Investors will be focused on the U.S. central bank this Wednesday as Federal Reserve policymakers are expected to raise the benchmark interest rate aggressively. The top U.S. stock indexes saw significant losses at the end of the week, and the Nasdaq composite saw its worst four-month starting performance since 1971. Crypto markets have had a rough week as well, as the crypto economy has shed 8.99% against the U.S. dollar since April 25, dropping from $1.967 trillion to $1.79 trillion.

Fed Expected to Raise Benchmark Interest Rate Aggressively, Dutch Bank ING Predicts a 50bp Hike and a QE Tightening Announcement

A number of financial institutions, analysts, and economists expect the Federal Open Market Committee (FOMC) will raise interest rates next week in an aggressive manner. Reuters’ authors Lindsay Dunsmuir and Ann Saphir reported on Friday that there may be “big Fed rate hikes ahead” and the authors also cite two reports that claim “hot inflation is peaking.”

“U.S. Federal Reserve policymakers look set to deliver a series of aggressive interest rate hikes at least until the summer to deal with hot inflation and surging labor costs, even as two reports Friday showed tentative signs both may be cresting,” the report explains.

A report written by James Knightley, the chief international economist at ING says: “For now, our base case remains that the Fed will follow up next week’s 50bp hike with 50bp increases in June and July before switching to 25bp as quantitative tightening gets up to speed. We see the Fed funds rate peaking at 3% in early 2023.”

A report written by James Knightley, the chief international economist at ING says: “For now, our base case remains that the Fed will follow up next week’s 50bp hike with 50bp increases in June and July before switching to 25bp as quantitative tightening gets up to speed. We see the Fed funds rate peaking at 3% in early 2023.”

In addition to the Reuters report, the Dutch multinational banking and financial services corporation ING Group believes a big hike will come this Wednesday. In the report, ING expects the FOMC and Fed Chair Jerome Powell to announce a 50 basis point rise. ING’s report says that “inflation worries outweigh temporary GDP dip.”

“The Federal Reserve is widely expected to raise its policy rate by 50 basis points next Wednesday as 8%+ inflation and a tight labour market trump the surprise 1Q GDP contraction attributed to temporary trade and inventory challenges,” ING Group’s report published on April 28 notes. While 50bp is a large raise, ING also believes the Fed will reveal a tightening plan when it comes to the central bank’s monthly bond purchases.

“We will also be looking for the Fed to formally announce quantitative tightening on Wednesday,” ING’s report details.

Wall Street Takes a Beating, Gold Reaps Macroeconomic Benefits

Meanwhile, when Wall Street closed the day on Friday, all the major U.S. stock indexes had suffered from a blood bath during the intraday trading sessions. Nasdaq, the Dow Jones Industrial Average, S&P 500, and NYSE all dropped significantly before the start of the weekend. Reports show that the Nasdaq composite saw its worst four-month start in over 50 years and S&P 500 dropped like a rock on Friday as well.

“By the end of trading on Friday, the selloff had gotten worse and we were staring at the worst start to a year since the Great Depression,” Barron’s author Ben Levisohn wrote.

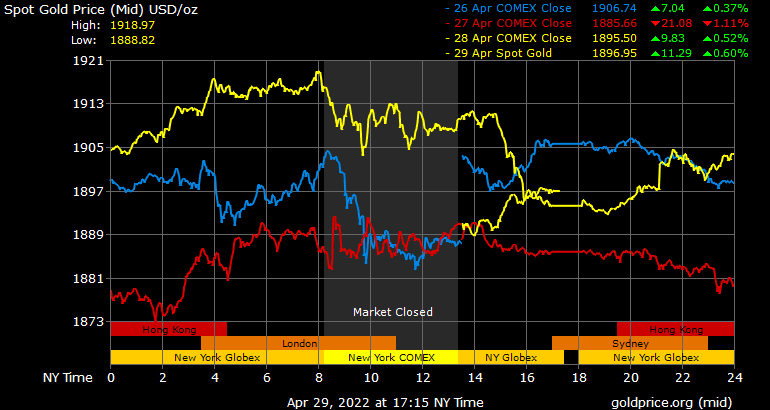

Friday’s gold prices saw a rise after equities and crypto markets took a beating.

Friday’s gold prices saw a rise after equities and crypto markets took a beating.

Gold reaped the benefits from the storm at the end of the week and the precious metal saw a steady increase against the U.S. dollar heading into the weekend as well. On Saturday, an ounce of fine gold is up 0.08% and 6.47% over the last six months. Presently, an ounce of fine gold is exchanging hands for $1,896 per unit. Trends forecaster Gerald Celente believes as long as inflation rises, precious metals will follow.

“The higher inflation rises, the higher safe-haven assets gold and silver rise. And, when the Banksters raise interest rates, it will bring down Wall Street and Main Street very hard… and the harder they fall, the higher precious metal prices will rise,” Celente tweeted on Saturday.

Fear Gives ‘Bear Market Vibes of 2018,’ Bitfinex Market Analysts Say Crypto Buyers Remain on the Sidelines

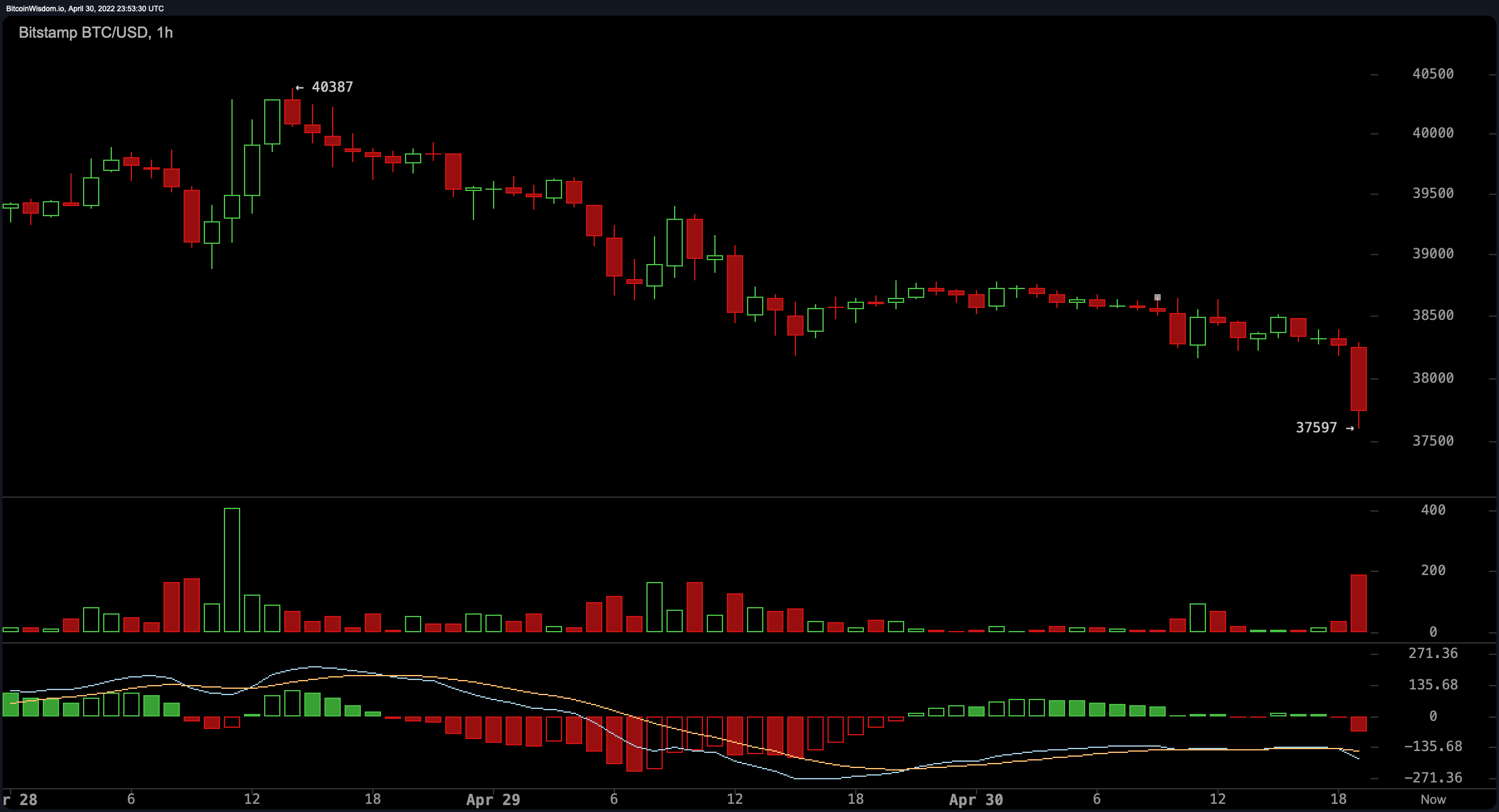

The crypto economy suffered as well this week and markets were correlated with equities markets. The CEO and founder of eightglobal.com Michaël van de Poppe tweeted about the fear in crypto markets on Saturday. “The amount of fear in the markets currently due to the upcoming FED meeting is comparable to the bear market vibes in 2018,” the Eightglobal founder said. “That tells a lot for the markets and Bitcoin.” On Saturday evening (ET) around 7:25 p.m., bitcoin (BTC) dropped below the $38K mark to $37,597 per unit.

BTC/USD 1-Hour chart on April 30, 2022.

BTC/USD 1-Hour chart on April 30, 2022.

Since April 25, 2022, the entire crypto economy’s net value slipped from $1.967 trillion to today’s $1.79 trillion. While the crypto economy lost 8.99% since then it has lost 1.2% during the last 24 hours. Bitcoin (BTC) has shed 4.9% this week and ethereum (ETH) has lost 7.6% against the U.S. dollar during the past seven days. In a note sent to Bitcoin.com News on Friday, Bitfinex market analysts explained that “bitcoin is in range-bound trading as buyers remain on the sidelines.”

“The day trading fervour symptomatic of lockdown – which saw so-called meme stocks pump to unearthly valuations – already seems like a thing of the past,” the analysts added. “Robinhood has cut staff amid a drop in revenues as a bearish sentiment takes hold in the stock market. Still, it is interesting to note that the percentage of the bitcoin supply dormant for a year or more made new all-time highs this month, according to data from on-chain analytics firm Glassnode.”

Tags in this story

Ann Saphir, Bank Rate, Ben Levisohn, Bitfinex market analysts, Central Bank, Crypto, Crypto markets, dow jones, Fed Chair Jerome Powell, Fed policymakers, FOMC, Gerald Celente, gold, Great Depression, inflation, ing, ING Group, interest rate hikes, James Knightley, Lindsay Dunsmuir, Michaël van de Poppe, nasdaq, NYSE, Rate Hike, S&P 500, Trends forecaster

What do you think about the outlook concerning global markets like gold, crypto, and stocks? Do you think the Federal Reserve will raise the benchmark rate by 50bp? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.