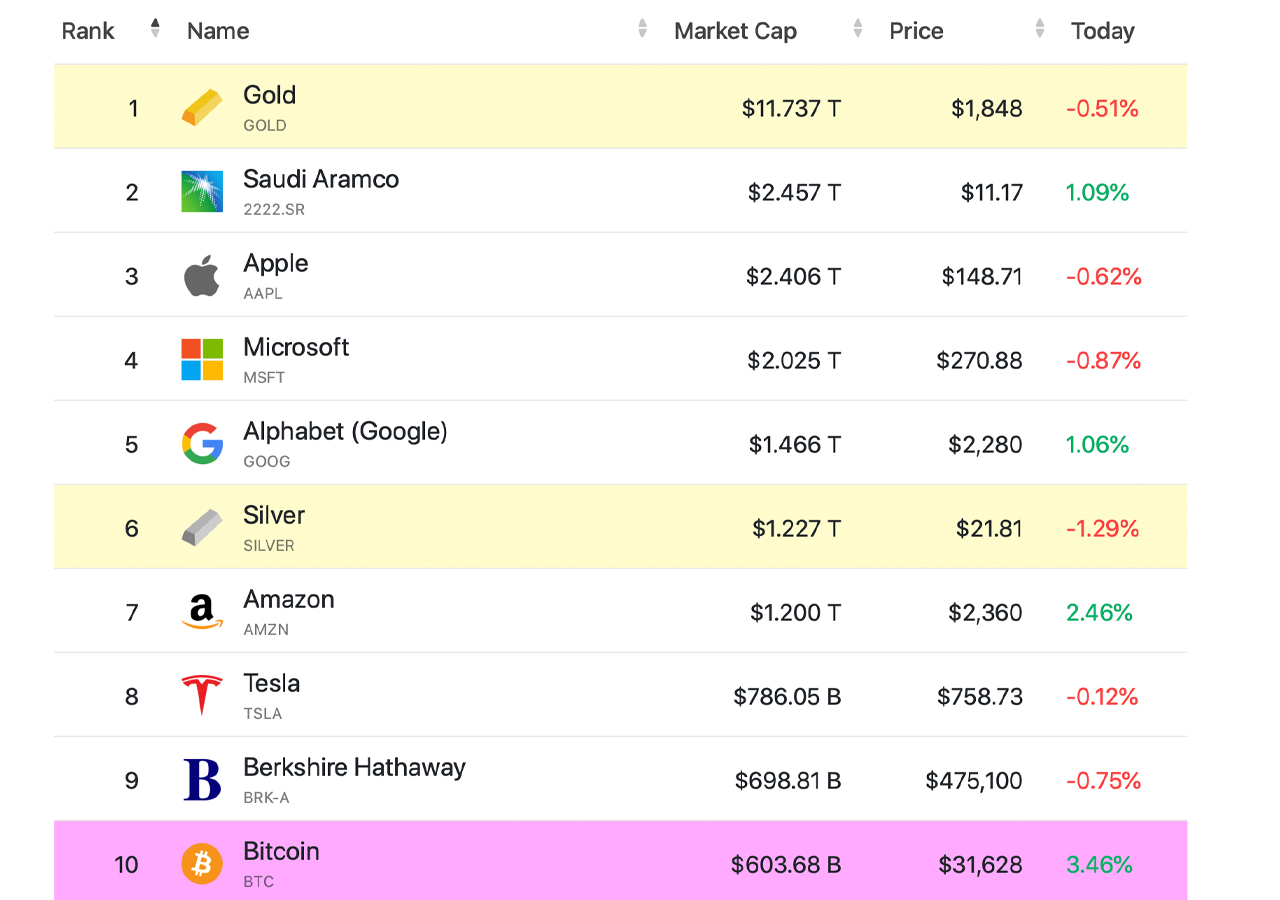

While bitcoin has lost more than 16% in value against the U.S. dollar during the past 30 days, the cryptocurrency’s market capitalization is still the tenth-largest asset by market valuation. With $603 billion in market value, bitcoin is above Meta’s (formally Facebook) capitalization and just below Berkshire Hathaway’s overall valuation.

Despite Losing Over 16% in a Month, Bitcoin Is Still the 10th Most Valuable Asset Worldwide

The leading crypto asset bitcoin (BTC) has had a rough few weeks in terms of market prices dropping. A month ago today, BTC was 16.4% higher in USD value as the recent stock market carnage and the Terra LUNA and UST fiasco contributed to bitcoin’s losses. However, in terms of market dominance, BTC’s market capitalization among more than 13,000 cryptocurrencies is now over 44% of the $1.36 trillion crypto economy.

While BTC is the number one leading crypto asset today in terms of market valuation, the crypto asset’s market cap makes it the tenth-largest in terms of all the major market capitalizations stemming from the likes of companies like Apple and Amazon, alongside precious metals like gold and silver.

Today, gold is the largest market capitalization among the 6,265 commodities and companies that make up $86.516 trillion in USD value. One ounce of fine gold today is exchanging hands for $1,848 per unit and it has an overall valuation of $11.737 trillion. Companiesmarketcap.com metrics currently show bitcoin’s $603 billion market cap equates to 5.13% of gold’s overall market capitalization.

The second-largest asset is Saudi Aramco, which is worth $2.457 trillion and it eclipses the entire $1.36 trillion crypto economy. The third-largest global asset in terms of commodities and company shares is Apple with $2.406 trillion. While bitcoin equates to only 5% of gold’s net worth, BTC represents 25.06% of Apple’s market valuation.

Following Apple includes assets like Microsoft, Alphabet (Google), Silver, Amazon, Tesla, and Berkshire Hathaway respectively. Berkshire Hathaway rests above bitcoin (BTC) as the company’s market capitalization today is $698.81 billion. This means that BTC’s market cap equates to 86.28% of Berkshire Hathaway’s net worth. Bitcoin’s market cap was much higher at one time and it once surpassed Facebook’s market valuation.

In February 2022, BTC was the ninth-largest crypto asset according to companiesmarketcap.com metrics. After dropping to a low recently, BTC held the eleventh position in terms of the world’s most valuable assets. The crypto asset’s latest gains has allowed it to recapture the tenth position in terms of the market capitalizations of 6,265 commodities and companies.

Tags in this story

Amazon, Apple, Assets, Bitcoin, Bitcoin (BTC), crypto economy, crypto economy’s market cap, crypto values, Digital Currency, Fiat Value, Global Assets, gold, Market Cap, Market Capitalization, Market Valuation, Markets, Meta, Microsoft, Prices, Saudi Aramco, silver

What do you think about bitcoin being the tenth most valuable asset worldwide? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

More Popular News

In Case You Missed It

Source: https://news.bitcoin.com/fresh-gains-push-bitcoin-back-into-the-worlds-top-10-most-valuable-assets/