U.S. lawmakers have penned a letter pressing Federal Reserve Chairman Jerome Powell for information on American banks’ ties to crypto following the collapse of FTX.

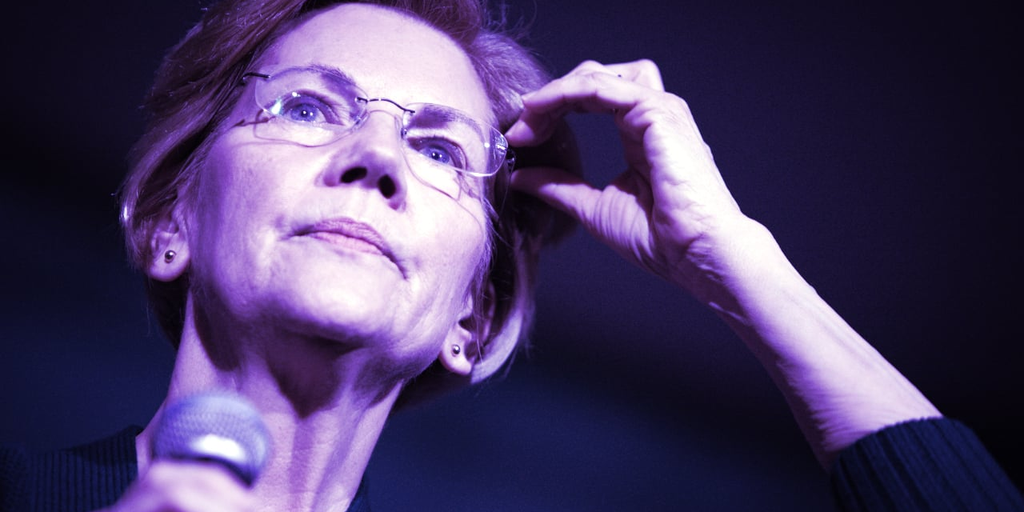

In a Wednesday letter, Democrat senators Elizabeth Warren of Massachusetts and Tina Smith of Minnesota asked Powell how his agency “assesses the risks to banks and the banking system” after it was made clear “crypto firms may have closer ties to the banking system than previously understood.”

Warren and Smith also wrote letters to Federal Deposit Insurance Corporation Acting Chair Martin Gruenberg, and Acting Comptroller of the Currency Michael Hsu raising the same concerns.

“Banks’ relationships with crypto firms raise questions about the safety and soundness of our banking system and highlight potential loopholes that crypto firms may try to exploit to gain further access to banks,” Wednesday’s letter said.

The senators referred to Alameda Research’s $11.5 million investment in Washington bank Moonstone in their letter—and noted other U.S. bank’s “heightened volatility” due to crypto investments.

Alameda Research is a collapsed crypto trading firm also founded by former FTX boss Sam Bankman-Fried.

The firm had a large and varied portfolio, having invested billions of dollars in everything from crypto startups and weight loss drug companies to Chinese news media.

Warren and Smith asked the banking bigwigs if plans were in place to review crypto firms’ ties to the banking industry, and pressed for details on banks that offer crypto services—including stablecoin reserves.

Both senators have recently been outspoken about the collapse of digital asset exchange FTX—and crypto in general. Just last month, Warren, Smith and Richard Durbin of Illinois asked Fidelity to scrap its 401(k) Bitcoin plan in light of the FTX collapse.

FTX went bankrupt last month in a highly publicized collapse after allegedly using client money to make risky investment bets through Alameda Research.

After the implosion of the company’s FTT token and a bank run on the exchange, the company was forced to admit it did not hold one-to-one reserves of customer assets, which culminated in a freezing of withdrawals and subsequent bankruptcy filing.

Stay on top of crypto news, get daily updates in your inbox.

Source: https://decrypt.co/116762/warren-fed-powell-banking-sector-crypto-ftx