countries all over the world. In 2020, per the Statista global survey, 32% of citizens in Nigeria, 21% in Vietnam, 20% in the Philippines and 16% in Turkey and Peru have indicated they have used or owned “cryptocurrencies.”

Source: Statista.

Corporate accumulation is also taking place. As of June 2021, 34 public companies collectively hold over 213,000 bitcoin. MicroStrategy and Tesla being the largest. The majority of companies who have adopted bitcoin have done so in the last 18 months.

Source: Buy Bitcoin Worldwide.

Google has partnered with Bakkt to provide Bitcoin payment solutions. Twitter has enabled tipping via the Bitcoin Lightning Network. Bitcoin has the capability of being the native currency of the internet, as predicted by Milton Friedman in 1999.

One of the most prominent U.S. real estate investment trusts (REITS), SL Green Realty Corp. (NYC Office REIT), has dipped their toes into bitcoin with a $10 million investment in a bitcoin fund. Banks are another corporate sector actively embracing bitcoin after trying to ignore and fight the asset for years. Banks make their money by lending out their assets. The Commonwealth Bank of Australia has enabled 6 million of its customers to buy bitcoin. Banks must choose to adopt bitcoin or risk becoming irrelevant.

Pension funds and insurance companies are also beginning to gain exposure to bitcoin. The Houston Firefighters Relief and Retirement Fund (HFRRF) in partnership with NYDIG has purchased $25 million in bitcoin (and ether) in October 2021. MassMutual also purchased $100 million in bitcoin in December 2020.

The reason why pension funds and insurances are drawn to bitcoin is because they need to save their monetary energy (purchasing power) for the future. With inflation levels at decade highs, cash savings (in fiat) are being devalued. These funds are forced to take on riskier investments in search of higher yields, to maintain their purchasing power that is being devalued through inflation.

Holding bitcoin is simpler, as bitcoin enables the ability to save due to its deflationary nature.

The toothpaste (Bitcoin adoption) can’t go back in the tube. Adoption has grown to a saturation level (in terms of scale and diversity) which makes a future bitcoin standard for the world inevitable. The majority of the world has blinders on and cannot see this or the groundswell of adoption and accumulation taking place.

Source: Visual Capitalist.

Paul Tudor Jones says it best, “Bitcoin has this enormous contingent of really, really, smart sophisticated people who believe in it…. You’ve got this group — which by the way is crowdsourced all over the world — that are dedicated to seeing Bitcoin succeed in becoming a commonplace store of value and transactional to boot.”

It might make sense to get some, in the event that the rate of adoption continues to accelerate.

This is a guest post by Drew MacMartin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source: https://bitcoinmagazine.com/business/bitcoins-path-toward-global-adoption