Bitcoin was back above $20,000 on Tuesday, as the U.S. dollar fell to its lowest point in two weeks versus several G7 currencies. The stronger dollar has impacted purchasing power in cryptocurrencies, and commodities like crude oil, which last week fell to a nine-month low. Ethereum was also up, hitting a five-day high.

Bitcoin

Bitcoin (BTC) briefly rose above $20,000 on Tuesday, as the U.S. dollar continued to decline versus other major currencies.

This has resulted in the world’s largest cryptocurrency climbing to a peak of $20,071.20 earlier in today’s session.

Today’s high is the strongest point that BTC/USD has traded at since September 30, and is marginally below a ceiling of $20,200.

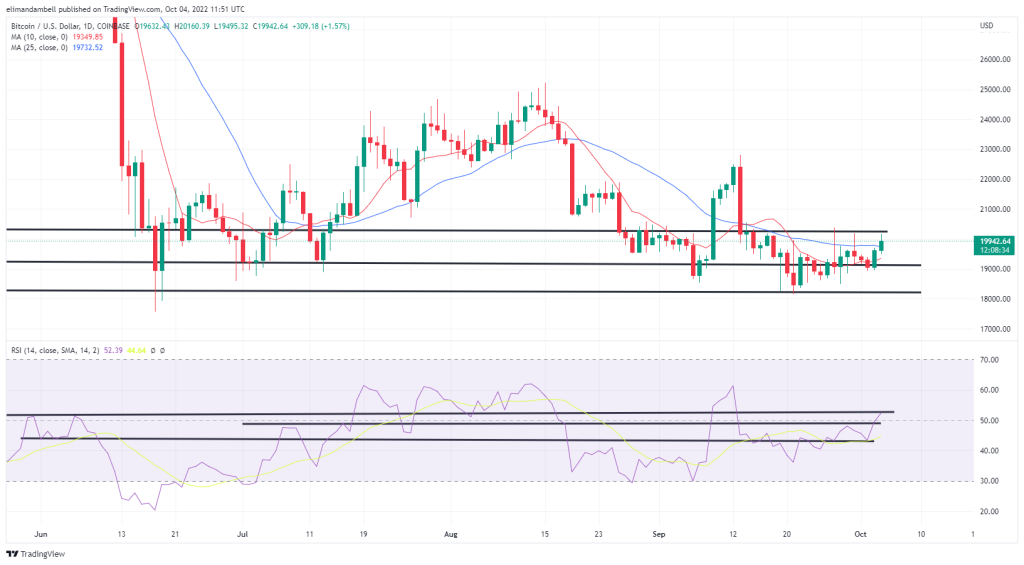

BTC/USD – Daily Chart

BTC/USD – Daily Chart

As can be seen from the chart, earlier bulls retreated from the market as BTC neared the aforementioned resistance point.

Overall, the rally began following a breakout of another point of uncertainty, this being the ceiling of 49.00 on the relative strength index (RSI).

The index is now tracking at 52.22, which is slightly below a resistance of 53.00, and this seems to be another reason why BTC has slipped from its earlier high.

Ethereum

Like BTC, ethereum (ETH) also rose to a five-day high in today’s session, moving above a key resistance level in the process.

Following a low of $1,294.41 to start the week, ETH/USD raced to an intraday high of $1,355.89 earlier in the day.

The move saw ethereum break out of its ceiling of $1,330, with the 14-day RSI also moving beyond a point of resistance.

ETH/USD – Daily Chart

ETH/USD – Daily Chart

Looking at the chart, the indicator rose above its ceiling of 41.50, and as of writing, is tracking at 44.82.

This is the strongest reading for the index since September 15, when ETH was trading at a high of $1,470.

In order to move back towards those levels, the RSI will need to break out of an upcoming ceiling of 45.00.

Register your email here to get weekly price analysis updates sent to your inbox:

Could we see ethereum hit $1,400 before the end of the day? Leave your thoughts in the comments below.

![]()

Eliman Dambell

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.