beginner

Although for many people the word “blockchain” has become synonymous with the term “cryptocurrency,” that’s not all there is to it. Cryptocurrencies are just one of the many, many use cases that exist for blockchain technology.

Blockchain technology is essentially a system of recording information. It is incredibly secure, making it almost impossible to change, hack, or tamper with the data recorded this way. Because of this and its incredible utility, blockchain technology has become a staple in many industries — most significantly, the banking sector.

Financial institutions have a lot to gain from working with blockchain. But before we talk more about blockchain in banking, let’s establish what this technology is all about first.

How Does Blockchain Work?

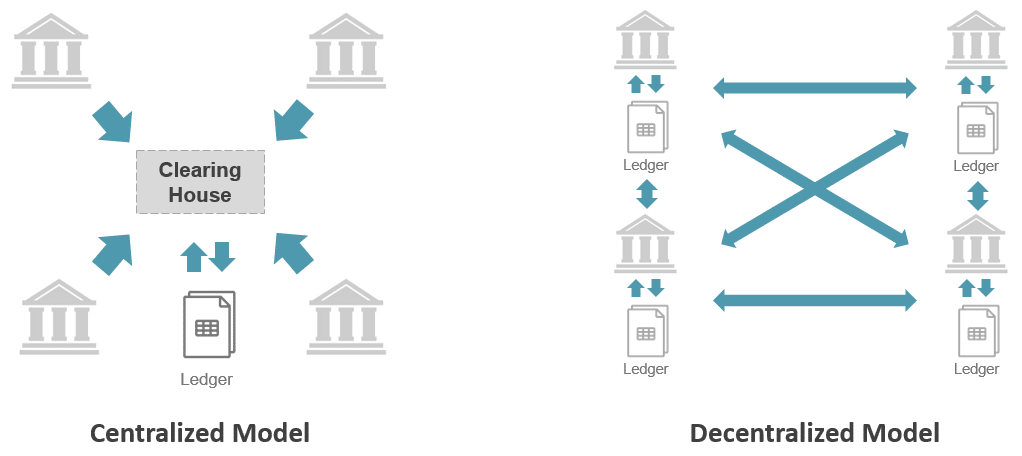

Blockchain isn’t just a platform for launching cryptocurrencies and smart contracts applications — it is a type of distributed ledger technology, a decentralized database that is managed by multiple participants.

Distributed Ledger Technology

Source: steemit.com

Source: steemit.com

A distributed ledger is a database that exists across several locations or is kept by several participants. These participants can be computers, organizations, servers, and so on. In order for any type of data to be recorded on a distributed ledger, all participants must process, validate, and authenticate it first.

All data recorded on a distributed ledger is time-stamped and given a unique identifier. As all participants can view the entire ledger at any time, it is really hard to falsify records on distributed ledgers.

What Is Blockchain?

Blockchain is a type of distributed ledger technology that uses an immutable cryptographic signature called hash to record transactions. It is essentially a secure digital database that does not require a third party to generate trust and guarantee the safety and security of one’s data.

“The Business Blockchain” by William Mougayar

“The Business Blockchain” by William Mougayar

The most defining feature of blockchains is the “blocks” that they are built of. Blocks are a collection of information and hold sets of data. Once a block is filled and verified, it gets added to the blockchain, and the data contained in it can no longer be changed. Blockchain is quite literally a chain of blocks that all contain some sort of data.

There are two main ways in which blockchains keep all of our data secure. Firstly, there is a hash — a unique identifier that is assigned to every single block upon its creation. Each block in a blockchain contains its data, its own hash, and the hash of the previous block. Hashes change if any changes are made to the data contained within their corresponding blocks, making it nearly impossible to alter information that has been recorded on a blockchain.

Secondly, blockchain networks are protected by their distributed nature. Instead of keeping the database in one place, its copy is shared with an entire peer-to-peer network that anyone can join. Each of the participants that possess a copy of the blockchain is called a node.

Each node has to verify each new block before it can be added to the blockchain. Once all the nodes come to an agreement, they reach a consensus, unanimously deciding whether the block is valid or not. If at least one node finds out that the block has been tampered with, it gets rejected.

Read also: What is blockchain and how does it work?

In order to reach that anonymous agreement on the validity of each block, blockchains utilize a feature called consensus mechanisms. It also helps to further secure the network, for example, by slowing down the block creation process (using the proof-of-work algorithm).

Let’s take a look at the way blockchains work, exploring an example of a crypto transaction:

Person A wants to exchange BTC for ETH on a crypto exchange.The transaction request is sent to all the nodes on the blockchain network. The nodes validate the transaction using a consensus mechanism.Once the transaction is verified, it is combined with other recent transactions to create a block.Once that block is filled, it gets added to the blockchain.The transaction is complete.

Here are some of the key properties of blockchain technology:

Anonymous

All participants of a distributed ledger database are fully anonymous, and their identities are hidden.

Secure

With all records being individually encrypted, it is nearly impossible for criminals and other third parties to tamper with the data recorded on blockchains.

Immutable

All blockchain records are irreversible and cannot be changed.

Programmable

Users can use this technology to create, store, or execute programs — for example, blockchain-based smart contracts.

Distributed

The distributed nature of blockchains ensures full transparency — all participants of each blockchain network hold the entire copy of the database.

The Promise and Benefits of Blockchain for Banking

The benefits of blockchain technology for the banking industry become evident as soon as one finds out its properties. Who else but the financial sector can gain more from using a technology that allows for a fully secure, immutable way to record and transfer data?

Thanks to all the progress we’ve made in the information technology field, an average bank transfer nowadays is fairly protected — but criminal activity in the banking industry is at an all-time high. Credit card theft, scams, identity thefts, and other misfortunes are the things that most people that have used financial services have unfortunately come across. Blockchain can help to make the banking sector a lot more secure.

Financial institutions like investment banks or accounting firms can greatly benefit from the transparency distributed ledgers can offer. Blockchain can provide them with a way to record data in a secure and well-organized way in a single place.

Additionally, blockchain can revolutionize the global financial system by significantly lowering transaction costs and decreasing the time wasted on processing transactions. These innovations can especially benefit international trade.

How Can Blockchain Be Used in the Banking Sector?

There are many use cases for blockchain in banking. There’s a lot this new technology can offer to the centuries-old financial sector: after all, modern issues like hacking require equally modern solutions.

Here are just some of the ways in which blockchain technology can be used by financial institutions. As this field develops further, more and more applications for blockchain in banking are going to be discovered.

💳 Payments

One of the biggest advantages of using blockchain in banking is its ability to facilitate much faster financial transactions — especially when it comes to cross-border payments.

Not only will the payments that go through the decentralized channels established by blockchain networks be faster, but they will also be a lot cheaper. Blockchain can lower global trade processing costs as well as asset exchange fees.

The lower costs, higher processing speed, and increased security of blockchain technology can provide banks and other financial institutions with the push they need to overcome their current challenges, allowing them to compete with new trendy fintech startups.

💸 Bank Transfers

Traditional bank transfers can also benefit from blockchain technology. The lack of need for the involvement of any intermediaries and other third parties will make bank transfers a lot more efficient, secure, and customer-friendly.

🪙 Asset Purchases

Blockchains can fully eliminate the need for a third party from all types of asset transfers, be it purchases or sales. This will significantly reduce the fees associated with buying and selling both real-world and digital assets.

Beyond being naturally great for crypto assets, blockchain technology can also help out the traditional securities market. This subcategory of the financial sector operates by terribly outdated rules — data has to be recorded and shared across a rather convoluted network of custodian banks, brokerages, exchanges, and other participants. This leads to higher chances of security breaches, long processing times, and other inconveniences and complications.

Both retail and institutional investors can benefit from the implementation of blockchain technology. A digital distributed ledger can greatly reduce the time it takes to process transactions on the securities market. It can also solve the issue of the prevalence of imprecise and inconsistent data going around.

This can be achieved through the process called “tokenization” — substituting both digital and real-world assets with tokens on a blockchain. When it comes to payments, this will reduce both processing speed and fees, significantly increasing the efficiency of the market.

🤝 Credit and Loans

Loans and bank deposits have become an integral part of our reality. However, for something so essential, they are relatively inefficient and associated with lots of challenges, like the complex and lengthy loan approval process or their vulnerability to hackers and other criminals.

Blockchain networks can provide consumers with a much more efficient, cheaper, and secure alternative to traditional bank borrowing — fully trustless peer-to-peer loans.

🧮 Clearance and Settlement Systems

Blockchain is a lot more efficient at validating and keeping track of transactions than existing systems, such as SWIFT. In addition to being faster, it is also a lot more transparent and does not lack in the security department.

An average bank transfer not only takes a while but also requires the involvement of an abundance of third parties. Transactions executed directly on the blockchain, on the other hand, are fully transparent and do not require the involvement of any intermediaries.

🙏 Fundraising

Blockchain technology can also have an impact on the charity sector.

First of all, blockchain can provide the obvious benefit of increasing the pool of potential donors. Cryptocurrencies allow people to make faster, more efficient cross-border payments and, in some cases, give people who were previously unable to access charity websites the ability to donate.

Cryptocurrencies also provide a way to trace and track all donations, giving donors greater transparency and thus increasing their trust in the charity foundation of their choice. Additionally, crypto donations would allow both donors and fundraisers to bypass paying exchange and bank fees, increasing the overall pool of funds for everyone involved.

There are already dozens of big charity organizations that have started accepting donations in crypto: UNICEF, the Salvation Army, UK’s Breast Cancer Support, and many others.

Some charity fundraisers have also decided to utilize a rather controversial aspect of blockchain and crypto, namely mining. For example, Give Byte offers users an opportunity to donate their spare computing power, turning it into cryptocurrencies that are later used for charity.

Beyond giving donors a wider range of payment options and an ability to keep track of their donations, blockchain technology can also be used to create charity-specific utility tokens.

🌐 Trade Finance

The current trade finance industry is ripe with unnecessarily complicated, time-consuming, and costly processes. Blockchain technology can solve all these issues by providing a time-efficient, fully transparent digital database that will allow all trade participants to keep their records in a single secure place.

🗄 Blockchain in Banking for Accounting

Accounting and auditing are two incredibly complex and rigid fields of finance. They may seem simple at first glance but are astonishingly complicated in reality, featuring a ton of strict regulatory requirements and rules.

Blockchain technology could help to simplify those rules, making the field a lot more accessible and, as a result, efficient. Not only will this sector benefit from having a fully transparent, always up-to-date digital ledger, but it will also be able to take advantage of advanced technology such as smart contracts.

✔️ Digital Identity Verification

Nowadays, most banks require their clients to come to one of their offices to confirm their identity. That is incredibly inconvenient, and not just because we’re currently in a pandemic. In a rapidly digitizing world, it can be burdensome to have to take the time out of your day to go to your local bank office and stand in a line for hours — all for a quick and short procedure. Not to mention, you will likely have to go through additional identity verification processes every time you need to use your bank account.

Blockchain technology can enable faster identity verification processes. Using such technology as zero-knowledge proof, clients and customers won’t ever have to go through the complicated and lengthy identity verification more than once.

The Future of Blockchain in Banking

There’s no denying that blockchain has a lot of use cases in banking. The financial sector still seems somewhat apprehensive about this new technology but is slowly warming up to it. From cross-border payments to hedge funds, blockchain technology is slowly but surely revolutionizing the banking industry.

The traditional banking industry is clearly in need of a shake-up, and blockchain-based solutions, including but not limited to smart contracts and cryptocurrencies, seem to be the right tool to revitalize the established financial infrastructure. It’s not unlikely that in a few years, we will all be using a national central bank digital currency instead of USD or EUR.

Blockchain technology also has a wide range of applications beyond the financial industry. It is currently disrupting the supply chain sector, the healthcare industry, marketing, and advertising. It is even used by musicians and artists.

However, there’s also a pushback against it. Many people are concerned about the environmental impact cryptocurrencies may have on our planet. Some of them can only see blockchain as another name for crypto and think of it as nothing but a speculative tool. Others just find the concept of NFTs ridiculous, so they mock everyone who supports this new technology.

Of course, most of these issues arise because of the general ignorance and misinformation that surround everything related to blockchain. However, resolving these misunderstandings won’t be easy — clearly, simply explaining what blockchain is won’t dissuade people who are already prejudiced against the technology.

Uprooting those preconceived misconceptions will take time and a lot of effort. However, as blockchain becomes more and more integral to our daily lives and is adopted by more industries and companies, more people will see it for what it is — a useful and efficient tool.

FAQ

Is blockchain technology being used by banks?

Yes, hundreds of banks have reported using blockchain technology in one form or another.

Which banks use blockchain?

Banks like JPMorgan, PNC, Citi, Wells Fargo, US Bancorp, Signature Bank, and others have announced that they use blockchain in one form or another.

How many banks use blockchain?

Bank of America reported back in February 2021 that over 21% of the banks they work with use blockchain technology.

How is blockchain used in payments?

Blockchain technology can facilitate faster, more secure, and low-cost international transactions.

Why do banks adopt blockchain?

Using blockchain in banking comes with lots of benefits: higher efficiency, lower costs, increased security, eliminating potential errors, and many more.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.