Visa, the financial services corporation headquartered in San Francisco, California, published a blog post that talks about leveraging ethereum and the layer two (L2) scaling solution Starknet so people with self-custodial wallets can pay their bills. The blog post notes that while Ethereum doesnt support account abstraction or delegable accounts, the financial services company implemented a delegable accounts solution on Starknet, the L2 blockchain network.

Visa Develops Account Abstraction Using the L2 Ethereum Scaling Solution Starknet, Payments Company Envisions a Future With Programmable Money

On Dec. 19, 2022, Visa’s Crypto Thought Leadership blog published a post written by Andrew Beams, Catherine Gu, Srini Raghuraman, Mohsen Minaei, and Ranjit Kumaresan. Visa’s subject brief is about “auto payments for self-custodial wallets,” and Visa shows that it is possible to leverage Ethereum to execute auto-payments from a self-custodial wallet solution. However, the concept utilizes account abstraction, a feature that Ethereum core developers are currently debating.

“Account abstraction (AA) is a proposal that attempts to combine user accounts and smart contracts into just one Ethereum account type by making user accounts function like smart contracts,” the Visa blog post details.

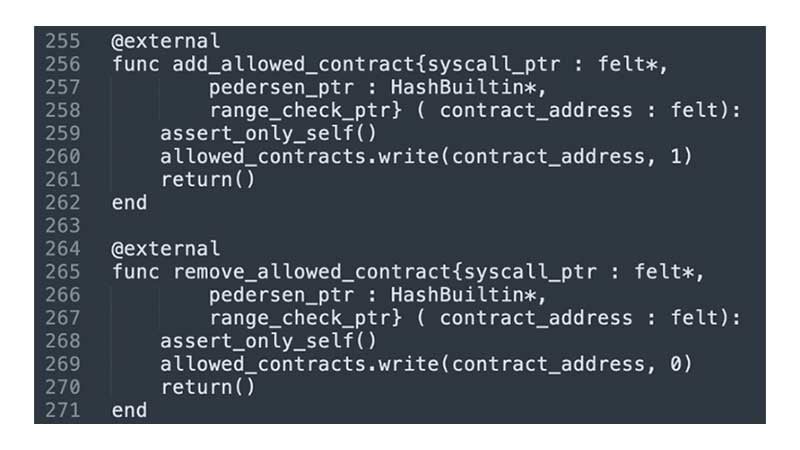

Visa’s Starknet account abstraction concept code.

Visa’s Starknet account abstraction concept code.

In order to bypass the issue that AA is currently not feasible using Ethereum’s layer one (L1), Visa crypto researchers have summarized how they can accomplish auto payments for self-custodial wallets with AA via the L2 scaling solution Starknet. “With Starknet’s account model, we were able to implement our delegable accounts solution thus enabling auto payments for self-custodial wallets,” Visa explained. The company’s blog post adds:

We see auto payments as a core functionality that existing blockchain infrastructure lacks.

The Visa blog post on the subject originally stems from a research paper that was published in Aug. 2022. The news follows Visa filing trademark applications at the end of Oct. 2022 and the trademarks covered a broad range of crypto products including a wallet. Being one of the world’s largest payment networks, Visa said the firm wants to help “make money and payments programmable.”

In addition to Visa, the second-largest payment-processing corporation worldwide and Visa’s competitor, Mastercard, is also working to make cryptocurrency solutions more accessible. During the first week of Nov. 2022, Mastercard said: “We’re welcoming a new cohort of startups to ease access to digital assets, build communities for creators and empower people to innovate for the future through Web3 technologies.”

Visa’s statements are akin to the same ideas and the auto-payments from a self-custodial wallet solution could provide a myriad of concepts. “We shared a novel solution that leverages the concept of account abstraction to provide self-custodial wallets with automatic recurring payments capability,” Visa’s blog post concludes. “Using the approach we have introduced, other real-world applications beyond recurring payments could be brought to the blockchain.”

Tags in this story

account model, auto payments, Blockchain Infrastructure, Crypto Visa, Cryptocurrency Solutions, Ethereum, Ethereum payments, L2 scaling solution, MasterCard, Self-Custodial Wallet, Starknet, Starknet Solution, technology, VISA, visa crypto, Visa Crypto Concept, web3 technologies

What do you think about Visa’s auto payments for self-custodial wallets concept using Starknet? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: Tony Stock / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.