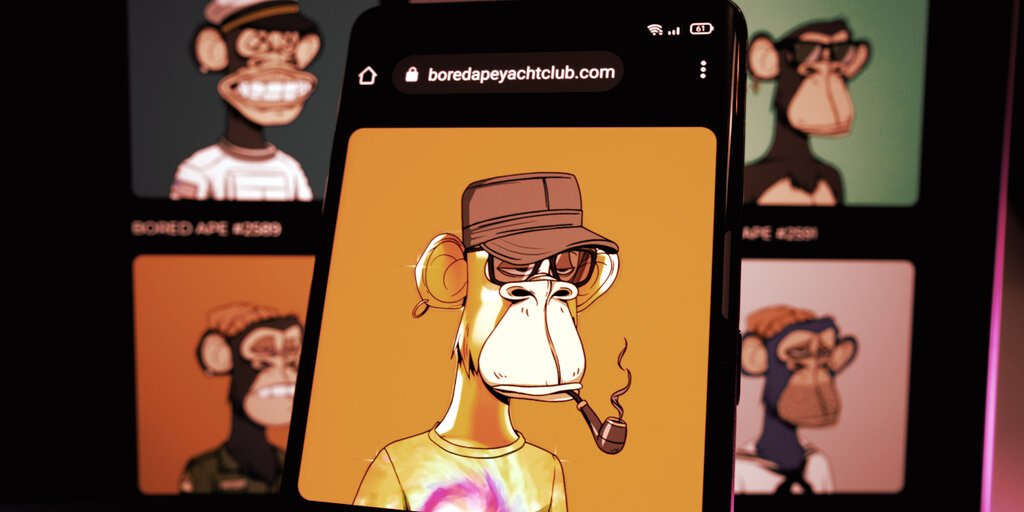

The volume of DeFi transactions was the lowest it’s been in a year while NFT transactions reached an all-time high during Q1, according to a new DappRadar report.

DeFi refers to a collection of financial tools on blockchain networks that allow for the trading, borrowing, and lending of crypto assets without third-party intermediaries. These products have seen a large increase in users in the last two years, though the market has since cooled in recent months. But NFTs, provably unique tokens that are used to demonstrate ownership over digital assets, have never been more popular.

Blockchain analytics platform DappRadar tallied more than 116 million transactions involving NFTs—on decentralized applications and marketplaces—across all blockchains in the first three months of the year. That’s a 22% increase from Q4 2021.

Blockchain games accounted for 78% of all blockchain transactions, up 520% from what they were a year ago.

“We can’t say for sure that more money is being used as investment for game assets,” DappRadar told Decrypt, “it is simply people interacting more with game dapps.”

But it is clear that venture capitalists have taken notice. In its last report, DappRadar found that $2.5 billion in venture capital had poured into the play-to-earn category.

The play-to-earn, or GameFi, category has been growing at a fast clip. That growth has given rise to firms like MetaLend, which just closed a $5 million seed round led by Pantera Capital. The company provides financial services to play-to-earn gamers, collateralizing loans with NFTs and providing capital to gaming guilds.

“The number of NFT trades in all blockchains also peaked in Q1 2022, growing 153% from Q1 last year,” DappRadar wrote in its report. “The growth of the NFT market in Layer-1 alternatives, namely Avalanche and Solana, acts as support as the demand for Ethereum NFTs stabilizes from January’s record levels.”

Growth on the Avalanche and Solana networks has been significant. Since last year the blockchains, which have each been billed as Ethereum alternatives, saw transaction volume grow by 10,500% and 9,700%, respectively.

Waiting on the Ethereum Merge

The delayed Ethereum merge, which will change the network from a proof-of-work to proof-of-stake consensus model and theoretically increase the blockchain’s efficiency and performance, has played a big part in driving growth on Solana and Avalanche.

Ethereum transaction volume has fallen by 58% compared to this time last year, DappRadar wrote in its report.

As volume leaves the Ethereum network, it has increased the need for bridges that connect different blockchains. That’s made them an appealing target for thieves, who have stolen close to $1 billion from bridge chains already.

There’s almost $18 billion currently locked on Ethereum bridge chains, according to analytics firm Dune. That’s a $3 billion drop from just a month ago, when Axie Infinity’s Ronin bridge was hacked and $622 million worth of Ethereum and USDC were stolen.

The vulnerability of bridge chains has led to an increase in developers working to secure the Cosmos, Solana, and Polkadot networks, DappRadar said.

The best of Decrypt straight to your inbox.

Get the top stories curated daily, weekly roundups & deep dives straight to your inbox.

Source: https://decrypt.co/98996/defi-transactions-1-year-low-nfts-all-time-high-q1