On Monday, December 13, following Friday’s U.S. consumer price index report published by the Bureau of Labor Statistics, Americans are discussing the Federal Reserve. Thousands of tweets concerning the Federal Reserve topic have been trending on Twitter, as inflation has gripped the U.S. economy. Furthermore, Mohamed El-Erian, the chief economic advisor for the German multinational financial services company Allianz says the term “transitory” was the “worst inflation call in the history,” according to a recent interview.

Allianz Chief Economic Advisor Says Calling Inflation ‘Transitory’ Was a Bad Call by the US Central Bank

At the end of April 2021, members of the Federal Open Market Committee (FOMC), told the American public that the Federal Reserve would keep the benchmark interest rate near zero and monthly bond purchases would continue. The FOMC’s and Fed chair Jerome Powell’s statements stressed that inflation would only have “transitory effects” on the American economy. Not only did members of the Fed say inflation would be temporary, but it was also parroted routinely by the media, U.S. policymakers, and America’s banking giants as well.

If the US really paid its debts the Federal Reserve wouldn’t be monetizing them.

— Axiomatic Enemy of the State (@DeTocqueville14) December 13, 2021

Just before the Bureau of Labor Statistics’ November consumer price index (CPI) report was published, the ‘transitory’ talking heads started to back peddle on saying that inflation was temporary. The latest CPI report indicated that the metric jumped the highest its ever been in close to forty years, skyrocketing to 6.8% over the same period in 2020. The cost of goods and services in America continues to rise month after month, and a lot more Americans are starting to point fingers at the U.S. central bank.

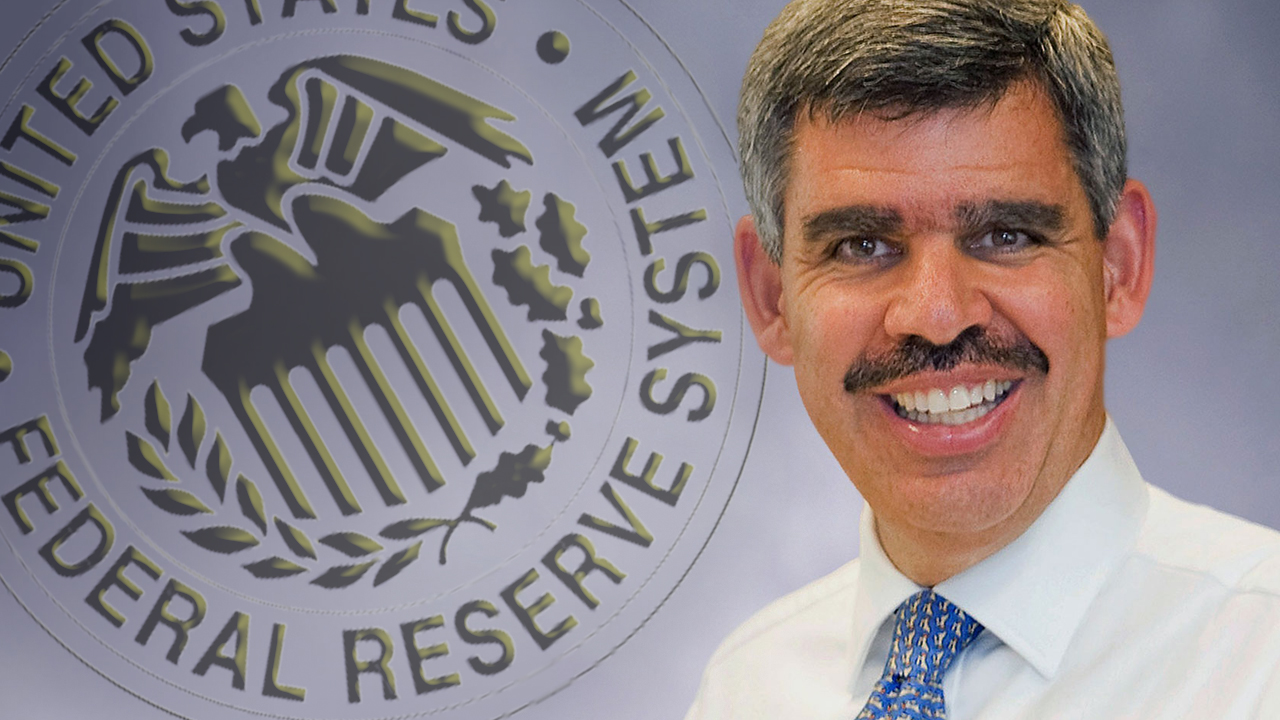

For instance, the name “Federal Reserve” is trending quite a bit on Twitter and can be seen in thousands of tweets in the United States. On Sunday afternoon, the chief economic advisor for the German multinational financial services company Allianz criticized the Fed on the broadcast CBS’ “Face the Nation.” Mohamed El-Erian says that the description “transitory” was one of the worst calls in the Federal Reserve’s history.

“The characterization of inflation as transitory is probably the worst inflation call in the history of the Federal Reserve, and it results in a high probability of a policy mistake,” El-Erian insisted during his interview. “So, the Fed must quickly, starting this week, regain control of the inflation narrative and regain its own credibility,” the Allianz chief economic advisor said. El-Erian further added:

Otherwise, it will become a driver of higher inflation expectations that feed onto themselves.

Critics Denounce the Fed’s Actions Using Terms Like ‘Fraud’ and ‘Bankrupt,’ El-Erian Says the Central Bank Can Still Change Its Course

Sven Henrich, the analyst behind northmantrader.com, denounced U.S. president Joe Biden’s recent tweet when the president said he was raising the debt limit. “The United States pays its debt obligations by taking on even more debt,” Henrich tweeted. “[And] when it can’t find enough buyers for its debt, it has the Federal Reserve buy its debt, currently to the tune of over $5.6 trillion. [And] if rates were to go back to 2007 levels the U.S. would be bankrupt.”

Next year they’ll tell you that inflation has peaked as price increases will have stabilized and you will feel better when you shopping. pic.twitter.com/P4LlMeNHxn

— Sven Henrich (@NorthmanTrader) December 12, 2021

The popular finance author Carol Roth also roasted the Fed’s monetary policy decisions on Twitter. “If you were to go into your bank account, digitally increase your balance, and then use that new balance to buy things, it would be called fraud,” Roth said. “When the Federal Reserve does that, it is called monetary policy,” she added. During his CBS interview, El-Erian claimed there’s a chance the U.S. central bank could take the reigns and control the economy. “If they catch up now, if they’re honest about their mistake and take steps now, they can still regain control of it,” El-Erian remarked.

As of right now, the Federal Reserve has been talking about rate changes and tapering back quantitive easing measures, but so far has yet to implement any of its discussions. El-Erian opined that the U.S. central bank should, however, “ease their foot off the accelerator,” instead of tapering at an extremely fast rate. The economist further said that rather than the rich being affected by inflation, like a number of media pundits have claimed publicly, El-Erian insists it is low-income households that suffer more from rising inflation.

“There is the possibility that they may have to raise rates,” El-Erian concluded. “Look, it’s important to stop inflation [from] being embedded into the system because two things happen when inflation gets embedded. One, you lose purchasing power, and the poor suffer the most. Second, you get a Fed overreaction and then you get a recession and then you get income losses. So, you really want to navigate this process in a timely and orderly way.”

Tags in this story

1982, Allianz, American Public, Bureau of Labor Statistics, Carol Roth, cars, consumer price index, CPI, economics, Economy, El-Erian, Energy, Fed, Federal Reserve, Food, Housing, inflation, Inflation rising, inflation transitory, jerome powell, Liquidity, Mohamed El-Erian, persistent inflation, Political Class, Purchasing Power, Sven Henrich, transitory, US Inflation

What do you think about the recent criticisms toward the U.S. Federal Reserve and Mohamed El-Erian’s statements about the Fed’s ‘transitory’ description of inflation? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.