According to reports, the e-commerce giant Amazon has recently invested in a fractional sports trading card marketplace called Dibbs. The platform, built on top of the Wax blockchain, allows users to purchase and sell fractions of collectible trading cards. Reports further add that the financial terms of Amazon’s backing of Dibbs have not been disclosed.

Reports Disclose Amazon Has Entered the Digital Collectibles Space

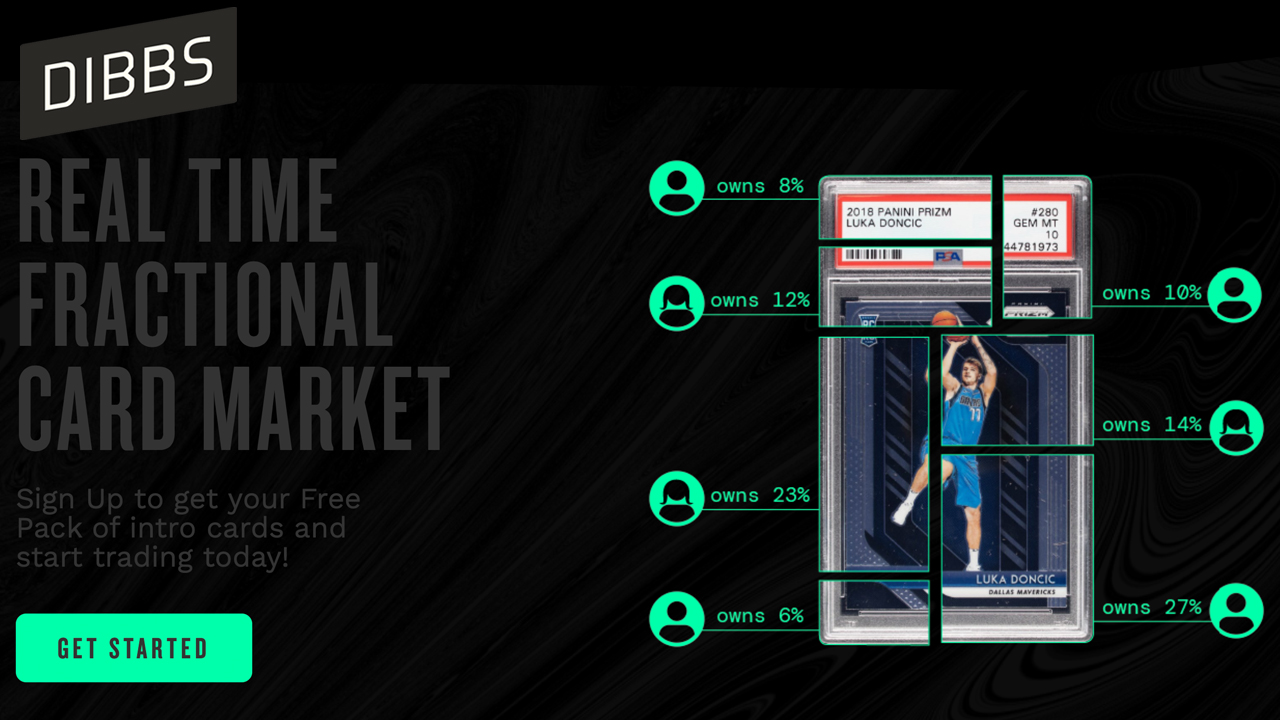

Non-fungible token (NFT) assets and digital collectibles have been gathering a lot of steam in 2021 and it seems that everyone wants a piece of the billion-dollar industry. Just recently reports disclosed that the online marketplace Amazon has invested in the trading-card platform Dibbs. “We’re thrilled to announce that Amazon entered the collectibles space by investing in [Dibbs.io],” the official Wax blockchain Twitter account tweeted on December 8. “[Dibbs] is a real-time fractional card market using Wax vIRL NFT technology.”

Dibbs was founded in 2020, and the platform allows members to list a collectible trading card and mint them into NFTs, then the NFTs can be fractionalized as well. While Amazon’s investment has not been publicized, the startup raised $16 million in a Series A funding round in July. Series A Dibb investors included athletes like Chris Paul, Channing Frye, DeAndre Hopkins, Kevin Love, Kris Bryant, and Skylar Diggins-Smith. Furthermore, the Series A in July was also backed by Foundry Group and Tusk Venture Partners.

The company has formally introduced a marketplace called “Sell with Dibbs” which allows owners to sell their collectibles and price and fractionalize pieces as well. Dibbs founder and chief executive Evan Vandenberg explains that NFTs and digital collectibles make the collectibles market, in general, more accessible. “For too long, the collectibles market has been riddled with barriers to entry that render it inaccessible and inequitable,” Vandenberg said in a statement this past week. The Dibbs executive added:

Traditional ownership has limitations that the emerging metaverse eliminates. Moving these collectibles, which genuinely represent an individual’s online persona, into the digital domain is essential for the future of ownership and identity.

Dibbs Eyes Other Types of Digital Collectibles, Fractionalized Collectibles Become a Big Deal in 2021

The Dibbs CEO also noted that cards are not the only focus his startup is concentrating on and the firm is considering moving into other avenues as well. “Cards are one thing that we do, but it’s one thing,” Vandenberg remarked. “This can be so much bigger than cards.” Besides the Dibbs concept, fractionalizing NFTs has become a significant trend that is seeing exponential growth. Blockchain projects making headway with fractionalized NFTs include platforms like Otis, Unicly, Fractional, and Daofi.

Cryptopunk collectibles have been fractionalized alongside the famous Doge NFT as well. This past week the Ross Ulbricht Genesis NFT Collection raised over $6 million at auction and the collection will be broken up into pieces and fractionalized among members of a decentralized autonomous organization (DAO).

Tags in this story

Amazon, Amazon Marketplace, Blockchain, cards, Daofi, Dibbs, Dibbs Collectibles, Dibbs Marketplace, Doge NFT, Evan Vandenberg, Fractional, fractionalizing NFTs, Fractions, Otis, Ross Ulbricht NFT Collection, Sell with Dibbs, sports cards, Trading Cards, Unicly, Wax Blockchain

What do you think about Amazon reportedly investing in the fractionalized NFT trading card platform built on top of the Wax blockchain called Dibbs? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Dibbs, Amazon,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.