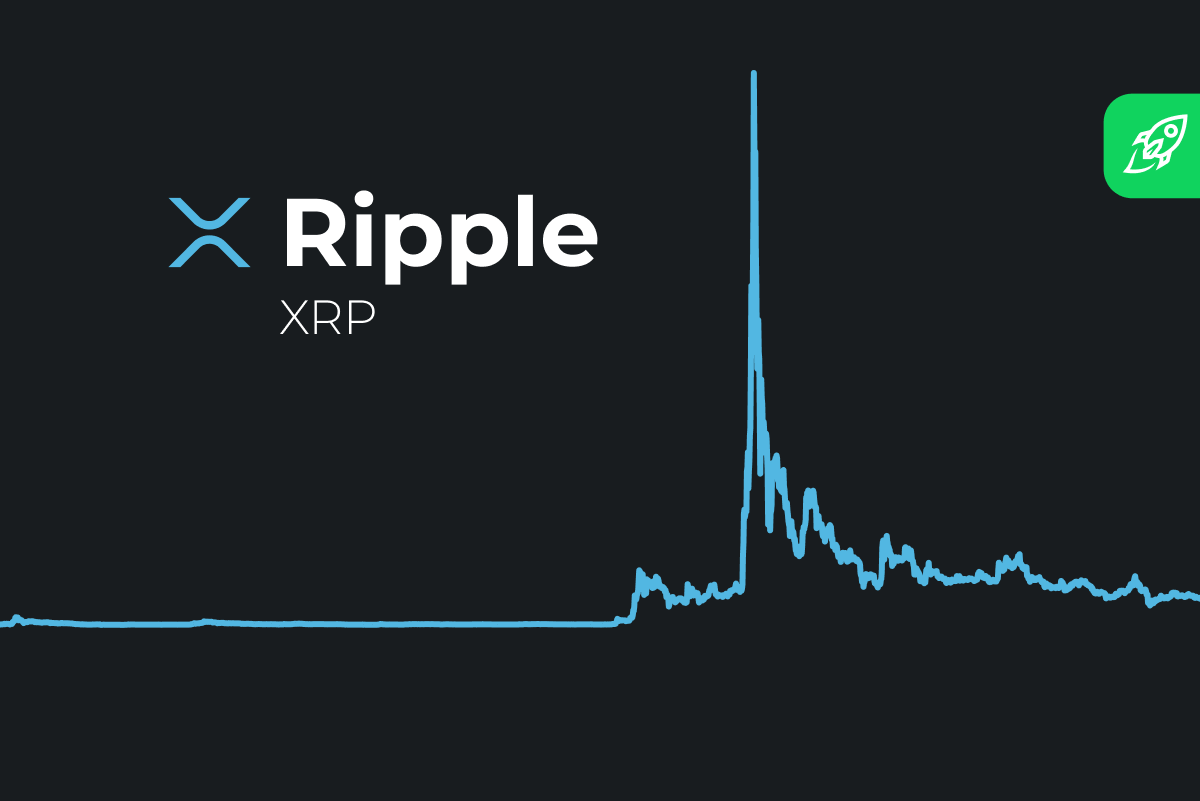

At the turn of 2017 and 2018, the Ripple cryptocurrency made a dizzying leap, briefly becoming the second most capitalized cryptocurrency in the world after Bitcoin. This growth was followed by a long and painful decline in the exchange rate and capitalization of XRP. The drop turned out to be even deeper on average than the general sagging capitalization of cryptocurrencies.

What Is XRP?

XRP was created neither as an alternative means of payment nor as an alternative to traditional paper money and the entire banking system as a whole (like most other cryptocurrencies).

The purpose of XRP is the emergence of a new method of calculation for the banking system, that is, the creation of an alternative system of interbank transfers with a minimum commission.

The main goal of the Ripple protocol is to ensure a high speed of money transfers. The system uses a consensus registry to record information about transactions, which differs in many ways from the classic blockchain. In traditional consensus algorithms, such as Proof-of-Work (PoW) or Proof-of-Stake (PoS), trust in nodes is formed based on their computing power or the value of the balance. In Ripple, trust is built on the reputation of the owners of node validators, which are banks and other registered companies (Axis Bank, American Express, Royal Bank of Canada). Confirmation of transactions is carried out by reaching an agreement on their authenticity between the validators.

Since the release of the maximum number of XRP tokens (1 billion coins) occurred at an early stage of the protocol’s existence, it is impossible to get coins in the system by mining or forging. There is no reward for checking transactions: commissions for making transfers are irrevocably “burned out,” reducing the number of tokens in circulation. Banks that use the protocol for mutual settlements are interested in the system’s stable operation, so they are most often the holders of the node.

Ripple network consensus mechanism is often criticized for its lack of transparency and low degree of decentralization. In July 2021, only 55 node validators performed transaction verification. The system developers recognize the need to expand the network: in their blog, the company has repeatedly announced plans to increase the number of trusted nodes.

Ripple supports instant currency and asset conversion. The user does not need to worry about what kind of currency is on his balance: when making a transfer, the exchange will be carried out automatically. The ability to exchange in such a fast manner turns the system into a central hub for international settlements and interbank payments.

The creators of the system are in favor of the legislative regulation of cryptocurrencies. Strict adherence to formal requirements has provided Ripple with wide recognition among major financial institutions. Since 2014, well-known banks such as Mitsubishi UFJ, UBS, and Unicredit have been actively connected to the system.

Ripple Technical Analysis

The Ripple network operates based on the Ripple protocol consensus algorithm. It does not use the famous Proof of Work or Proof of Stake systems. Instead, the Ripple transaction protocol performs consistent validation of accounts and transactions of the ecosystem by many independent nodes.

For the operation to pass validation, all nodes must agree on it, and this is the only way to perform transactions. This protocol allows the system to prevent “double spending,” primarily by conducting surveys to determine the majority opinion. Double spending is the risk that a digital currency can be spent twice. It is a potential problem unique to digital currencies because digital information can be reproduced relatively easily by savvy individuals who understand the blockchain network and the computing power necessary to manipulate it.

Ripple will not allow you to spend the same amount of coins two or more times because the system detects the requested transaction first and deletes all the subsequent ones. The validation process in this consensus protocol takes only a few seconds, so the transaction time is minimal: on average, it takes about four seconds to complete the operation.

The Ripple protocol works using gateways. The gateway acts as an intermediary in the chain of trust between two parties who want to complete a transaction. As a rule, banks are the gateways. The architecture of Ripple is similar to the architecture of the SWIFT global fast payment system.

XRP Price Analysis

For many years after its creation, the price of the XRP coin was so insignificant that it was almost worthless. Until 2017, the asset’s value fluctuated around $0.01, but this changed shortly as the token began to receive broader coverage. It also took advantage of the bullish growth of the crypto industry that year. By April 2017, XRP had risen to $0.05; the gradual increase soon continued, reaching $0.25 in May.

After that, the asset had reached the point of no return, as it attracted the attention of crypto enthusiasts, who saw the value and potential of the XRP coin. The asset’s value grew throughout 2017 and until the beginning of 2018, when it reached a record level of $3.84. But this was soon followed by a sharp drop in value, which affected all other cryptocurrencies. By the end of 2019, the price of XRP stabilized at $0.30 and did not exceed the $0.5 mark throughout the year.

However, the bullish growth of 2020, which began by the end of the year, helped the XRP currency exchange rate to rise. The value of the token reached $0.8 before the end of the year. The beginning of 2021 was supposed to be a continuation of the growth in the value of XRP, but this could not happen due to the SEC’s announcement of a lawsuit.

After the announcement, some exchanges excluded XRP from their platforms. Many of those who held the coin also sold it in a panic. This led to the fact that the price of XRP started to decline steadily to $0.166. However, XRP rose again to $0.755. Currently, Ripple is trading from $0.4 to $0.5.

Looking at this review, we can see the high volatility of XRP over the past few months, which makes it challenging to make a Ripple forecast. But volatility does not prevent analysts from making XRP forecasts based on trends. This only means that these forecasts can change at the slightest real news in the market. However, they still give a rough estimate of what to expect from the Ripple rate.

Will Ripple XRP Price Rise Again?

Apart from the influence of general crypto market trends on the price of XRP, there are seven categories of factors that are potentially important for the Ripple exchange rate:

The interest of global financial institutions.Speculative events on the cryptocurrency market, including regional ones.Informational reasons related to the development of technologies.News of competing cryptocurrencies and financial services.Actions of financial regulators.Lawsuits against Ripple Labs, Inc. and the course of their consideration.Potential price manipulations of the company itself.

In the past, the popularity of XRP and, as a result, the growth of its value largely depended on partnerships with these traditional institutions. Forming more partnerships will result in deeper acceptance by society, which invariably means higher value.

However, everything is not so simple for XRP. The SEC’s lawsuit further complicates the situation. Before the SEC filed the case, the XRP projections had been positive, even if they did not inspire optimism. But the lawsuit interrupts the breakthrough and makes Ripple’s price prediction trajectory more difficult and enables Ripple to take the profit at the time when the crypto market was growing rapidly.

Given how difficult it is to predict a digital asset accurately due to the extremely high volatility on the crypto market, it is even more so for XRP. After the trial, more and more traders are showing a bearish attitude towards the XRP cryptocurrency, raising fears that it may fall below 10 cents. However, the increase in prices from retail investors and traders allowed it to rise again.

If XRP experiences a real breakthrough in 2021, it could reach its historical maximum of more than $3. But this looks unlikely while the SEC lawsuit is hanging over their head.

XRP Price Prediction 2021

According to the forecast price and technical analysis of XRP, in 2021, it is expected that the price will NOT cross the average price level of $1.35; the expected minimum value of the XRP price by the end of this year should be $1.30. Moreover, XRP may reach the maximum price level of $1.42.

MonthMinimum PriceAverage PriceMaximum PriceOctober 20211.161.271.31November 20211.261.321.37December 20211.301.351.42

XRP Price Prediction September 2021

The forecast of the XRP exchange rate for September 2021: $1.263 at the beginning and $1.352 at the end of the month.

The XRP exchange rate for September will be $1.300; the maximum value is expected at $1.360 per coin; the minimum will be $1.242. For September 2021, XRP is projected to grow by $0.036998 or +2.93%.

XRP Price Prediction October 2021

The forecast of the XRP exchange rate for October 2021: $1.358 at the beginning and $1.385 at the end of the month.

The XRP rate for October will be $1.374; the maximum value is expected at $1.397 per coin; the minimum will be at $1.347. The XRP price in October 2021 will grow by $0.07407 or +5.70%.

XRP Price Prediction November 2021

The forecast of the XRP exchange rate for November 2021: $1.390 at the beginning and $1.474 at the end of the month.

The XRP exchange rate for November will be $1.443; the maximum price is expected at $1.506 per coin; the minimum will be $1.382. Throughout November 2021, the XRP price will grow by $0.06857 or +4.99%.

XRP Price Prediction at the End of 2021 and in December 2021

The forecast of the XRP rate for December 2021: $1.478 at the beginning and $1.528 at the end of the month.

The Ripple digital coin rate for December will be $1.502; the maximum cost is expected at $1.544 per coin; the minimum will be $1.463. The XRP rate for December 2021 will grow by $0.05896 or +4.099%.

According to the analyst, the Ripple payment network native token (XRP) looks the readiest for growth and updating the historical maximum. In the event of another impulse, the XRP’s price may reach the level of $2.8 (an increase of 100% from current levels) and then exceed $4.3 (a rise of 244% from current levels), says van de Poppe. On September 5, XRP was trading for $1.25. Over the past month, the cryptocurrency has grown by 127%.

XRP Price Prediction 2022

Ripple price has gained support from some of the investment biggies, and the number of partnerships and events with crypto companies shows that many believe in the currency. The recent XRP price predictions and its price movement might mark a tremendous improvement by the end of the year unlike other major coins such as BTC and ETH, and cross its previous all-time high price of $3.84.

XRP Price Prediction 2025

Four years is a lot of time to determine what the actual price will be, especially for such a volatile market as cryptocurrency. However, according to the algorithmic analysis of Coinswitch, by 2025, the cost of Ripple might be about $4.52.

The future and current partnerships with banks in Latin America and Europe will help Ripple technology. It will open the door for XRP cryptocurrency to gain wider distribution in other parts of the world. This is already a work in progress since a more significant percentage of XRP holders are located outside of America.See also

Coinpedia is more optimistic about how much the XRP coin will cost in 2025; according to its price forecast, by then, the currency will be in the range of $4 to $8, which will be a record level. However, the middle of this forecast is suggested as a likely result. This means that by 2025, one XRP will cost about $6. By this time, the acceptance level will reach a mark where it will be more convenient for users to conduct a transaction with a currency and trade with it. Thus, for 2025, the maximum projected value of the asset will be $8, but it may fall to $4.

Ripple price prediction for 2025 is presented in the table below.

MONTHOPENCLOSEMO%TOTAL%Jan 2025$0.48$0.40-16.7%-45.9%Feb 2025$0.40$0.34-15.0%-54.1%Mar 2025$0.34$0.29-14.7%-60.8%Apr 2025$0.29$0.3417.2%-54.1%May 2025$0.34$0.3914.7%-47.3%Jun 2025$0.39$0.390.0%-47.3%Jul 2025$0.39$0.33-15.4%-55.4%Aug 2025$0.33$0.3815.2%-48.6%Sep 2025$0.38$0.32-15.8%-56.8%Oct 2025$0.32$0.24-13.9%-55.8%Nov 2025$0.24$0.45+34.5%+31.2%Dec 2025$0.45$0.89+48.7%+44.3%

XRP Price Prediction 2030

The long-term forecast of what the value of XRP will be in the next ten years also looks pretty remarkable. Experts expect that the currency will grow exponentially as the speed of its adoption will increase over time. According to forecasts, by 2030, its rate will exceed $17. According to Coinwatch, crypto enthusiasts believe that the use of XRP will increase significantly by that time, so it might become one of the favorite cryptocurrencies.

XRP Price Prediction by Experts

The online forecast service Wallet Investor has taken a bearish position in its forecasts about the future of the XRP price. The resource predicts that XRP will trade well above $0.70 in the first days of 2022, right before falling sharply.

According to the long-term Ripple price forecast on the website, it is expected that by the end of 2021, the coin will be trading at an average of $0.80. After starting 2022 at $0.90, that XRP will fall below the $0.1 level in August and recover to close the year at $0.77. Looking even further, the projected cost of XRP in November 2025 will be in the range of $1.20 to $1.60.

According to TradingBeasts.com, the coin will close 2021 at $1.3 with a maximum target price of $1.79 and a minimum of $0.83. Based on the XRP price forecast for 2022, the cryptocurrency should end next year at around $2.66.

On the other hand, according to CoinSwitch’s forecast, XRP might reach the $2 mark in 2021, trade at about $3 in 2023, and grow to $4.52 in 2025 thanks to new partnerships and new technologies.

It is difficult to predict the value of digital currencies due to their high volatility and unclear position of the world central banks in relation to them. If the situation with the SEC’s lawsuit is successfully resolved, it can be assumed that the price will return to or exceed the April 2021 maximum of $1.96. In 2022, the coin may break its record of 2018, when it was estimated at $3.24.

FAQ

Will XRP hit $5?

According to the XRP price forecasts presented above, the majority of experts are sure Ripple will not reach $10. However, the price of $5 is a realistic sum.

Is XRP a good investment?

The internal currency of Ripple is an exciting and popular product with a bright future price perspective. An important role is played by a complete lack of competition with other crypto projects.

The widespread use of the Ripple coin makes it popular in various circles of society – from financial corporations to ordinary private users. Therefore, the purchase of digital currency looks like a promising idea.

Will XRP ever reach $10?

Anything is possible, but it’s doubtful that Ripple will reach $10 in the foreseeable future. Ripple potential will grow if it becomes the best choice for cross-border payments by financial institutions, but this is a very rosy long-term prediction.

Will Ripple explode?

Ripple has been the rapid and secure payment gateway that it has manifested, allowing users worldwide under no encumbrances of government or any other financial institution, making it completely customer-focused. And as per the recent price movements, it may soon show a considerable gain, and hence, it is good to hold XRP coins.

Is Ripple a bad investment?

Ripple is unlikely to be a bad investment because it has proven to be very popular among financial institutions, which could drastically increase demand for crypto. Furthermore, as we have pointed out in this article, Ripple could benefit hugely if regulations are implemented. The most concerning issue with Ripple is its case with the SEC.

Is there any hope for XRP?

According to the XRP technical analysis and XRP price history, investing in XRP may bring you profit if you properly evaluate your risk, position yourself wisely, do your own research and take profits when the time is right. Most investors see XRP as a long-term profitable investment.

Will XRP reach $100?

The XRP coin has an incredibly substantial total supply, 100 000 000 000 XRP. As you probably know, the price of one coin is obtained when you divide the market cap by the circulating supply.

As of right now, XRP = $0.7564 at a market cap of $29,303,993,685 which gives us a circulating supply of 38,739,144,847.

Given these figures, it’s clear that for the XRP coin’s price it is almost impossible to reach $100; its market cap will have to be 100x more at least. This seems rather challenging for the asset’s value to achieve in the next five years, considering the competition and the relatively small size of the cryptocurrency market.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.