We’re thrilled to announce our partnership with MoonPay, bringing you a seamless and secure method to sell your cryptocurrency through Changelly. This step-by-step guide will walk you through the process to ensure that you can confidently and efficiently sell your digital assets.

Step 1: Access Your Changelly Account

Begin by navigating to Changelly’s crypto selling page — your gateway to a range of cryptocurrency transactions. Log in using your Changelly account details (if you haven’t done it yet).

Step 2: Set up Your Sell Order

On our sell page, you’ll see a drop-down menu where you can choose the type of cryptocurrency you wish to sell. Click on the menu and select from a variety of options, such as Bitcoin (BTC), Ethereum (ETH), or any other listed cryptocurrency you’re looking to sell.

At this stage, your only task is to select the cryptocurrency you intend to sell. Once you’ve entered your billing address, you’ll have the opportunity to receive cash in your preferred fiat currency, aligned with the local currency of your bank account. MoonPay will provide payment options tailored to your regional requirements, ensuring a seamless transaction process.

Specify the Sale Amount

Enter the amount of cryptocurrency you plan to sell, for example, 0.01 BTC. Instantly, an estimate will appear, indicating the approximate fiat currency amount (like EUR, USD, etc.) you can expect to receive. This estimate is based on the current market rate minus any applicable fees.

After entering the amount, click Continue.

Step 3: Checkout

If you already have a MoonPay account, simply enter the email address associated with it. Click Continue and go to Step 5 of this guide.

Step 4: Identity Verification

If you are a new MoonPay user, you will be prompted to complete a one-time identity verification process. This step is crucial for ensuring compliance with regulatory requirements and maintaining the security of your transactions.

It starts with verifying your email — enter the code MoonPay sends to the provided address. Tick the box to agree with MoonPay’s Terms of Use and Privacy Policy.

Click Continue.

Following that, you will be required to input your complete legal name, date of birth, and nationality. Fill in the fields, verify that the information entered is accurate, and then proceed by clicking the Continue button.

Now, MoonPay requires your billing address, which should match the residential address you provided to the bank you use. Please enter the accurate address.

Let’s now proceed to identity verification. In this step, you will need to submit the documents and undergo a liveness check.

This entire process should take no more than 2 minutes of your time. Click Continue to begin.

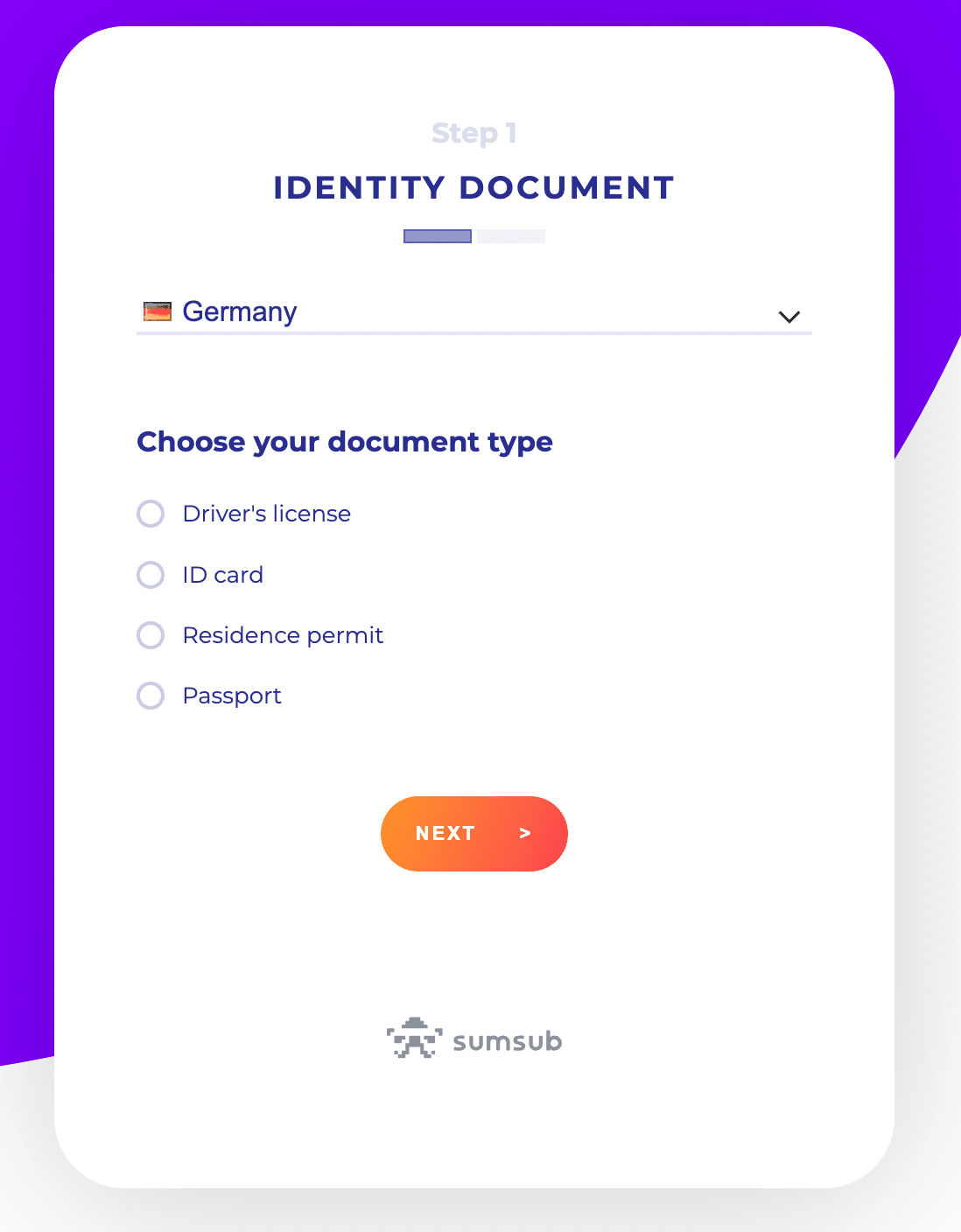

Get your verification document ready, which may include one of the following:

Driver’s licenseID CardResidence permitPassport

Keep in mind that the list of acceptable documents might differ depending on your country. For detailed information about the verification process and the types of documents MoonPay accepts, please refer to this page on the MoonPay website.

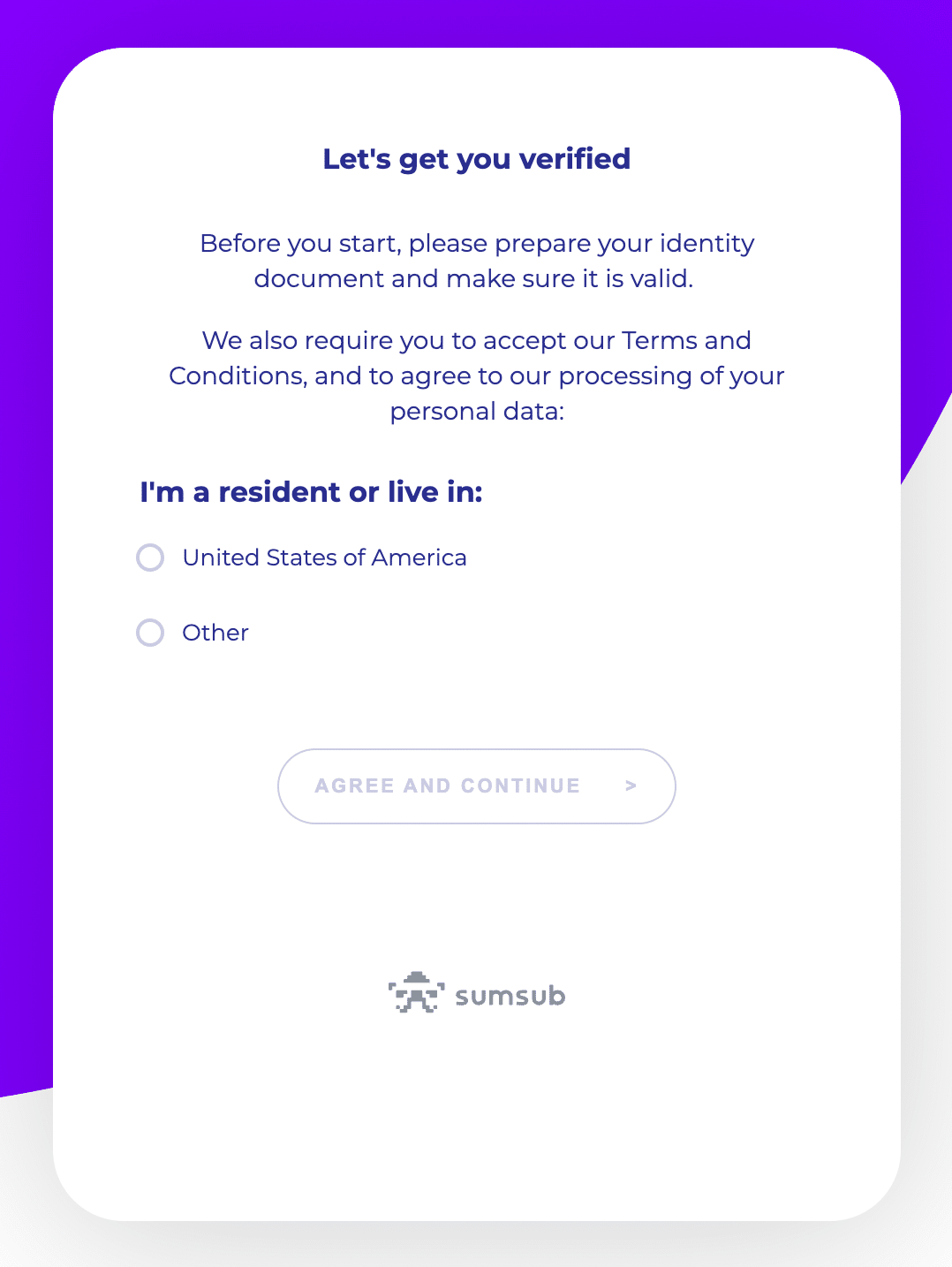

If you are a U.S. resident or domiciled in the U.S., please choose the first option. If you are undergoing verification outside of the U.S., select the second one.

Click ‘Agree and Continue’ to proceed.

On the following page, choose your country and indicate the type of document you intend to use for the verification process. Click Next.

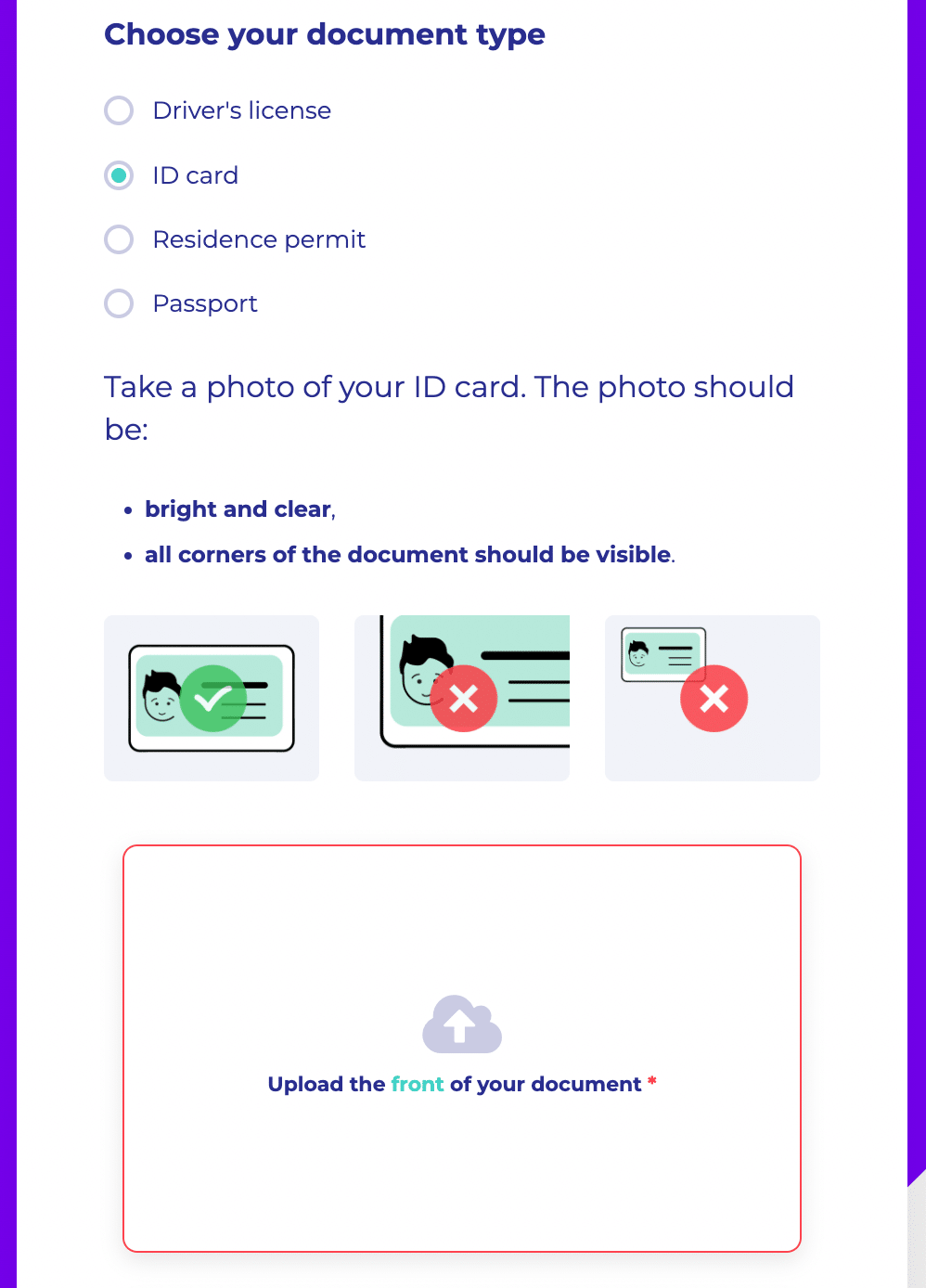

MoonPay will now prompt you to provide photos of both the front and the back side of your document. Ensure these photos are of high quality and upload them in the designated fields.

Additionally, if you are undergoing verification on a computer, you can switch to a mobile device by selecting ‘Continue on Phone’ at the bottom of the page.

Please be aware that your photos and the document itself must adhere to the following criteria:

Photos should be in high resolution.Photos must be in color.Only original photos are accepted; screenshots or images edited using graphic software will not be considered.The document should be easily readable, with no flash or blurriness.Ensure all four corners of the document are clearly visible.The document should bear your signature.Physically, the document should be undamaged.The document should be valid for a minimum of 1 month.Documents containing Latin characters are accepted; documents in Arabic, Hebrew, or Japanese without an English translation will not be processed.

Liveness Check

After document verification, you’ll proceed to a 3D Liveness Check, or selfie photograph, which necessitates camera access. Liveness check serves as biometric verification confirming your status as a real person.

This swift, straightforward, and secure method to validate your identity can be effortlessly completed using your mobile or web camera. The process is uncomplicated; a full head rotation is the only instruction required.

You can refer to Step 4 of our KYC guide for more details.

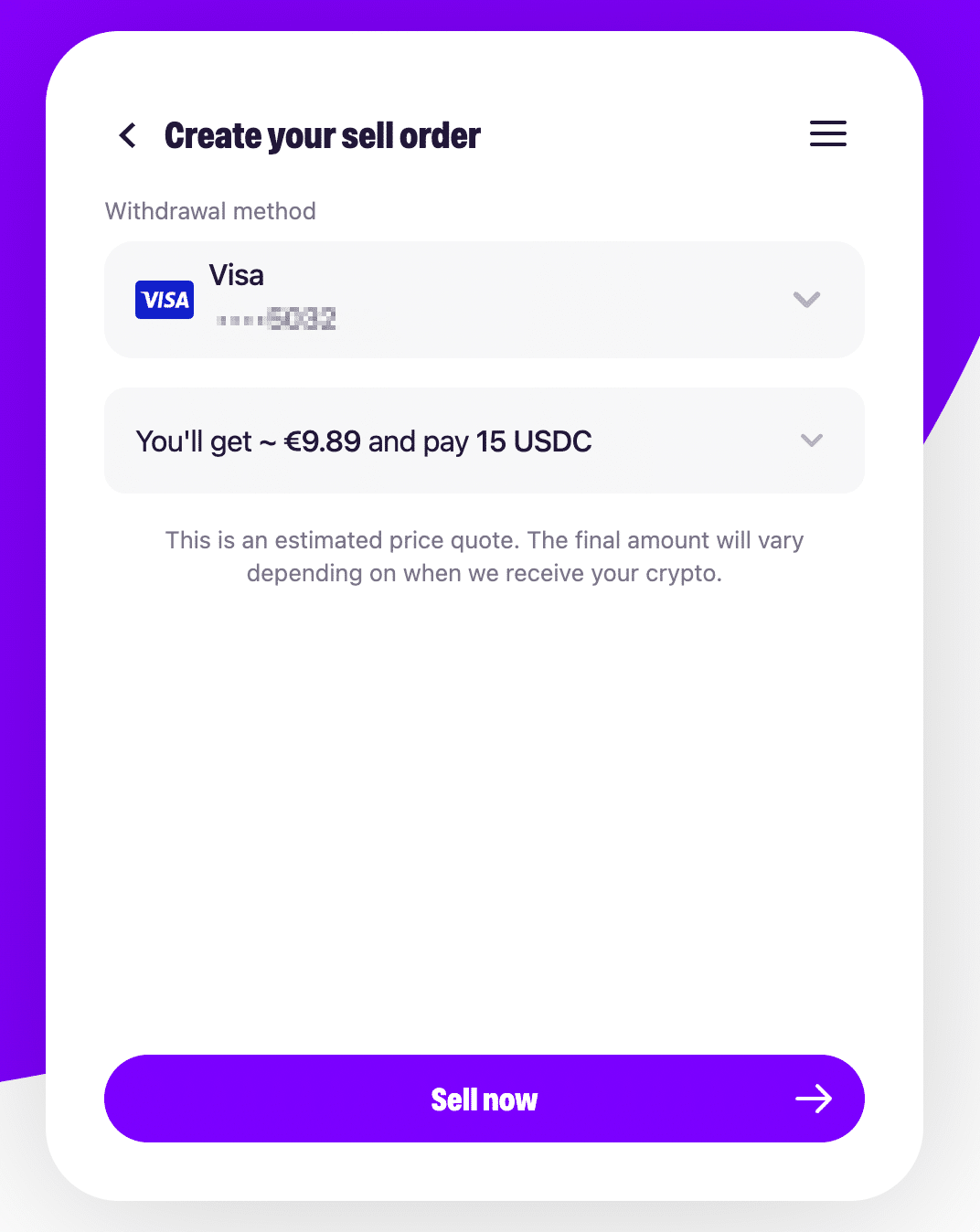

Step 5: Provide Your Withdrawal Method Details

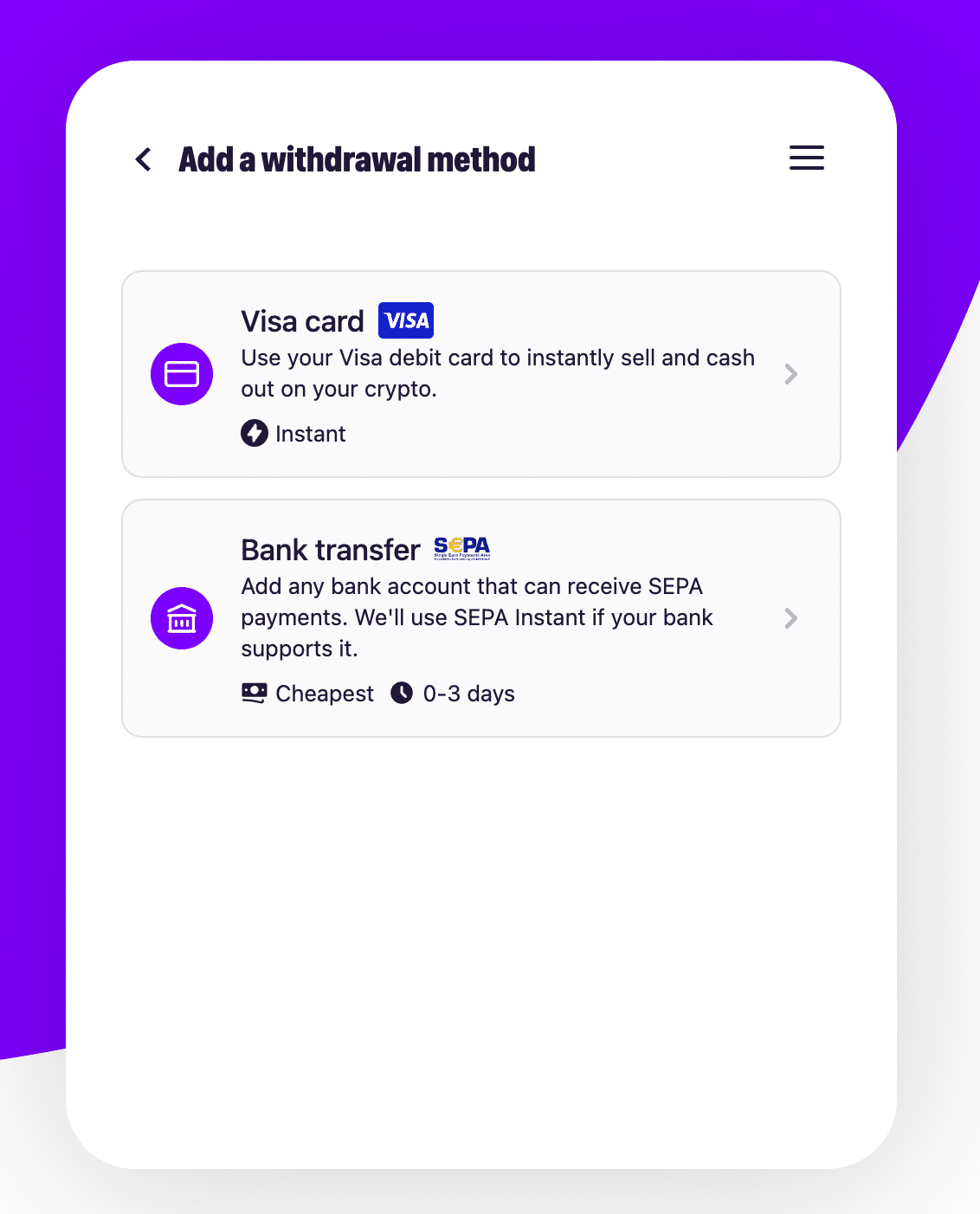

Now, proceed to set up your withdrawal method.

Depending on your location, you will be presented with the withdrawal options available. For instance, in the screenshot below, you can see a Visa bank card and SEPA bank transfer.

In this guide, we will demonstrate the withdrawal to a Visa card.

Complete the form with your card information, including the card number, expiry date, and CVC.

Beneath, on the same screen, you will find your saved billing address.

Thoroughly review all the entered data and make any necessary corrections. If all the information is accurate, click Continue.

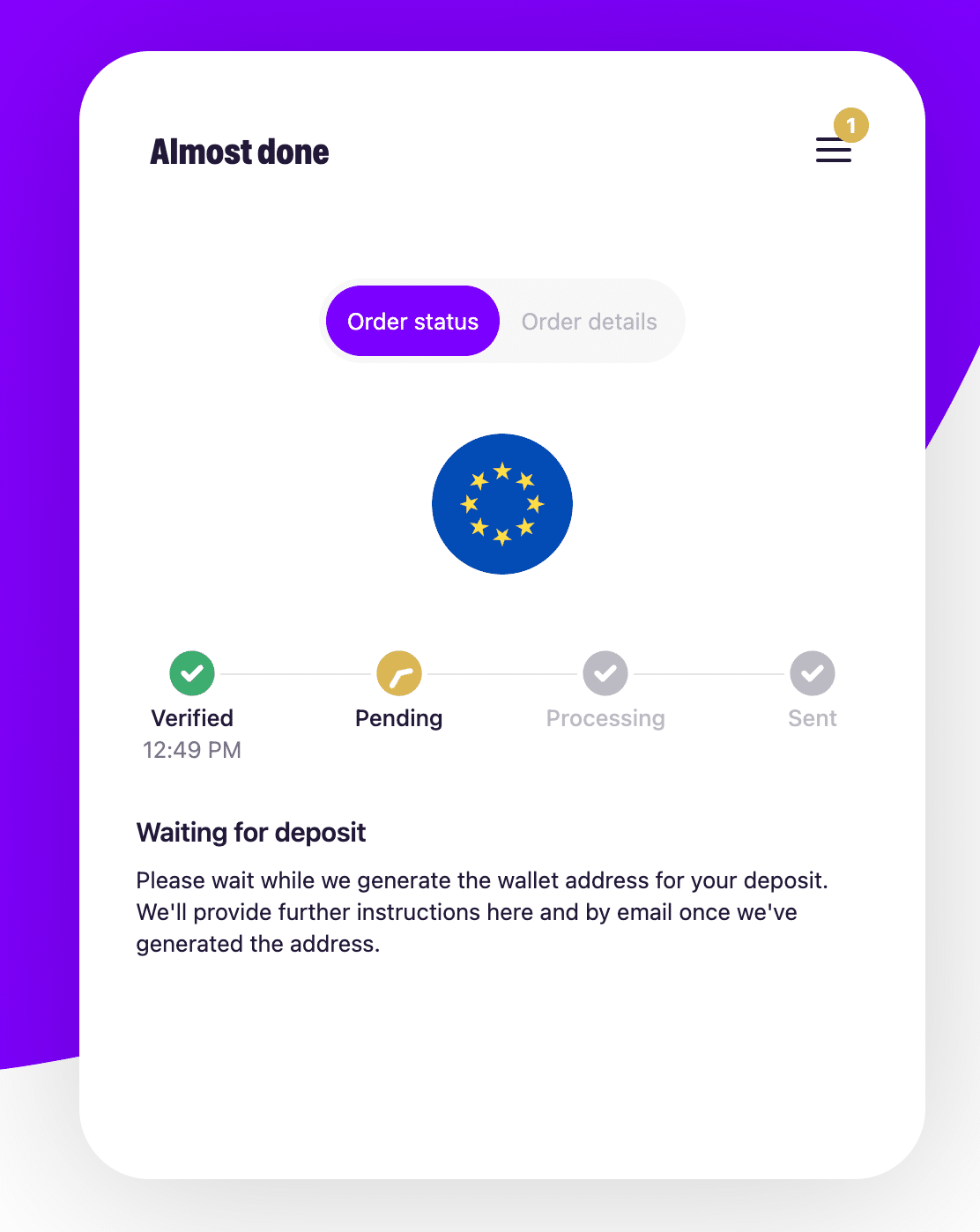

At this stage, you will be displayed the approximate amount you will receive after the sale and the commission. The Sell Now button will be at the bottom of the page. Click on it to create your order.

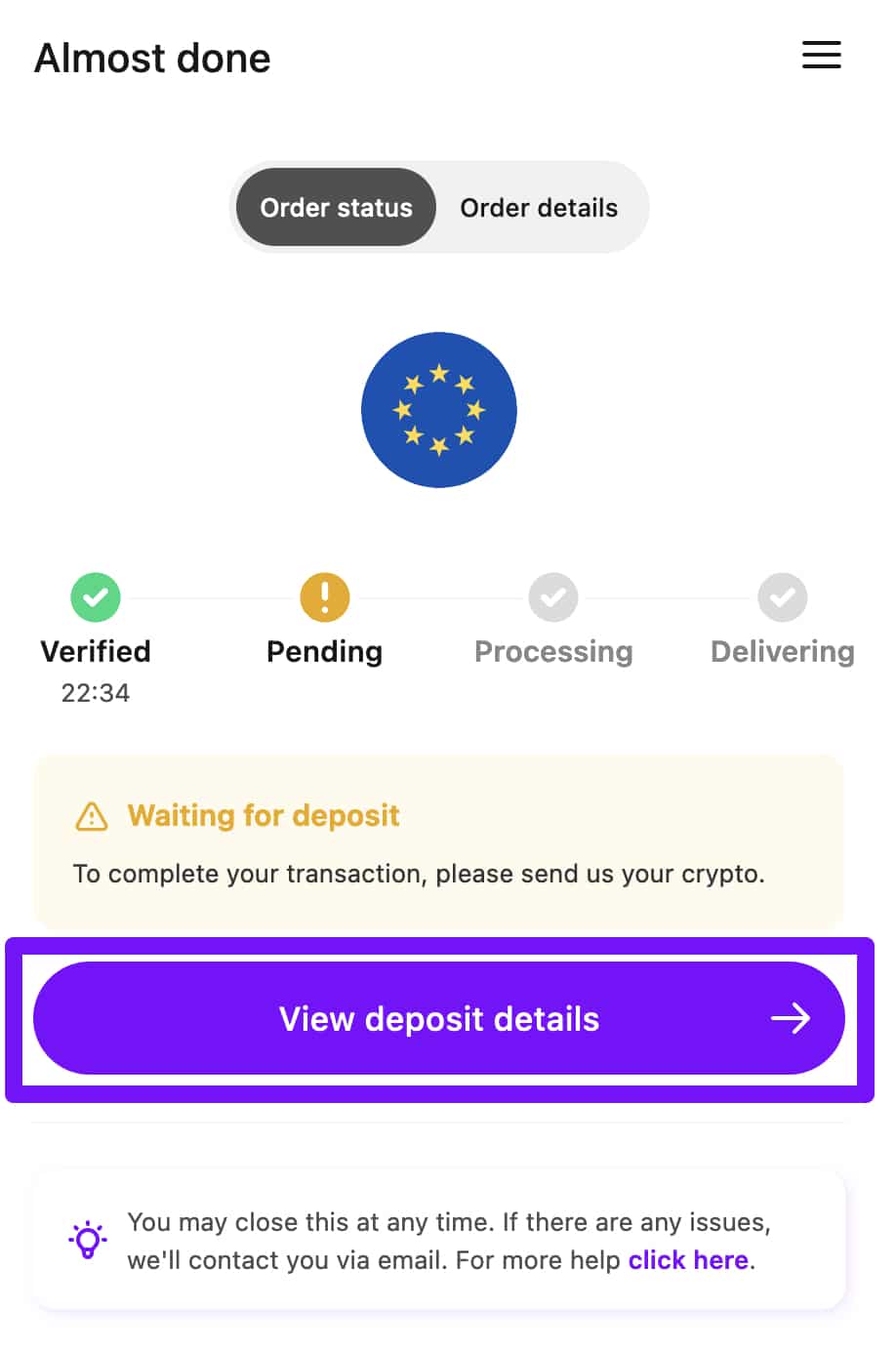

Please allow a moment as MoonPay processes your order and performs internal checks. Within a few minutes, MoonPay will provide an address for your deposit transfer. You can find information about this address on your order page, and a confirmation will also be sent to your email.

Once all checks are finalized, you’ll find a “View deposit details” button on your order page.

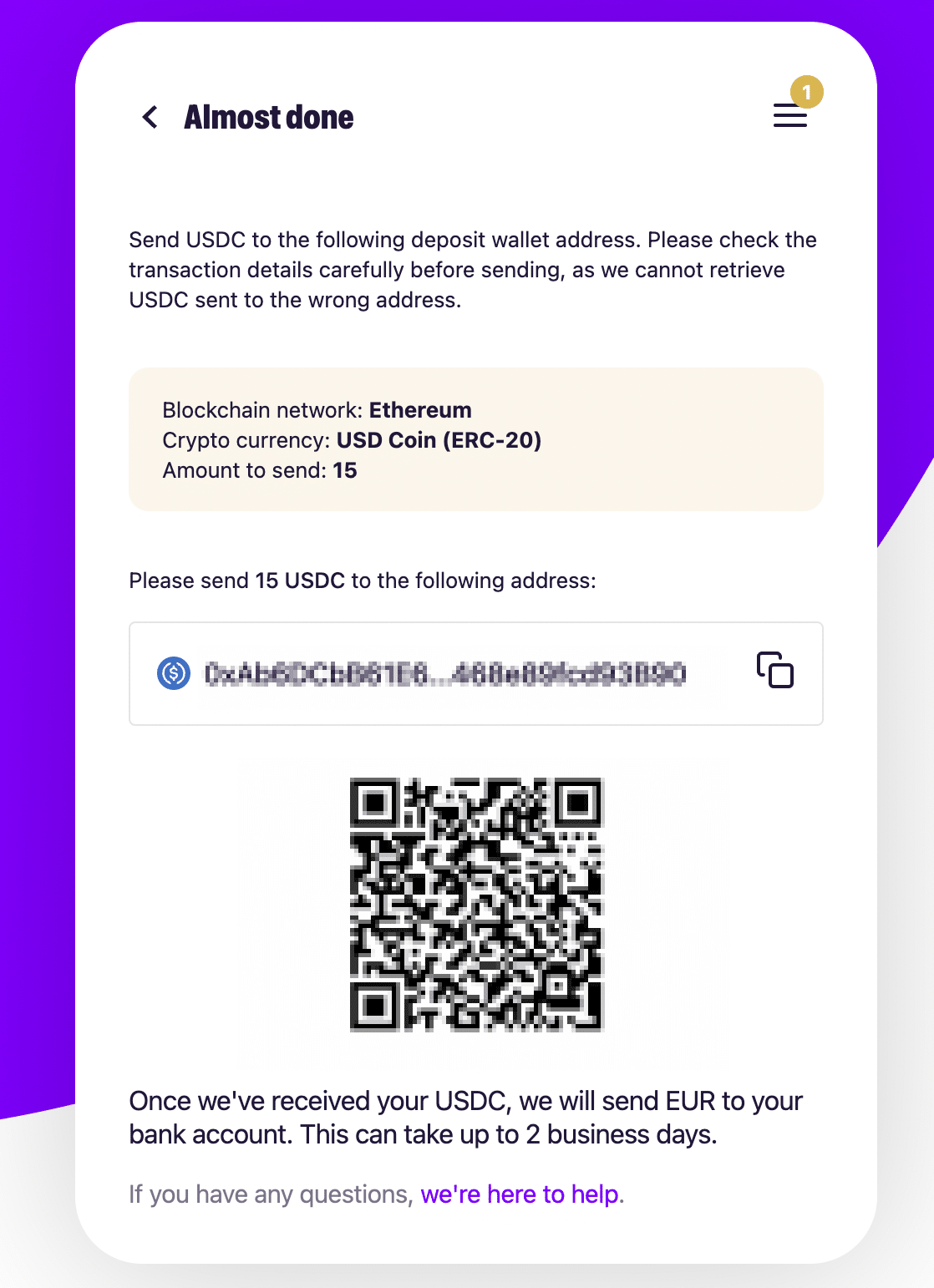

Click on it to reveal the wallet address and QR code, facilitating the transfer of your cryptocurrency for the sale.

Before moving forward, it’s crucial to carefully verify the address and network to which you are transferring your funds. Remember, blockchain transactions are irreversible, so accuracy at this stage is key.

Confirm that you are sending the intended currency through the right network. If there’s any uncertainty about the network your wallet uses for a particular currency, don’t hesitate to reach out to your wallet’s support team for clarification.

Finally, send the specified amount of cryptocurrency to the provided address.

You’re all set! Once MoonPay receives your cryptocurrency, they will initiate a bank transfer shortly.

For those using standard Visa cards, it may take up to 48 hours for the funds to become available. In the case of bank transfers, a sell transaction could sometimes take 24 hours or more to execute.

Be sure to keep an eye on the final screen for your transaction progress updates. Additionally, it’s important to regularly check your email address, as we may send emails requesting further actions or providing updates on your transaction.

For more details on processing times for bank transfers, please refer to this link.

Troubleshooting

In this section, we will address the most frequently asked questions and concerns. If you encounter any issues with your orders, please don’t hesitate to contact MoonPay support. You can create a new support ticket here.

How to sell crypto without KYC?

For individuals interested in conducting smaller-scale crypto cashouts without engaging in a comprehensive Know Your Customer (KYC) process, Moonpay presents an accommodating option. They allow you to sell cryptocurrency up to the value of 150 USD/EUR by simply providing some basic personal information, including your first name, last name, date of birth, gender, and country of residence.

It’s important to be aware, however, that this exemption from the full KYC procedure is limited to just one transaction of the above-mentioned amount. If you wish to make more transactions within this range, you will have to pass the complete KYC process.

Please note that the details provided here are based on information available at the time of writing, and this no-KYC option may not always be accessible. Additionally, this offer is exclusively available through the web version of our platform.

How long does it take for the transaction to go through?

The processing time of your transaction is contingent upon your location and chosen withdrawal method. As outlined by MoonPay, here are the estimated durations:

In the case of bank accounts in the United Kingdom, funds are typically credited within 1 working day after the receipt of your cryptocurrency.

Payouts to bank accounts in Europe generally take 1–3 working days after the receipt of your cryptocurrency.

Withdrawals to bank accounts in the United States usually take 3–5 working days after the receipt of your cryptocurrency.

Withdrawals to your card will vary in time. Visa Fast Funds card users typically receive payouts within 30 minutes, while standard Visa card transactions may take up to 48 hours for funds to become available.

How long is the verification period?

Most verifications are processed between 5 to 30 minutes.

Where is the MoonPay sell service available?

MoonPay’s off-ramp service is accessible throughout the US, EU, and UK. To view the list of non-supported countries, states, and territories, please visit this page.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Source: https://changelly.com/blog/guide-how-to-sell-crypto-with-moonpay/