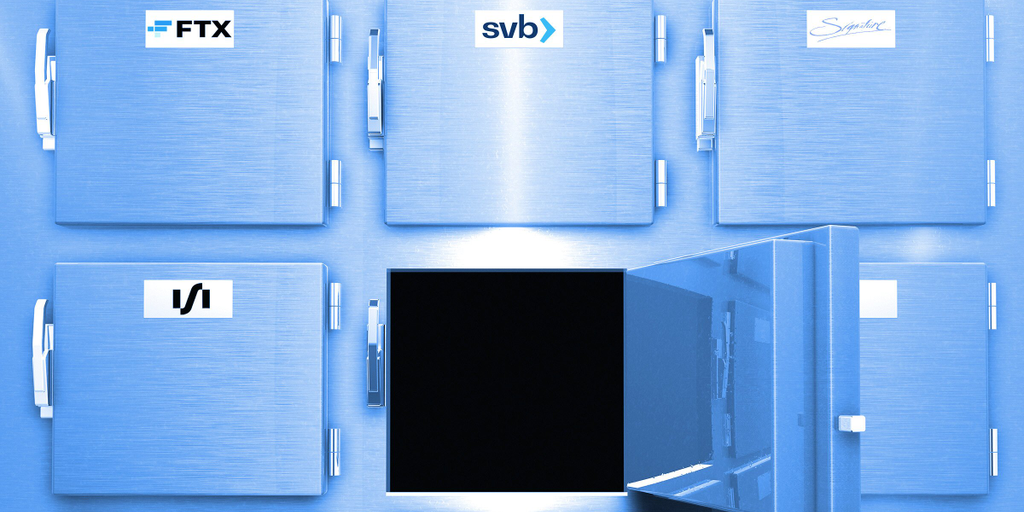

Illustration by Mitchell Preffer for Decrypt

As of close of business Friday March 10 Coinbase had an approximately $240m balance in corporate cash at Signature. As stated by the FDIC, we expect to fully recover these funds. https://t.co/XY5L7m4RMs

— Coinbase (@coinbase) March 12, 2023

This morning, the Government and the Bank of England facilitated a private sale of Silicon Valley Bank UK to HSBC

Deposits will be protected, with no taxpayer support

I said yesterday that we would look after our tech sector, and we have worked urgently to deliver that promise

— Jeremy Hunt (@Jeremy_Hunt) March 13, 2023

Cross River has not hedged any of it’s HTM portfolios according to it’s own filings. Absolute disaster of a solution if I ever saw one.

— Peter | פיטר | Tel Aviv Commodities (@TLVOilTrader) March 13, 2023

“because we personally do not like their customers” is not a valid answer to these questions

— ⚡🌙 (@dystopiabreaker) March 13, 2023

OH MY, THE CONTRAST–Fed voted down 100%-cash reserved @custodiabank & then days later voted a bank bailout after 2 epic bank runs (as Fed Vice Chair for Supervision brags Fed-supervised banks are “well protected from bank runs” on the morning of SVB bank run). Can’t make it up🤯 https://t.co/zFKP6iFO99

— Caitlin Long 🔑⚡️🟠 (@CaitlinLong_) March 13, 2023

For @wsj to say flat out that SVB could have failed because they added non-white men to their board shows how far behind the times (and certifiably stupid) this publication really is. It makes me so angry and very sad. WSJ readers and staff deserve better. pic.twitter.com/ppbcugJNhW

— Jessica Lessin (@Jessicalessin) March 13, 2023

#BREAKING: European financial regulators are “furious” at the handling of Silicon Valley Bank by US authorities.

“They tore up a rule book they helped write.”

Senior Eurozone official said the US showed “total and utter incompetence” pic.twitter.com/I9BxoUKLCd

— Mario Nawfal (@MarioNawfal) March 16, 2023

In other news

Some product news: across the company, we’re looking closely at what we prioritize to increase our focus. We’re winding down digital collectibles (NFTs) for now to focus on other ways to support creators, people, and businesses. 🧵[1/5]

— Stephane Kasriel (@skasriel) March 13, 2023

I’m thrilled to have been appointed to the CFTC’s Technical Advisory Board. I’ll do everything I can to move the space forward, inform regulators about the latest developments in crypto, and bring the benefits of blockchains to our financial system.https://t.co/5RpC1pb8Sd

— Emin Gün Sirer🔺 (@el33th4xor) March 13, 2023

I dumped a live Ethereum contract into GPT-4.

In an instant, it highlighted a number of security vulnerabilities and pointed out surface areas where the contract could be exploited. It then verified a specific way I could exploit the contract pic.twitter.com/its5puakUW

— Conor (@jconorgrogan) March 14, 2023

Today, I sent a letter to FDIC Chairman Gruenberg regarding reports that the FDIC is weaponizing recent instability in the banking sector to purge legal crypto activity from the U.S. 👇 pic.twitter.com/fDmaA0XGWv

— Tom Emmer (@GOPMajorityWhip) March 15, 2023

It’s no wonder the American people are skeptical of a system that holds millions of struggling student loan borrowers in limbo but steps in overnight to ensure that billion-dollar crypto firms won’t lose a dime in deposits.

— Elizabeth Warren (@ewarren) March 16, 2023

I’ll bet anyone $1 million dollars that the US does not enter hyperinflation

— James Medlock (@jdcmedlock) March 16, 2023

I will take that bet.

You buy 1 BTC.

I will send $1M USD.

This is ~40:1 odds as 1 BTC is worth ~$26k.

The term is 90 days.

All we need is a mutually agreed custodian who will still be there to settle this in the event of digital dollar devaluation.

If someone knows how to do this… https://t.co/tcuBNd679T pic.twitter.com/6Aav9KeJpe

— Balaji (@balajis) March 17, 2023

Stay on top of crypto news, get daily updates in your inbox.

Source: https://decrypt.co/123966/this-week-on-crypto-twitter-crypto-banking-crisis-reaction-analysis