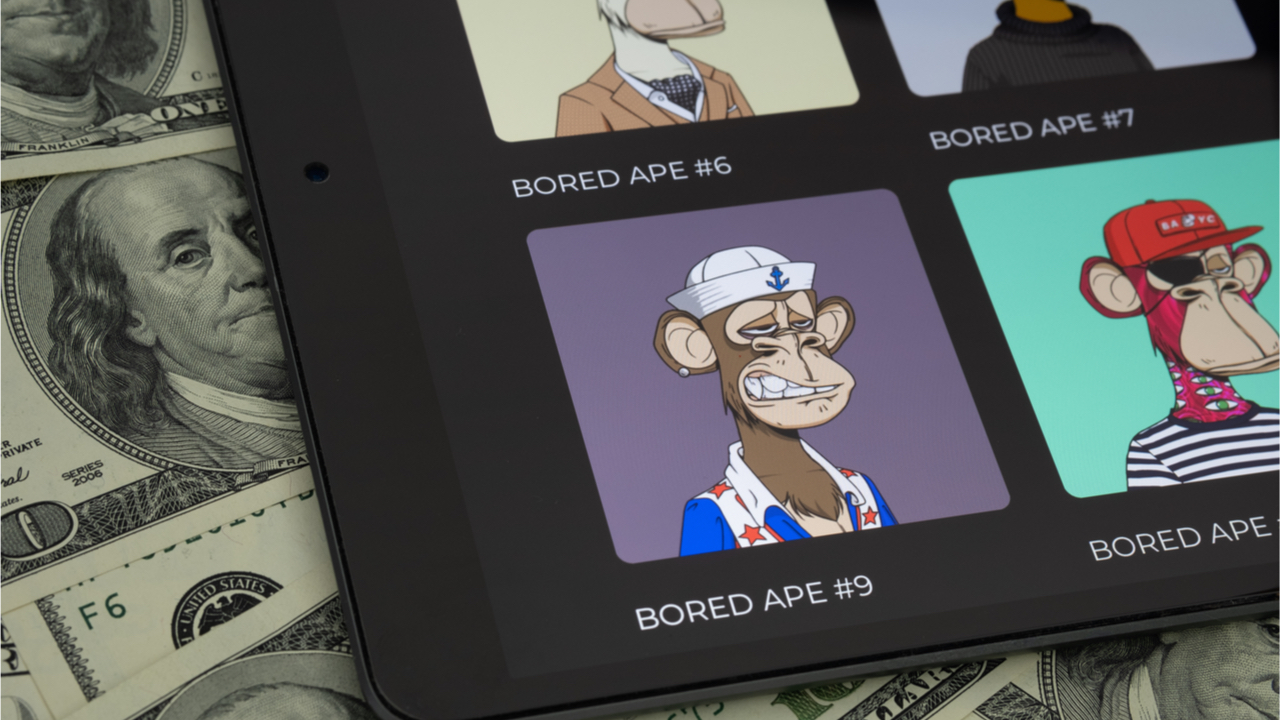

On Saturday, the creators of Bored Ape Yacht Club (BAYC), Yuga Labs, revealed the Otherside metaverse virtual land sale which turned out to be one of the largest non-fungible token (NFT) mints to date. The Otherside metaverse virtual land sale raised close to $320 million by selling 55,000 parcels of Otherside land.

Otherside Metaverse Sees $320 Million Raised, Ether Fees Spike, Etherscan Crashes

The Otherside metaverse virtual land sale took place on Saturday, and a great deal of people purchased Ethereum-based NFTs dubbed “Otherdeeds.” Demand for the Otherside metaverse deeds propelled ethereum (ETH) fees upwards, causing the average ether gas fee to rise dramatically.

“Otherside is a gamified, interoperable metaverse currently under development,” the website explains. “The game blends mechanics from massively multiplayer online role-playing games (MMORPGs) and Web3-enabled virtual worlds. Think of it as a meta RPG where the players own the world, your NFTs can become playable characters, and thousands can play together in real-time.”

“Otherside is a gamified, interoperable metaverse currently under development,” the website explains. “The game blends mechanics from massively multiplayer online role-playing games (MMORPGs) and Web3-enabled virtual worlds. Think of it as a meta RPG where the players own the world, your NFTs can become playable characters, and thousands can play together in real-time.”

When the sale finished, 55,000 Otherdeeds were sold and the project raised close to $320 million from the sale. The BAYC collection’s creators Yuga Labs wrote about the mint after it was completed and discussed some of the network issues that took place.

“We know that the Otherdeed mint was unprecedented in its size as a high-demand NFT collection, and that would bring with it unique challenges,” the team wrote. “The hope was that those challenges would be assuaged via a rigorous gating mechanism in the form of an on-chain KYC, a max mint of 2 per KYC’d wallet, and a significant clearing price at 305 Apecoin.”

Statistics on May 1, 2022, indicate that there are 28,348 Otherdeed holders. The unique holder ratio for Otherdeed holders is 0.332 and Opensea shows the project’s current floor value is 7.88 ETH or $21,754 USD. Secondary Otherdeed sales have been live for six hours since this article was written and there’s 85.8K items available on Opensea today.

Statistics on May 1, 2022, indicate that there are 28,348 Otherdeed holders. The unique holder ratio for Otherdeed holders is 0.332 and Opensea shows the project’s current floor value is 7.88 ETH or $21,754 USD. Secondary Otherdeed sales have been live for six hours since this article was written and there’s 85.8K items available on Opensea today.

However, the on-chain KYC did not curb demand and virtual land plots started selling immediately after at 9 p.m. (ET) on Saturday. Ethereum fees leveraged to mint the non-fungible tokens cost roughly $166.2 million or 60,234 ETH. Furthermore, the mint saw so much demand it crashed the blockchain explorer Etherscan.

“This has been the largest NFT mint in history by several multiples, and yet the gas used during the mint shows that demand far exceeded anyone’s wildest expectations,” Yuga Labs said. “The scale of this mint was so large that Etherscan crashed.” The BAYC creators further added:

We’re sorry for turning off the lights on Ethereum for a while. It seems abundantly clear that Apecoin will need to migrate to its own chain in order to properly scale. We’d like to encourage the DAO to start thinking in this direction.

After explaining that Apecoin needs to leverage a different blockchain, Yuga Labs mentioned that the team was aware some users had failed transactions during the sale. “For those of you affected, we appreciate your willingness to build alongside us – know that we’ve got your back and will be refunding your gas,” Yuga Labs concluded.

At the time of writing, secondary Otherside NFT sales have been live for over six hours now on Opensea’s NFT marketplace. The Otherdeed collection’s floor value today is 7.88 ether or $21,754 USD, at the time of writing.

Tags in this story

$320 Million, BAYC, BAYC creators, BAYC NFTs, Bored Ape, Bored Ape Yacht Club, Land Sale, Largest Mint, Metaverse, Metaverse land sale, metaverse virtual land, nft, NFT Holders, NFTs, Non-fungible Token, Otherdeed, Otherdeed holders, Otherside, virtual land, Yuga Labs

What do you think about the massive Otherside metaverse land sale that took place on Saturday evening? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.