Now that the U.S. Securities and Exchange Commission has finally approved the first round of spot Bitcoin ETFs, investors are wondering how to get their hands on these new investment products.

Exchange-traded products (ETP) cover a broad category of investment vehicles, which includes exchange-traded funds, commodities, and notes. But it’s often the case that the terms ETP and ETF get used interchangeably.

An exchange-traded fund (ETF) is a type of investment traded on exchanges, much like stocks. The funds themselves hold assets such as stocks, bonds, or, in the case of Bitcoin ETFs, Bitcoin. Spot ETFs are designed to trade in line with the price of their underlying asset.

A Bitcoin ETF, therefore, offers investors exposure to Bitcoin without the need for the buyer to hold and store Bitcoin themselves—much like gold ETFs for the gold bugs out there. That means easier access for mom and pop investors—they can now dip a toe in Bitcoin without the need for cryptocurrency exchanges or digital wallets directly.

How are ETFs different from stocks?

Stocks are investment vehicles that allow individuals or businesses to own portions of a publicly traded company. Like a stock, an ETF is a publicly traded investment vehicle that tracks the performance of an underlying asset or index—not just one company.

For instance, an ETF might be thematic and track the tech sector. Or you could buy a currency ETF if you wanted to hedge against fluctuations in exchange rates.

What is a Bitcoin ETF?

A Bitcoin ETF works in much the same way as any other ETF. Investors buy shares in the ETF through a brokerage like Robinhood or eToro. Bitcoin ETFs track the current price of Bitcoin. And because the shares track BTC’s price, it exposes investors to the asset without needing to buy and store the digital asset.

The SEC has approved 11 spot Bitcoin ETF applications, including from VanEck, BlackRock, Invesco, and Bitwise.

Where can you buy a Bitcoin ETF?

To invest in an ETF, the first thing an investor will need is a brokerage account. Brokerage companies like E-Trade, Fidelity, Robinhood, eToro, and Charles Schwab are popular investing platforms. Notably, Vanguard and Merrill Lynch recently said they would not provide Bitcoin ETF products to their clients.

Leading up to the SEC’s approval, spot Bitcoin ETF issuers offered deep discounts on fees, including 0% for six months, to entice investors. Keep in mind that some brokerages may have stipulations determining which investors can access a particular fund through their firm.

To begin trading, all you need to do is sign up for account on one of the aforementioned platforms, provide the company with the necessary information (including banking details), and you’re off. Here’s what’s currently available where:

BlackRock’s iShares Bitcoin Trust

BlackRock’s iShares Bitcoin Trust spot Bitcoin ETF can be accessed through a Fidelity brokerage account.

Buying a Bitcoin ETF on Fidelity. Image: Screenshot

Grayscale Bitcoin Trust

Investors can purchase a Grayscale Bitcoin Trust (GBTC) Bitcoin ETF through brokerage firms, including Fidelity, Robinhood, E-Trade, Ameritrade, Interactive Brokers, and Charles Schwab.

Fidelity Wise Origin Bitcoin Fund

Along with offering other spot Bitcoin ETFs, Fidelity also offers its own ETF, the Fidelity Wise Origin Bitcoin Fund (FBTC). Customers can buy and sell through the Fidelity website.

ARK 21Shares Bitcoin ETF

ARK Invest’s 21Shares Bitcoin ETF can be purchased through several brokerage firms, including Charles Schwab, Chase, E-Trade, Fidelity, TD Ameritrade, Webull, SoFi, and Robinhood.

Bitwise Bitcoin ETF

According to the Bitwise website, investors looking to take advantage of the Bitwise Bitcoin ETF can contact the firm to learn how to open a brokerage account and get started.

Invesco Galaxy Bitcoin ETF

Investors looking to take advantage of the Invesco Galaxy Bitcoin ETF (BTCO) can contact the firm to learn how to open a brokerage account and get started.

Valkyrie Bitcoin Fund

Investors looking to invest in Valkyrie Bitcoin Fund (BTF) can do so through Robinhood, E-Trade, Charles Schwab, Fidelity, Pershing, and TD Ameritrade.

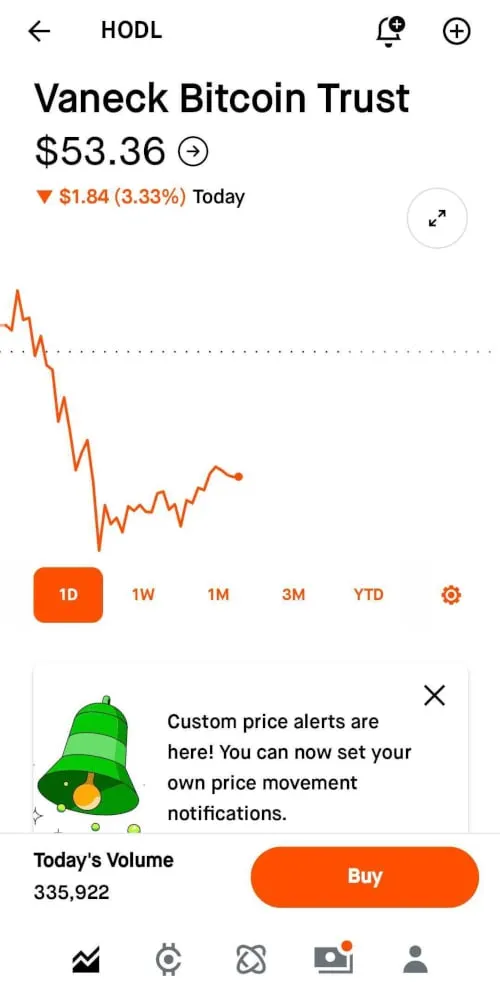

VanEck Bitcoin Trust

For investors wishing to invest in VanECk’s Vaneck Bitcoin Trust, the Bitcoin ETF can be purchased through a VanEck advisor or brokerage accounts, including Ally Invest, Charles Schwab, E-Trade, Robinhood, and Fidelity.

Buying a Bitcoin ETF on Robinhood. Image: Screenshot

Buying a Bitcoin ETF on Robinhood. Image: Screenshot

Franklin Bitcoin ETF

Investors interested in Franklin Templeton’s Franklin Bitcoin ETF (EZBC) can ask their Franklin advisor how to invest in the firm’s spot Bitcoin ETF.

WisdomTree Bitcoin Fund

Investors wishing to invest in WisdomTree’s spot Bitcoin ETF, the WisdomTree Bitcoin Fund (BTCW), can be purchased through Fidelity, Charles Schwab, E-Trade, and Ally.

Hashdex Bitcoin Futures ETF

The Hashdex Bitcoin Futures ETF ($DEFI) can be purchased through brokerage firms, including Robinhood, E-Trade, Fidelity, TD Ameritrade, and Charles Schwab.

What are the risks?

While the regulatory agency has given the green light to the new Bitcoin ETFs, SEC Chair Gary Gensler continues to warn investors about the risk of investing in cryptocurrency.

“While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse Bitcoin,” Gensler wrote in a statement. “Investors should remain cautious about the myriad risks associated with Bitcoin and products whose value is tied to crypto.”

For example, while it is exceedingly difficult, it’s not beyond the realm of possibility for the Bitcoin network to be attacked and compromised. Cryptocurrency exchanges are also prone to hacks, and while that doesn’t have a direct impact on your Bitcoin ETF shares, such exploits can lead to extreme price volatility in the market.

There’s also the tricky business of forks—when a network such as Bitcoin splits in two as a result of a contentious disagreement among network developers, miners, or validators. It’s happened a few times in Bitcoin’s history, resulting in competing networks such as Bitcoin Cash and Bitcoin SV, and Bitcoin ETF issuers have plans in place should one occur again.

Still, despite the risks and Gensler’s warnings, the crypto community is riding a wave of euphoria. Case in point: It took less than an hour for someone to inscribe Gensler’s letter announcing the approvals of the ETFs on the Bitcoin blockchain.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.