The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

As most people who own bitcoin know, price drawdowns that are greater than 50% have been a regular occurrence after each all-time high. What we also know is that bitcoin price has proven to significantly recover from every major drawdown, which has made it the best performing asset over the last decade.

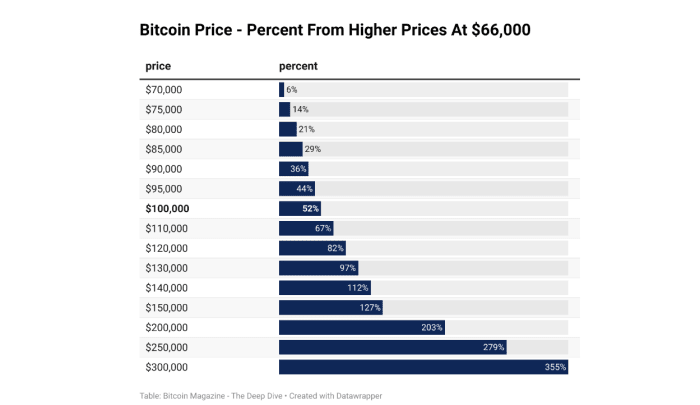

Currently we’re rebounding from a 56% price drawdown post a 228% recovery. Historically what comes next is yet another massive recovery. This double top pattern playing out is eerily similar to 2013 where price went on to explode over 10 times in just 52 days, starting in early October. As we hover around $66,000, a six-figure bitcoin price is only a 51% price move away. This is a more conserative percentage move during a bitcoin bull cycle recovery based on previous cycles.

History may not repeat itself exactly but all of the on-chain metrics, recent price action and expectations of new entrant demand, during the most bullish holder behavior in bitcoin’s history, have signaled a major price recovery underway.

At its core, bitcoin price is a function of new demand, through increased adoption, relative to the amount of limited supply available on the market. And right now, there’s just not that much supply on the market until the current holders of bitcoin find a new, higher price worth selling at. This is the free market, volatile nature of bitcoin that so many criticize playing out. Except this time the volatility is price exploding to the upside just like it has in every previous cycle.