The tokenization of real-world assets has captured the imagination of financial institutions worldwide—delivering faster payments at lower cost, complemented by greater levels of automation.

Stablecoins, digital assets that can be redeemed for fiat currencies like the U.S. dollar at a 1:1 ratio, now have a total market capitalization above $220 billion as Washington spearheads efforts to introduce clearer regulations.

Image: Stellar

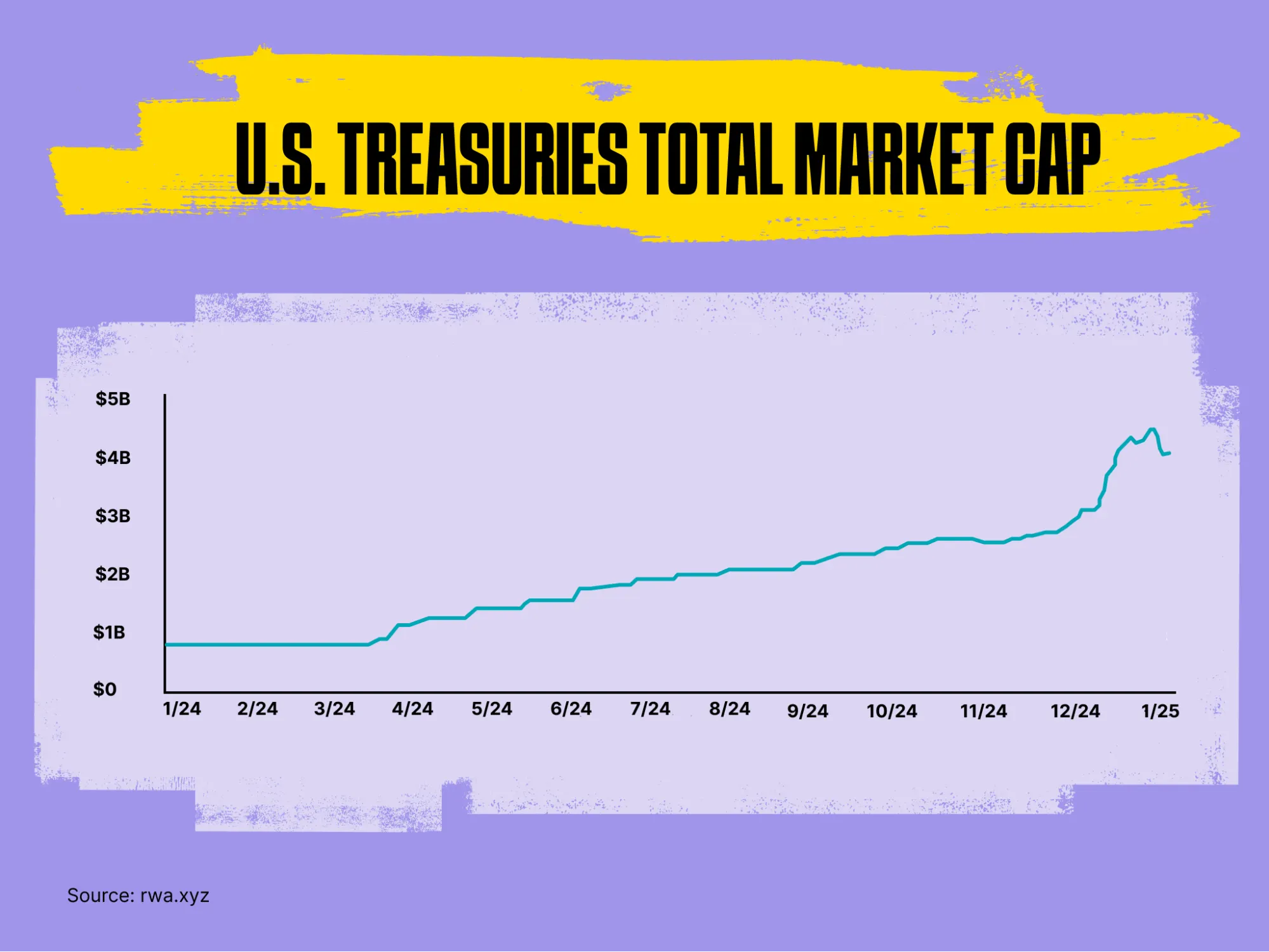

Meanwhile, demand for tokenized U.S. Treasuries, bonds and cash equivalents have proven insatiable, surging beyond $3.6 billion at last count.

Firms like global asset manager WisdomTree are already offering tokenized securities and other financial services to the tune of $100 billion in assets under management, while BlackRock’s Larry Fink recently argued that tokenization will usher in “the next generation for markets,” with Wall Street stocks digitally represented on the blockchain.

Image: Stellar

Image: Stellar

But, says the Stellar Development Foundation, tokenization can also make the global financial system more accessible to everyday consumers—including some of the world’s most vulnerable citizens.

Tokenization in action

According to the SDF, smart contract blockchain Stellar is already being used to help make the world a better place.

The United Nations High Commissioner for Refugees was the first to pilot the award-winning Stellar Aid Assist platform, which allows much-needed financial support to reach those in need “quickly, efficiently, and securely.”

All of this is complemented by full traceability and accountability, giving governments and citizens reassurance that the funds they donate are spent appropriately.

Stellar Aid Assist has also been used on the ground in Ukraine, with the UNHCR helping families affected by the conflict to pay for rent, food, medical care and heating during the cold winter months. According to SDF, more than $4.2 million has already been dispersed to over 2,500 households in the country.

“Aid to refugees across the globe could be done faster and cheaper with this technology, with the upshot being that more money can get into the hands of those who need it most and done in a more transparent, traceable, and auditable manner,” Rob Durscki, Senior Director, Partnerships of the Stellar Development Foundation told Decrypt.

Tackling hyperinflation

The need for blockchain-powered, crypto-based alternatives to fiat currencies also comes into sharp focus when you consider the impact that hyperinflation is having on fiat currencies around the world.

In Argentina, the peso has been ravaged by year-on-year inflation as high as 275%—eroding the purchasing power of refugees and consumers alike. Not only does this make everyday essentials more expensive, but it robs the public of financial freedom.

Digital assets can offer a compelling solution here, all while shielding users from the volatility seen in cryptocurrencies such as Bitcoin, according to the SDF. Hundreds of thousands of Argentinians now hold the U.S. dollar-backed USDC stablecoin in the Vibrant wallet, built atop the Stellar blockchain infrastructure.

Meanwhile, real-world solutions enable this USDC to be turned back into physical cash with ease, according to the SDF. A dedicated MoneyGram International app enables consumers to decide how much they would like to withdraw from their stablecoin balance, and then take a transaction code to a local MoneyGram branch to receive their banknotes in person.

Opening up finance

Beyond the column inches devoted to how hedge funds and billionaire financiers are interacting with crypto, it’s use cases like this that show how tokenization can be life-changing for people struggling with the current financial system.

And the Stellar Development Foundation believes that millions of others around the world will be able to benefit from the power of blockchain if more trusted institutions like MoneyGram and the UNHCR start to innovate.

“There is opportunity for everyone in the new global financial system that is being built by tokenizing real-world assets,” Durscki said. “To seize that opportunity, more institutions should embrace the future of everyday financial services.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source: https://decrypt.co/306303/tokenization-is-already-helping-the-worlds-vulnerable-heres-how