Amid Lebanon’s financial crisis, significant demonstrations have erupted in Beirut targeting financial institutions. Outraged Lebanese depositors, witnessing their savings vanish, have resorted to smashing bank windows, setting fires, and engaging in riots. Simultaneously, leaders of Lebanon’s central bank face grave allegations of fraud, embezzlement, and political corruption.

Lebanese Citizens Left Penniless as Financial Institutions Crumble

In February 2023, Lebanese depositors that were incensed by the alleged theft of their life savings by the country’s central bank, set ablaze the very banks that held their fortunes. Bitcoin.com News highlighted this distressing situation, revealing that regional banks had frozen accounts, leaving residents unable to access their hard-earned funds. As if that weren’t enough, Lebanon was plagued by skyrocketing inflation, further exacerbating the plight of its citizens.

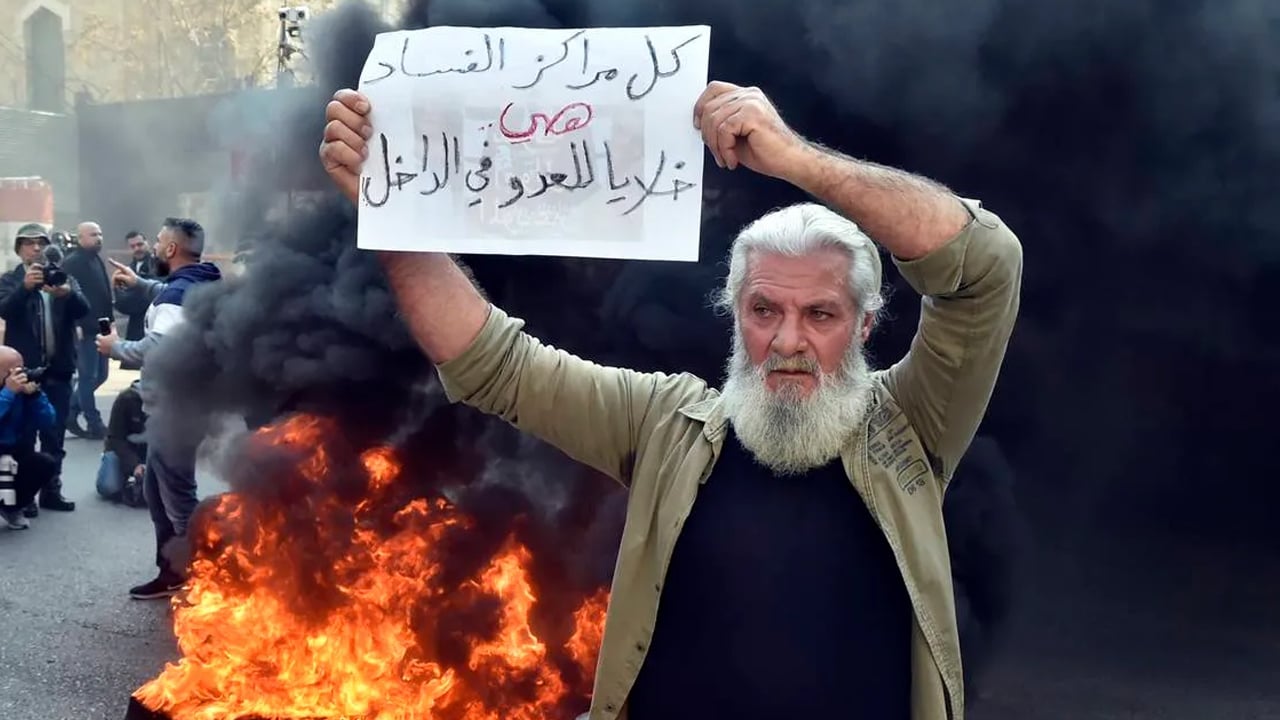

The wave of discontent continued in March 2023 when protests reverberated throughout Beirut and other regions. Outlookindia.com vividly reported scenes of shattered windows, burning tires, and passionate demonstrators venting their anger against Riad Salameh, the governor of Lebanon’s central bank.

Amidst the month of May 2023, resolute demonstrations persist as Lebanese residents grapple with mounting anxiety over the fate of their hard-earned savings. Reports reveal that the bank, in a bid to restore order, enlisted the aid of security personnel and called upon riot police to quell the upheaval unfolding outside the downtown Beirut branch of Bank Audi.

Frustration simmers among Lebanese citizens who find themselves utterly deprived of access to their deposits, with accusatory fingers pointed squarely at Salameh and his brother. Alarming allegations have emerged from six European countries, as detailed by The National, suggesting that Salameh and his brother orchestrated an intricate embezzlement scheme of colossal proportions.

“In Lebanon, it is not one firm or one bank but the whole financial system that collapsed without warning from auditing firms,” The National’s reporter Nada Maucourant Atallah explains. “The crisis exposed losses of almost $70 billion wiping depositors’ savings out and triggering an uncontrolled inflationary spiral, which plunged more than 80 percent of the population into poverty.”

Leaders of Lebanon’s Central Bank Under Fire: Grave Allegations of Fraud and Corruption Surface

According to French court documents reviewed by Reuters, French prosecutors have unveiled their intentions to level preliminary accusations of fraud and money laundering against Salameh. The charges revolve around allegations that he concealed his wealth using purportedly counterfeit bank statements. A scheduled hearing in France on May 16th has been arranged by the French judicial authorities.

Meanwhile, the circumstances faced by ordinary citizens and Lebanese bank depositors persist, leaving them without any funds. The consequences of this predicament have ignited relentless indignation, as people grapple with the urgent need to provide for their families and meet basic necessities such as food and shelter. Lebanese financial institutions have now devolved into mere façades, with hollow bank tellers, vacant ATMs, and fortified buildings standing as bleak reminders of Lebanon’s broken economy.

Tags in this story

Accusations, bank windows, Beirut, broken economy, central bank leaders, demonstrations, desperation, economic meltdown, embezzlement, Financial Crisis, Financial Institutions, fires, Fraud, indignation, inflation, Lebanese depositors, Political Corruption, Riots, Savings, unrest, Uprising

What are your thoughts on the ongoing financial turmoil in Lebanon and the allegations surrounding the central bank’s governor? Share your insights and opinions in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.