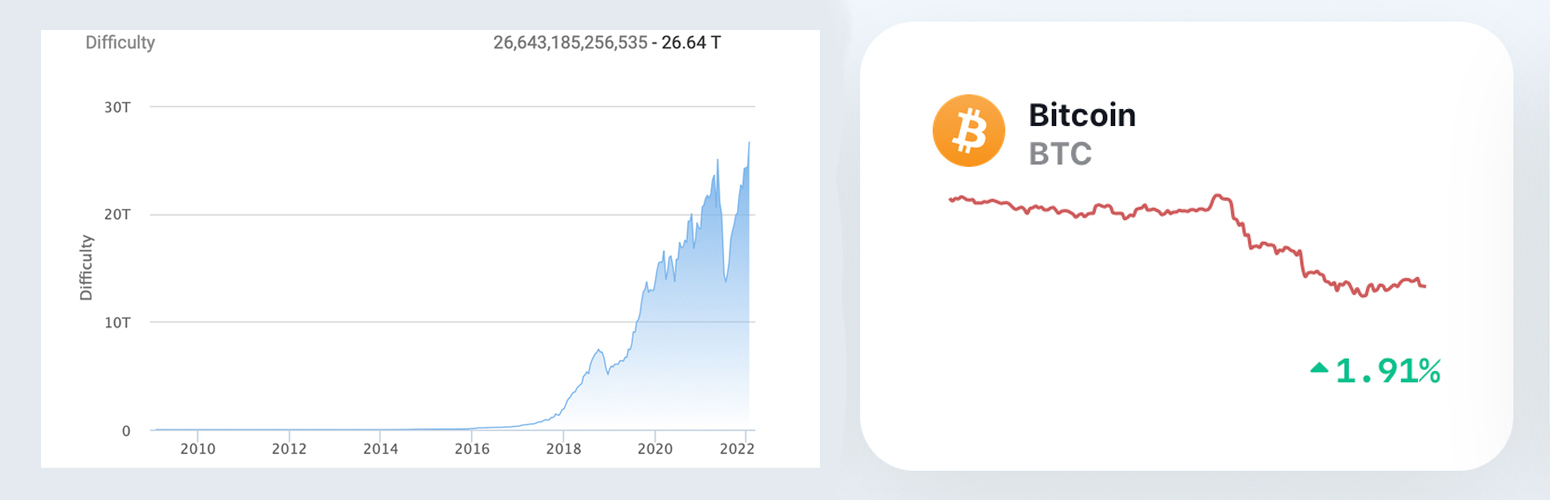

After Bitcoin’s mining difficulty jumped to the highest value ever at 26.64 trillion, the overall hashrate slumped a hair due to the rise in difficulty and lower bitcoin price. This weekend, Bitcoin’s hashrate is coasting along at 189 exahash per second (EH/s), after dropping to a low of 167 EH/s three days ago. The lower price and difficulty rise has put a squeeze on bitcoin mining profits.

Mining Difficulty Makes Block Rewards Harder to Find, Bitcoin’s Lower Price Makes It Less Profitable for Miners

Bitcoin’s hashrate remains high after the network saw the mining difficulty reach an all-time high of 26.64 trillion on January 20, 2022. That day, the network difficulty adjustment algorithm (DAA) increased 9.32% and the next DAA epoch is set to change in 11 days.

Bitcoin’s mining difficulty reached its all-time high on January 20, 2022, and BTC’s price slipped more than 17% during the last week. Both of these factors have squeezed mining profits a great deal. (Chart left: Bitcoin difficulty. Chart right: BTC/USD 7-day chart)

Bitcoin’s mining difficulty reached its all-time high on January 20, 2022, and BTC’s price slipped more than 17% during the last week. Both of these factors have squeezed mining profits a great deal. (Chart left: Bitcoin difficulty. Chart right: BTC/USD 7-day chart)

The last change makes it a lot harder for miners to find a bitcoin (BTC) block subsidy and more difficult than ever before during the last 13 years. Another obstacle bitcoin miners faced this past week is the fact that BTC’s price shed 17.9% over the last week.

Both the higher difficulty and the lower price make it less profitable for miners. With 189 EH/s of SHA256 hashrate dedicated to the chain, it doesn’t seem like these factors have slowed miners down. Although, aggregate profits stemming from bitcoin mining rig statistics indicates that SHA256 miners are feeling the pressure from both the price drop and difficulty rise.

Top Six Bitcoin Mining Rigs Today Make Less Than $10 a Day, Older Machines Suffer

Currently, the top bitcoin mining rig on January 23, 2022, using $0.12 per kilowatt-hour (kWh) and current BTC exchange rates, makes around $9.41 per day. The mining rig, Bitmain’s Antminer S19 Pro processes around 110 terahash per second (TH/s). The second-most profitable miner on Sunday is Microbt’s Whatsminer M30S++ with roughly 112 TH/s.

The top two mining rigs today in terms of profitability make less than $10 a day with electricity rates at $0.12 per kWh and current bitcoin (BTC) exchange rates.

The top two mining rigs today in terms of profitability make less than $10 a day with electricity rates at $0.12 per kWh and current bitcoin (BTC) exchange rates.

The Whatsminer M30S++ gets an estimated $9.12 per day in profit using current BTC exchange rates. Two weeks ago, these two mining devices were getting $13-16 per day in profits, and two weeks before that, profits were up to $25 per day per machine.

Following Microbt’s M30S++ machine, are three models from Bitmain stemming from the S19j series, which process between 96 to 104 TH/s. These three models make an estimated $8.23 to $8.91 per day in profit. The sixth most profitable mining rig today is Microbt’s Whatsminer M30S+, which processes around 100 terahash per second.

The M30S+ pulls around 3400W of electricity off the wall and with electricity rates at $0.12 per kWh and current BTC exchange rates, the mining rig can profit by $7.28 per day. A great number of older bitcoin mining machines, with less than 28 TH/s in processing power, are having a hard time grabbing profits unless the electricity rates are lower than $0.12 per kWh.

This means that older generation units, like the well known Bitmain S9, are far less profitable today than they were when BTC prices were higher and mining difficulty was less.

Tags in this story

$0.12 per kWh, Bitcoin hashrate, Bitcoin Miners, Bitmain, Bitmain S9, BTC Hashrate, BTC miners, BTC Prices, difficulty, Electricity, Global Hashrate, Hashpower, Hashrate, M30S++, Microbt, Miners, Mining Difficulty, Mining Pools, mining rigs, Most Profitable, Old Rigs, Over 200 EH/s, pool distribution, pressure, Price, Whatsminer

What do you think about the profits miners are making with the current bitcoin price change and mining difficulty increase? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.