Illustration by Mitchell Preffer for Decrypt

Crypto prices barely moved this week. In the context of 2022, that doesn’t necessarily mean it was a bad week, just slow. Most weeks this year have brought losses. To those who have followed prices keenly, this is no surprise. On New Year’s Day, Bitcoin posted an intraday low of $46k; yesterday it bottomed out at closer to $19k.

In other words, if 2021 was Bitcoin’s great bull run, then 2022 has been more of a bear run. Investors are feeling more cautious than last year for a number of reasons, but three big factors have been the collapse of Terra back in May—which had profound knock-on effects on the liquidity of several big crypto businesses—enhanced scrutiny from regulators worldwide, and a generally cautious global economy.

On Monday, Kim Kardashian was fined $1.26 million after failing to disclose that she was paid $250,000 to publish an Instagram post shilling a token called EthereumMax. United States Securities and Exchange Commission (SEC) Chair Gary Gensler posted a video on Twitter warning his quarter of a million followers not to buy into crypto purely because of celebrity endorsements.

Today @SECGov, we charged Kim Kardashian for unlawfully touting a crypto security.

This case is a reminder that, when celebrities / influencers endorse investment opps, including crypto asset securities, it doesn’t mean those investment products are right for all investors.

— Gary Gensler (@GaryGensler) October 3, 2022

Gensler explained that day that Kardashian ran afoul of SEC regulations as the hashtag she used to alert her followers that the promo was paid for did not clarify “the amount she was paid and the nature of it.” The securities regulator chief has long implied that the only cryptocurrency he believes doesn’t fall under his jurisdiction is Bitcoin.

As crypto becomes more popular, so too does crypto crime. ROK Capital researcher @Crypto_Mckenna warned people on Monday about crypto crime in Bogota during conference season.

Heard someone from the Solana eng team got robbed at Bogota airport (they were wearing Solana merch lmao).

Think ETH devs should value safety for me bringing no crypto stuff at all.

Picking up and new laptop and phone tomorrow. Taking zero chances.

— McKenna (@Crypto_McKenna) October 3, 2022

On Tuesday, crypto gumshoe ZachXBT posted a new mega thread showing the results of his investigation into a Twitter hack earlier this year in which a lot of crypto was stolen.

1/ Time for an investigation into the @beeple Twitter hack which resulted in $450k+ stolen, where those funds are now, and tracking down the three people responsible.

Let’s jump in.

— ZachXBT (@zachxbt) October 4, 2022

Crypto artist Beeple, whose Twitter account was compromised to execute the scam, rewarded sleuthing by rendering him in an exclusive bit of art. Zach appeared humbled in his reply.

18/ All my work is possible because of donations so if you like my investigative threads such as this one please consider donating to my ENS or sharing this thread!

0x9D727911B54C455B0071A7B682FcF4Bc444B5596

zachxbt.eth

Thanks to @beeple for making this sick 1 of 1. https://t.co/V8aAGFWFHX

— ZachXBT (@zachxbt) October 4, 2022

That same day, Coinbase CEO Brian Armstrong shilled a new documentary movie about the exchange’s recent history.

1/ Big announcement: we’ve been working with director Greg Kohs on a documentary about cryptocurrency and Coinbase over the last three years, and it will be coming out this Friday on Amazon Prime/iTunes/YouTube etc.

See the trailer here: https://t.co/JNAc2pjJPf

— Brian Armstrong (@brian_armstrong) October 4, 2022

For the second week in a row, Terraform Labs CEO Do Kwon downplayed rumors that he has been siphoning funds from Terra’s ecosystem.

I don’t get the motivation behind spreading this falsehood – muscle flexing? But to what end?

Once again, I don’t even use Kucoin and OkEx, have no time to trade, no funds have been frozen.

I don’t know whose funds they’ve frozen, but good for them, hope they use it for good 🙏 https://t.co/gSucKfqsxj

— Do Kwon 🌕 (@stablekwon) October 5, 2022

Crypto reporter Asa Hicken on Thursday posted a thread summarizing the findings of a recent article of his, concluding that the extent of downsizing going on at online crypto exchange Crypto.com is much higher than commonly thought. In addition to a massive headcount reduction, first reported by Decrypt in August, the company has also drastically pared down its marketing and sponsorship deals.

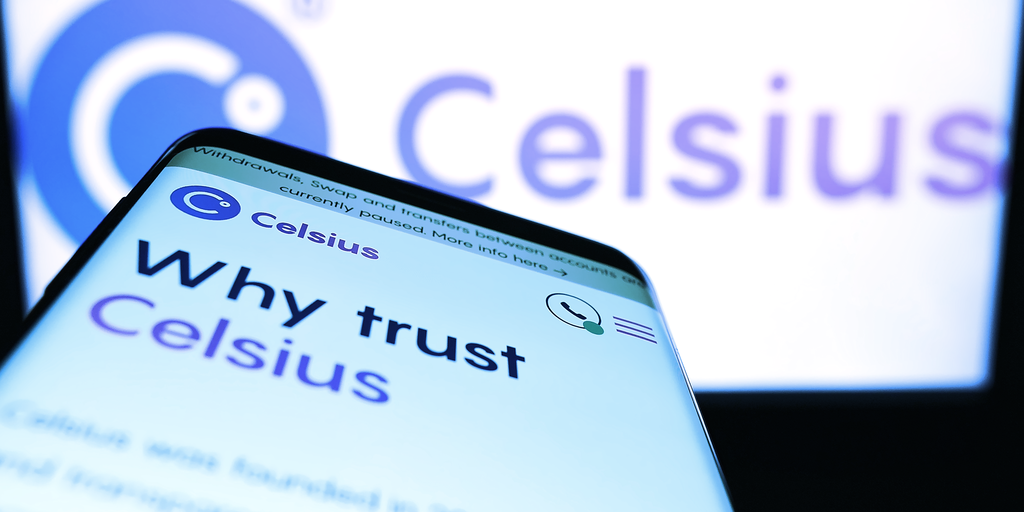

Last Friday, bankrupt crypto lender Celsius inexplicably leaked thousands of customer names and transactions in a 14,500 page court filing. The compromising document has since been taken down, though no explanation for its leak has been given. Many were rightfully concerned by such a massive leak.

DeFi developer @0xfoobar even went as far as to warn that the leak may be a prelude to real violence.

Celsius published a 14,000-page document detailing every user’s full name, linked to timestamp & amount of each deposit/withdrawal/liquidation

This horrific breach of privacy will lead to many robbed & killed

Anything not provably cryptographically private will become public pic.twitter.com/xaLbEeedDe

— foobar (@0xfoobar) October 6, 2022

Solana co-founder Anatoly Yakovenko thinks Solana could conceivably become an Ethereum layer 2 if the NFT party migrates onto the network.

If all of eth NFTs move to solana, solana becomes an eth L2.

— toly 🇺🇸 (@aeyakovenko) October 7, 2022

Bitcoin maxi David Marcus, who formerly presided over PayPal, vented his issues with his former company’s draconian new rules. His tweet ended up catching the eye of Tesla chief and former PayPal CEO Elon Musk.

CNBC Mad Money host Jim Cramer boasted about his crypto trading skills on Friday.

Several people made fun of him.

Stay on top of crypto news, get daily updates in your inbox.

Source: https://decrypt.co/111523/this-week-on-crypto-twitter-celsius-data-leak-causes-outrage-jim-cramer-boasts-roasted