In light of recent events in the crypto industry, it’s becoming increasingly important for Kraken clients and industry participants to understand the significance of Proof of Reserves (PoR) at Kraken.

This technique, one that is only possible in the new world of cryptocurrency, is a way for Kraken clients to verify whether or not their account balances were included in a third party audit that proved Kraken held covered client assets on the day of the audit.

In other words, for every bitcoin, ETH and several other cryptoassets you entrust with us, we want you to be able to personally verify that an equivalent amount of that asset was verified as being held by Kraken, safe inside our secure wallets. PoR allows for this to be done transparently and securely.

What is a reserve?

In financial services, a reserve is traditionally a store of assets held in treasury. You can think of it as an amount of money kept by an institution, ready for any situation where it might be needed.

Reserves are typically held to cover client liabilities, which are outstanding debt a company owes to its clients based on the holdings in their accounts.

Reserves come into play when you may wish to take your cryptocurrency off our exchange and custody it yourself. In traditional finance, a bank holds cash and other valuable items in reserve, but in many cases, it doesn’t hold your actual deposits in full which means their reserves are not always backed one-to-one.

Why are reserves important?

In traditional finance, a situation when too many clients withdraw their funds all at once is called a bank run and it can be fatal for an economy.

Runs can also happen on centralized cryptocurrency exchanges, leading to major problems if the platform doesn’t have sufficient assets in reserve to facilitate client withdrawals.

Oftentimes in these unfortunate scenarios, platforms without adequate reserves may suspend withdrawals, leaving clients unable to retrieve their assets from the platform. Depending on the circumstances, these situations can potentially take weeks, months or sometimes years to resolve, and even then, there’s no guarantee clients will receive the full amount of what they lost.

What is Proof of Reserves?

There is currently no legally approved definition of what a Proof of Reserves audit is.

At Kraken, PoR is an independent audit conducted by a third party that serves to prove we held assets in reserve on the date of the audit that at least equaled our clients’ covered balances. This is done with user-verifiable cryptography to provide 100% transparency and certainty.

At Kraken, PoR isn’t a case of simply subtracting client liabilities from client assets, or providing a list of on-chain wallet addresses for others to inspect. These practices are incomplete and can be misleading for clients looking to understand the transparency of their exchange.

We believe the only way to unequivocally prove to clients that we held covered assets at least equal to covered liabilities on the date of the audit is to employ sound mathematics and an independent firm to prove that the balances in your account of cryptocurrencies like BTC and ETH (other than those on which you opted in to earn additional yield) were in fact held by Kraken.

Why are Proof of Reserve audits important?

Proof of Reserves help to prove to our clients and the industry that we did not loan the crypto in your account out to others without your knowledge or back your holdings with anything other than the cryptocurrency itself.

In a world of uncertainty, PoR audits exist as one of the few processes where clients can truly know whether or not a platform is sufficiently solvent and able to process withdrawals.

How are Proof of Reserves audits performed at Kraken?

Our reserves are verified through audits conducted biannually (twice a year) by an independent, top-25 global accounting firm. As an independent third-party, the auditor attests to the accuracy of both our client liabilities as well as the assets held by Kraken to cover those liabilities.

Kraken takes this a step further by allowing our clients to then independently verify that their holdings were included in the Proof of Reserves as well.

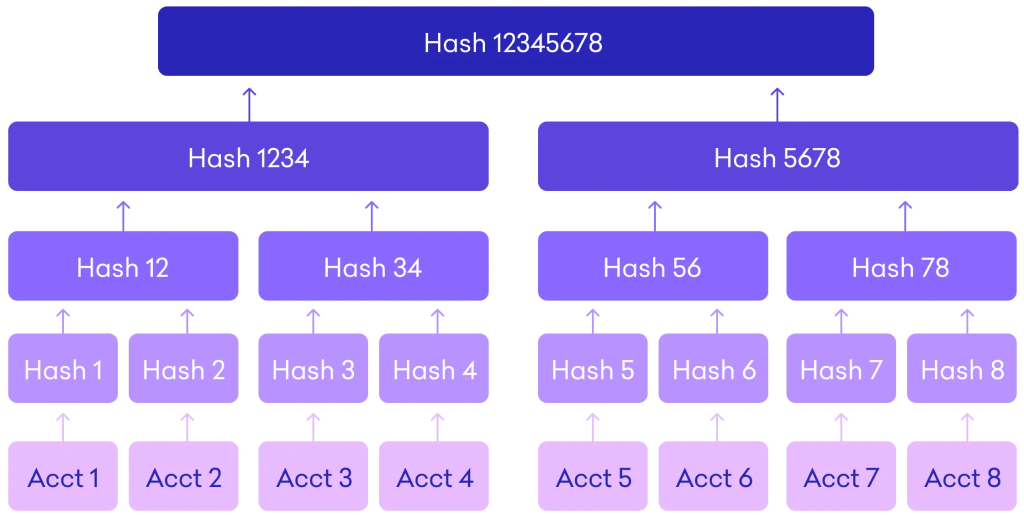

At a more granular level, the auditing firm takes a snapshot of client balances and arranges them in something called a Merkle tree — a type of data structure used in cryptography to aggregate and verify the integrity of a dataset.

Using the Merkle tree, account balances are first hashed (converted into unique hexadecimal codes) and then repeatedly hashed together in pairs, until the final two pairs of hashes are hashed together to form a single hash code. Known as a Merkle root, this single code acts like a fingerprint that uniquely represents all data captured in the auditor’s snapshot.

The auditor then matches up the amount of assets held in Kraken’s on-chain crypto wallet addresses with the balances shown in the Merkle tree.

To avoid exposing security vulnerabilities, Kraken provides digital signatures to the auditing firm. These signatures prove we maintain control over the wallets without having to disclose the corresponding private keys. It also shows that the funds don’t belong to someone else.

Cryptoassets included in the PoR audit include BTC, ETH, USDT, USDC, XRP, ADA and DOT. In the future, we will look to include additional cryptocurrencies in the Proof of Reserves process with the goal of achieving even greater transparency for our clients.

How do I know my investments are safe?

Kraken’s Proof of Reserves audits are intended to reassure our clients that their funds are transparently and verifiably backed by sufficient assets held in reserve. Proof of Reserves audits indicate that assets were held in Kraken’s reserves which were sufficient to cover customer withdrawals.

In addition to our reserves, we maintain a high standard of security across all areas of our ecosystem. It’s why Kraken remains one of the few crypto exchanges in the industry that has never experienced a security breach that resulted in the loss of funds. You can learn more about Kraken’s industry leading security standards here.

Create an account today to benefit from Kraken’s industry leading security and transparency.

There are no formally accepted rules or procedures that define a proof of reserves audit. For ours, we engaged an independent accounting firm to perform an engagement under standards set forth by the American Institute for Certified Public Accountants and to issue an Independent Accountant’s Report on Agreed Upon Procedures. This report includes specific procedures performed by that firm as well as their findings.

These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, or hold any digital asset or to engage in any specific trading strategy. Some crypto products and markets are unregulated, and you may not be protected by government compensation and/or regulatory protection schemes. The unpredictable nature of the cryptoasset markets can lead to loss of funds. Tax may be payable on any return and/or on any increase in the value of your crypto assets and you should seek independent advice on your taxation position.

Like this:

Like Loading…

Source: https://blog.kraken.com/post/16400/what-is-proof-of-reserves-a-beginners-guide/