This is an opinion editorial by Josef Tětek, the Trezor brand ambassador for SatoshiLabs.

After a three-year hiatus, Bitcoiners once again met at the iconic Baltic Honeybadger event in the Latvian capital of Riga.

Source: author

Around 800 people attended the conference, so it was a rather small event — by comparison, the Bitcoin 2022 conference in Miami welcomed over 20,000 visitors. However, the saying that “small is beautiful” applied in this case -— compared to the Miami conference, visitors at Honeybadger did not have to worry about endless crowds and queues. But at the same time, it was a conference with global notoriety and one that was held entirely in English, so there was no problem attending hard-hitting talks and later chatting with well-known Bitcoiners like Adam Back, Jimmy Song, Peter Todd, Gigi and many others. Several dozen speakers gave presentations over the two days in two lecture rooms: the main Bitcoin Stage, and the secondary Sats Stage.

The entire conference was filmed and the recordings will be available on the Hodl Hodl YouTube channel (at the time of writing, only the Bitcoin Stage talks have been published).

Free Speech And Free Money

After an opening speech by Max Keidun from Hodl Hodl (the conference organizer), Giacomo Zucco took the floor. Zucco didn’t reveal the title of his talk beforehand, so the audience had no idea what to expect. However, the long-time Bitcoiner, with his characteristic humor peppered with an Italian accent, did not disappoint this time as he revealed the speech title:

Source: author

But as Zucco readily acknowledged, such a title might offend some, so he decided to make it nicer:

Source: author

Zucco explained that freedom of speech is a fundamental human right to which we can only make an exception when speech becomes direct aggression, as in the case of ordering a murder or deliberate fraud. He warned of the increasing level of censorship by both governments and corporations; the only practical self-defense is to build and use agorist tools such as the Tor browser.

Zucco then made a segue to money, which also falls under freedom of speech protection (especially in an age where money is overwhelmingly digital in nature) — people have the fundamental right to choose their monetary instrument and use their money as they see fit. However, as with freedom of speech, freedom of money is not guaranteed: again, agorist instruments such as bitcoin and the bitcoin ecosystem need to be built. A quote worth remembering:

“Know-your-customer laws mean that you don’t understand economics. The whole point of money is that you don’t have to know your customer.”

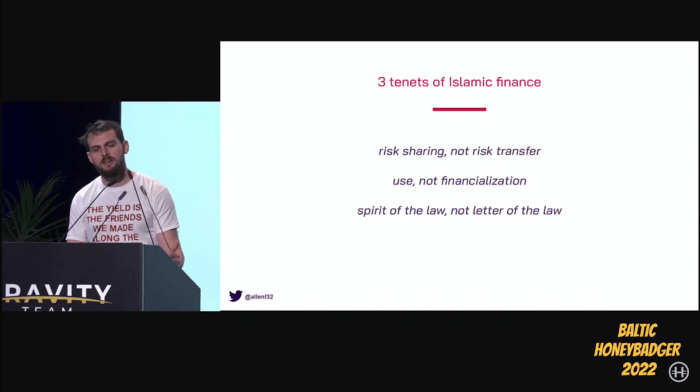

Bitcoin And Islamic Finance

Another talk worth watching is “Bitcoin And Islamic Finance” by Allen Farrington. Farrington is the co-author of “Bitcoin Is Venice,” which in my opinion is one of the very best books written on bitcoin and economics.

The yield is friends we made along the way. Source.

According to Farrington, Islamic finance has become a kind of a Bitcoin meme: we often refer to the concept without properly understanding its tenets. However, we should make the effort to learn more about Islamic finance, because its principles are almost the perfect antithesis of modern fiat money, and are consistent with how the world would likely operate on a bitcoin standard.

The three main tenets of Islamic finance are:

Risk is shared between trading partners, not transferredCollateral is transferred between the parties, not financialisedThe spirit of the law is important, not the letter of the law

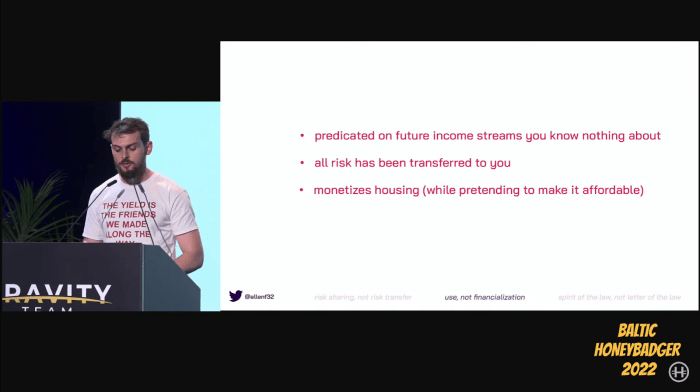

The consequence of these principles is that, for example, it is not possible to accept a loan backed by certain collateral and still have the same collateral available for use by the borrower (as is the case with mortgages).

The principles of Islamic finance let us see the negative side of some widely used financial instruments, such as mortgages. These rely on uncertain future income streams, transfer all the risks to borrowers and monetize housing, making it inaccessible without going into lifelong debt. Source.

If you find the mortgage-free world to be a wild idea, then it’s worth reminding that the over-financialization of real estate caused both the Great Financial Crisis of 2007 to 2008, and also made a lifetime debt slave out of virtually everyone who wants to own their own homes:

“The aversion to financialization in islamic finance comes from the pretty straightforward idea that there ought to be a one-to-one relationship between a financial instrument and the underlying real-economy asset. The more this ratio diverges, the less real finance becomes and the more we end up building a house of cards that will surely one day collapse.”

–Farrington

Bitcoin is close to the principles of Islamic finance because when it is used as a transaction instrument or collateral, it needs to be actually used and sent to the counterparty’s address (the classic not your keys, not your coins). The compatibility between bitcoin (i.e., in the principle of “commodity money”) and Islamic finance is not accidental, as these principles have evolved over hundreds of years under the gold standard and a system of commerce that relied heavily on merchant reputation.

However, unlike in the Western world, these principles have survived to this day in Islamic finance, as they have become part of the faith and thus ethics of the Islamic world. But, as Farrington pointed out, the principles themselves can be applied outside of any religious context — they are simply sound financial principles.

Security And Hardware Wallets

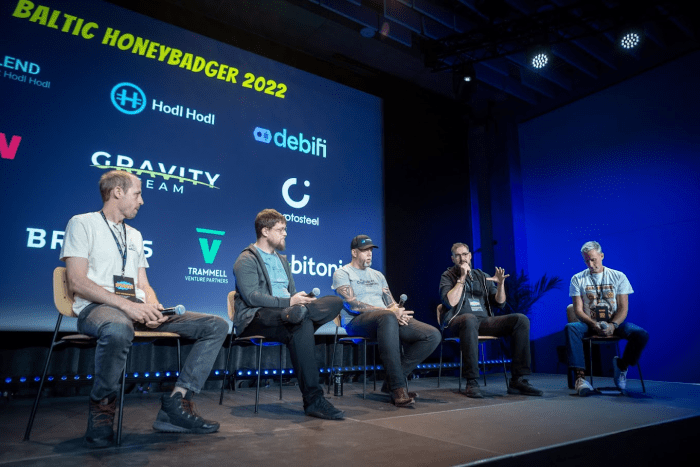

Another important theme of the conference was secure bitcoin self custody, a topic that is inherently linked to the industries of hardware wallets and physical backups. These industries were represented by the founders of Trezor, BitBox, Cryptosteel and Tinyseed, who were all present in Riga.

A panel on security. From the left: Douglas Bakkum (BitBox), Peter Todd (Bitcoin developer), Rigel Walshe (Swan Bitcoin), Pavol “Stick” Rusnák (Trezor) and Daniel Prince (“Once Bitten Podcast”). Source: Jan Pecinovský.

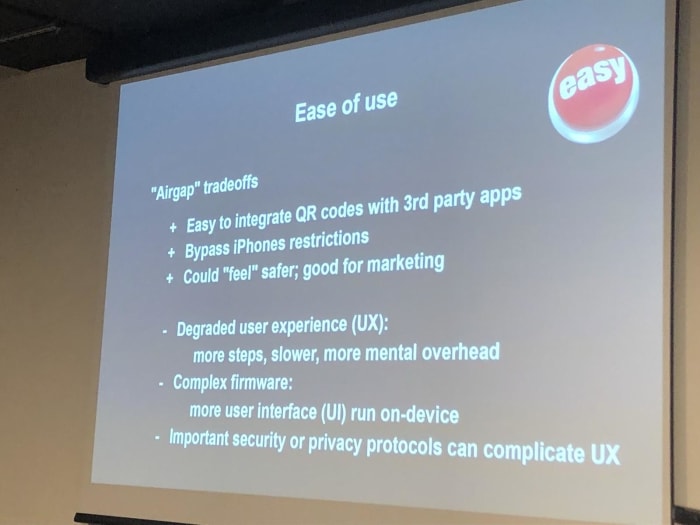

The concept of air gapping was discussed on two instances: in the panel on security, and in Douglas Bakkum’s lecture. Bakkum defined air gapping as a form of data transfer between hardware wallets and computers/phones utilizing SD cards or QR codes (i.e., not via USB cables). Addressing SD cards, Peter Todd noted that these devices now come with complex microprocessors that probably have a wider field of attack than USB cables. Stick added that QR codes, not SD cards, can be considered the proper method for air gapping these days; and also that the risk with USB cables tends to be the opposite of what some may fear, i.e., with USB devices attacking the host (computer or phone), not the other way around.

“We should be thinking about security threat modeling. I think that the security threat model of regular people is very different from that of Edward Snowden’s for example. And what we are trying to do is to tackle the problems of 99% of people, but if you have three-letter agencies coming after you, I agree you should be using something very different than the off-the-shelf solutions.”

–Stick

From Bakkum’s talk: Air gapping has the advantages of easy integration with third-party apps; air gapping makes it possible to bypass iPhone restrictions (note: it is not possible to connect, for instance, a Trezor to an iPhone precisely because of restrictions on the manufacturer’s side). Air gapping also provides the feeling of better security. On the other hand, the disadvantages are worse user experiences and higher firmware complexity. Source: author.

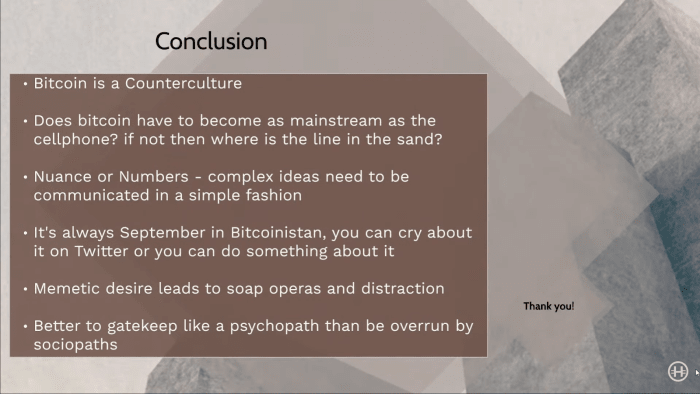

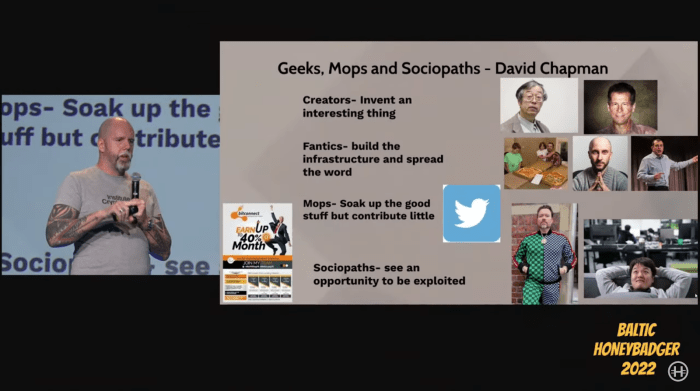

Bitcoin Counterculture And Its Psychopathic Defenders

Rigel Walshe (of Swan Bitcoin) dedicated his talk to Bitcoin culture. According to Walshe, not everyone agrees that Bitcoin represents a culture at all, however, as he stated, “When you get a couple of people together, you get a culture.”

And Bitcoin culture is best described as a counterculture, that is, a subculture revolving around the active opposition to certain elements of the mainstream culture. The fate of successful countercultures is that sooner or later they become part of the mainstream: Walshe gave the examples of the rise of punk, hip-hop, marijuana and LGBT subcultures. This transition from counterculture to mainstream culture is accompanied by phenomena that can be understood through three sociological theories:

Mimetic Theory: Most people adopt the desires of role models, and then imitate their behavior. Many latecomers to the subculture cannot adequately explain why they believe what they believe — they can only repeat what others are saying and turn up the volume, often upping one another in extremist statements. Tribalism and purity tests arise. Geeks, Mops And Sociopaths Theory: Describes how new ideas become cool. Cool things start with creators (Satoshi Nakamoto), that are helped by fanatics (Laszlo Hanyecz, Andreas Antonopoulos) who spread the word and build the infrastructure. Then come the mops: those who soak up the good stuff but contribute little (various Twitter influencers come to mind here). The final group are often the sociopaths who exploit the whole subculture for their gains (Richard Heart, Do Kwon).The Eternal September Theory: In the early ’90s, the internet (or rather, Usenet) was predominantly accessed through universities, and every September, it was swamped by college freshmen who didn’t know what they were doing and had to be taught by the veterans from previous years. The “eternal September” came when, in the mid-’90s, the internet started to be used by regular households and noobs started coming in droves every day. Bitcoin is experiencing this stage, with waves and waves of new users unable to understand the concepts of private keys and other previously unseen elements.

In conclusion, Walshe pointed out that there’s a trade off between numbers and nuance, and the only solution is to try to figure out what the core ideas of Bitcoin culture that we want to impart on new users are, and turn these into memes, sound bites and digestible pieces of information.

“So it’s on us to distill these ideas, and to disseminate these ideas to the newcomers that are coming aboard and to the sociopaths that would use bitcoin for their own nefarious ends to defend it. And defend it like a fucking psychopath.”

–Walshe

The talks described above are just a taste of the massive conference program, which featured over 40 individual lectures and discussion panels. I’m sure I’ll discover more treasures in the recordings in the coming weeks — as in previous years, the speakers had a lot to say and I believe we’ll be returning to some of the talks years from now. For instance, my favorite talk from the 2019 edition is “Social Impacts Of Gold And Bitcoin.”

Conference Announcements

During the Honeybadger event, several noteworthy announcements were made:

Trezor CoinJoin Implementation: Trezor and Wasabi Wallet are joining forces to introduce the CoinJoin anonymization technique for hardware wallets early next year. Trezor owners will be able to mix their coins using the WabiSabi protocol without their coins leaving the secure environment of the hardware wallet. This is the first implementation of its kind and a true revolution in Bitcoin anonymity.

BTCPay CoinJoin Implementation (also using the WabiSabi protocol): This means that a merchant or a fundraiser organizer can obfuscate the transaction history of any received bitcoin — this is fast becoming a welcome and an acute use case, as the recent protests of Canadian truckers illustrated.

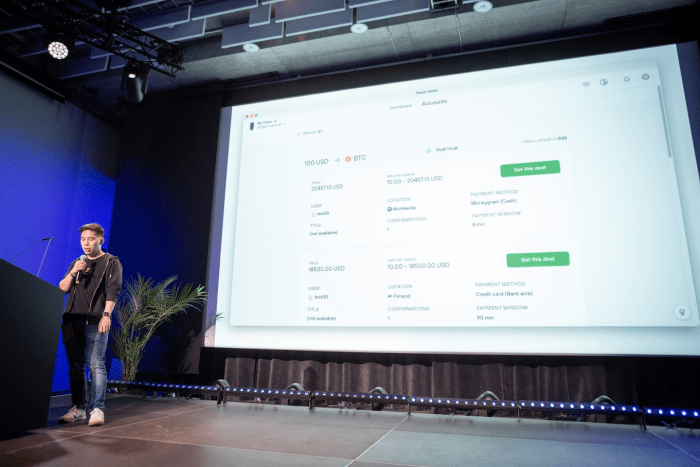

Trezor Suite, Hodl Hodl Trading Offers: For some time now, it has been possible to buy and sell bitcoin directly in Trezor Suite, the native interface of the Trezor hardware wallet. Until now, however, most of these offers required the users to undergo a KYC identification. During the conference, a partnership with the Hodl Hodl decentralized exchange was announced; soon it will be possible to buy bitcoin directly from individual sellers, thus without the need for identification.

Bach Nguyen from Invity (an integrator of trading partners) announces the Hodl Hodl partnership. Source: Jan Pecinovský.

Prince Philip Of Serbia Joining Jan3 As CSO: Samson Mow’s Jan3 is a Bitcoin company with the mission to accelerate hyperbitcoinization, and Prince Philip of Serbia has joined its ranks as chief strategy officer.

Fun Off Stage

As is the case at many conferences, most of the fun was had away from the stages. Although Honeybadger was a relatively small conference, it attracted dozens of well-known Bitcoiners, and the speakers didn’t have their own private VIP section (save for a small refreshment room), so they moved among the attendees and engaged in fruitful conversations.

For me personally, the most interesting discussion was the one I had with the aforementioned Farrington, where I had great fun talking about the writing process of “Bitcoin is Venice” and of “A Tale of Two Talebs” (I hope to have convinced Farrington to publish the latter in book form as well!).

It was also nice to see one of the fathers of bitcoin, Adam Back, wearing a BTCPay Server hoodie:

In the exhibition area, attendees could talk to folks from Braiins, Mempool.Space (I got a cool piece of swag from softsimon!), Cryptosteel, Tinyseed, IVPN, Peach, SeedSigner, BTCTKVR, Satochip, Debifi — while Jimmy Song, Daniel Prince and Knut Svanholm sold autographed books.

What’s Next For Bitcoin In Europe?

Baltic Honeybadger was, until recently, the largest bitcoin-only conference in Europe. In October, this status will likely be trumped by Bitcoin Amsterdam. Then, that one will likely be superseded by a yet bigger event: BTC Prague.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source: https://bitcoinmagazine.com/culture/recap-baltic-honeybadger-2022